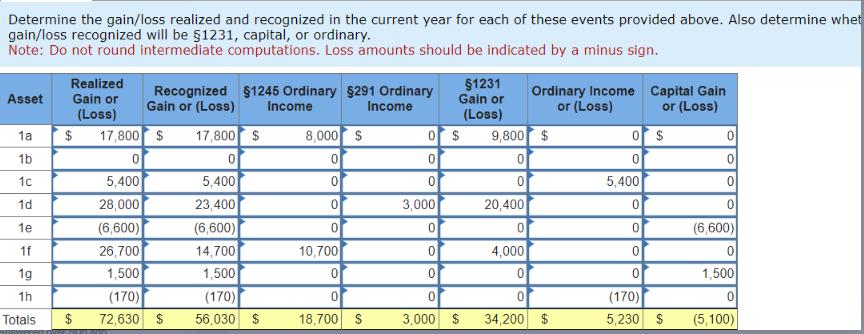

Determine the gain/loss realized and recognized in the current year for each of these events provided above. Also determine whet gain/loss recognized will be

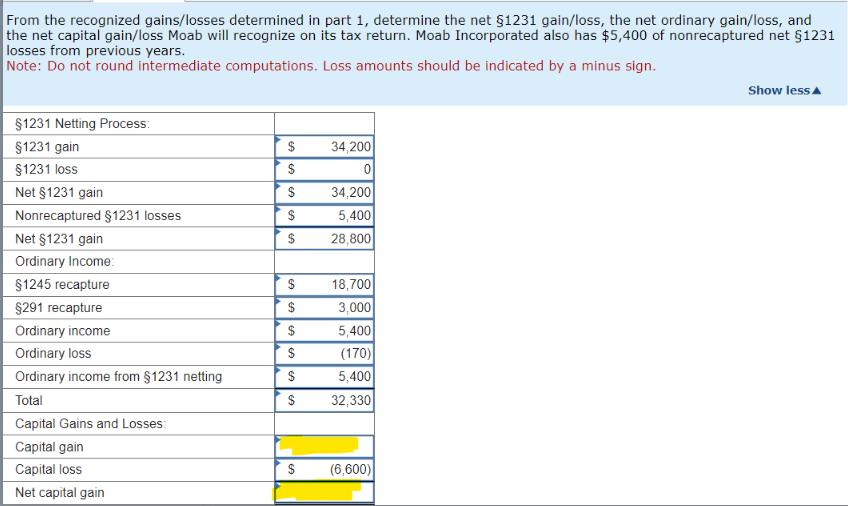

Determine the gain/loss realized and recognized in the current year for each of these events provided above. Also determine whet gain/loss recognized will be 1231, capital, or ordinary. Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign. Asset 1a 1b 1c 1d 1e 1f 1g 1h Totals Realized Gain or (Loss) Recognized Gain or (Loss) $ 17,800 $ 0 5,400 28,000 (6,600) 26,700 1,500 $ 1245 Ordinary 291 Ordinary Income Income 17,800 $ 0 5,400 23,400 (6,600) 14,700 1,500 (170) (170) 72,630 $ 56,030 $ 8,000 $ 0 0 0 0 10,700 0 0 18,700 S 1231 Gain or (Loss) 0 0 0 3,000 0 0 0 0 3,000 $ $ Ordinary Income or (Loss) 9,800 $ 0 0 20,400 0 4,000 0 0 34,200 $ 0 0 5,400 0 0 0 0 Capital Gain or (Loss) $ (170) 5,230 $ 0 0 (6,600) 1,500 0 (5,100) From the recognized gains/losses determined in part 1, determine the net 1231 gain/loss, the net ordinary gain/loss, and the net capital gain/loss Moab will recognize on its tax return. Moab Incorporated also has $5,400 of nonrecaptured net 1231 losses from previous years. Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign. 1231 Netting Process: $1231 gain 1231 loss Net 1231 gain Nonrecaptured $1231 losses Net 1231 gain Ordinary Income: 1245 recapture 291 recapture Ordinary income Ordinary loss Ordinary income from $1231 netting Total Capital Gains and Losses: Capital gain Capital loss Net capital gain $ $ $ $ $ $ $ $ $ $ $ $ 34,200 0 34,200 5,400 28,800 18,700 3,000 5,400 (170) 5,400 32,330 (6,600) Show less

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Asset Realized Gain loss Recognized gainloss Character 1a 16100 16100 8000 of 1245 recaptur...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started