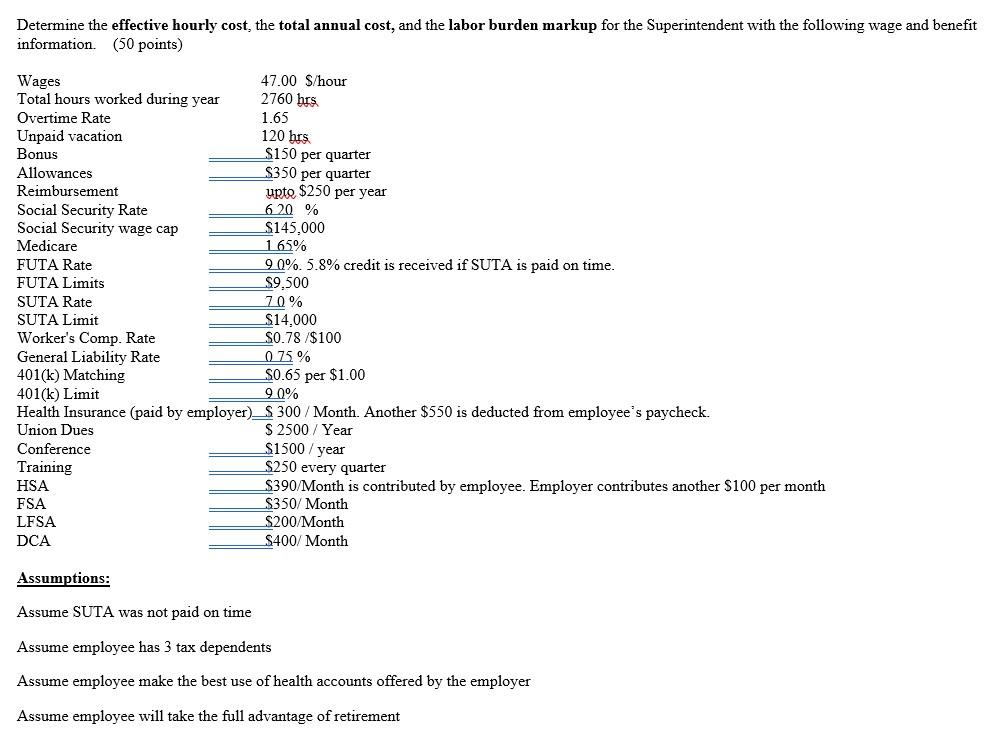

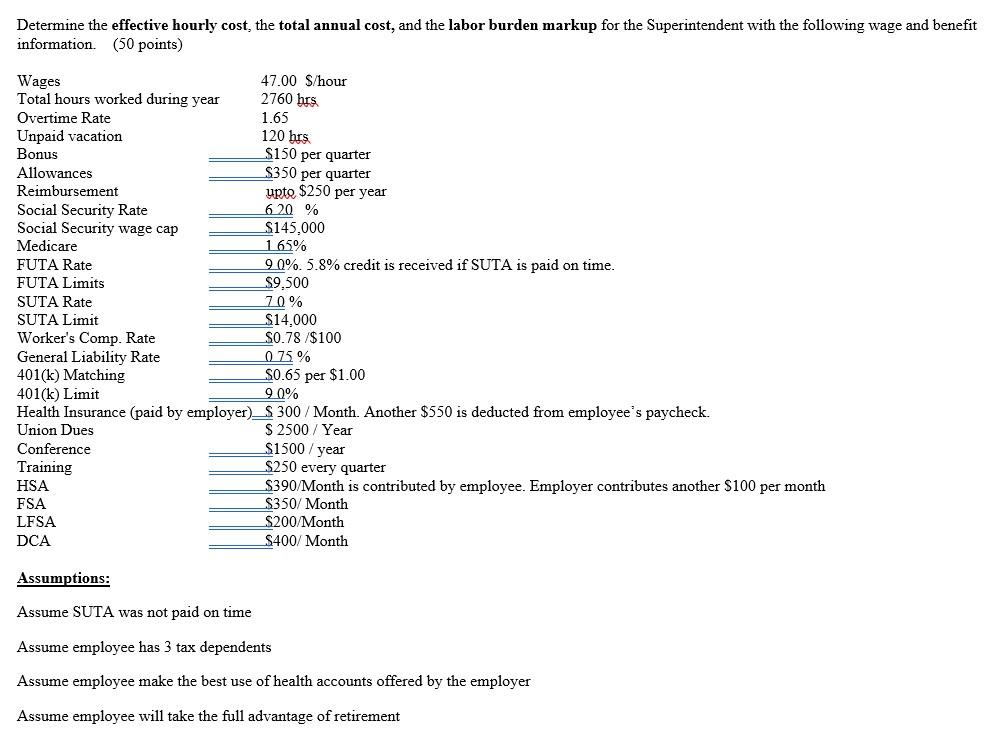

Determine the effective hourly cost, the total annual cost, and the labor burden markup for the Superintendent with the following wage and benefit information (50 points) 2760 hrs Wages 47.00 S/hour Total hours worked during year Overtime Rate 1.65 Unpaid vacation 120 hrs Bonus S150 per quarter Allowances S350 per quarter Reimbursement upto $250 per year Social Security Rate 620 % Social Security wage cap S145,000 Medicare 165% FUTA Rate 90%.5.8% credit is received if SUTA is paid on time. FUTA Limits S9.500 SUTA Rate 70% SUTA Limit $14,000 Worker's Comp. Rate S0.78 /$100 General Liability Rate 0 75% 401(k) Matching $0.65 per $1.00 401(k) Limit 9.0% Health Insurance (paid by employer)_S 300/Month. Another $550 is deducted from employee's paycheck. Union Dues $ 2500 / Year Conference $1500/year Training $250 every quarter HSA $390/Month is contributed by employee. Employer contributes another $100 per month FSA S350/Month LFSA $200/Month DCA S400/ Month Assumptions: Assume SUTA was not paid on time Assume employee has 3 tax dependents Assume employee make the best use of health accounts offered by the employer Assume employee will take the full advantage of retirement Determine the effective hourly cost, the total annual cost, and the labor burden markup for the Superintendent with the following wage and benefit information (50 points) 2760 hrs Wages 47.00 S/hour Total hours worked during year Overtime Rate 1.65 Unpaid vacation 120 hrs Bonus S150 per quarter Allowances S350 per quarter Reimbursement upto $250 per year Social Security Rate 620 % Social Security wage cap S145,000 Medicare 165% FUTA Rate 90%.5.8% credit is received if SUTA is paid on time. FUTA Limits S9.500 SUTA Rate 70% SUTA Limit $14,000 Worker's Comp. Rate S0.78 /$100 General Liability Rate 0 75% 401(k) Matching $0.65 per $1.00 401(k) Limit 9.0% Health Insurance (paid by employer)_S 300/Month. Another $550 is deducted from employee's paycheck. Union Dues $ 2500 / Year Conference $1500/year Training $250 every quarter HSA $390/Month is contributed by employee. Employer contributes another $100 per month FSA S350/Month LFSA $200/Month DCA S400/ Month Assumptions: Assume SUTA was not paid on time Assume employee has 3 tax dependents Assume employee make the best use of health accounts offered by the employer Assume employee will take the full advantage of retirement