Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the market potential for a product that has 40 million prospective buyers who purchase an average of ten units per year at an

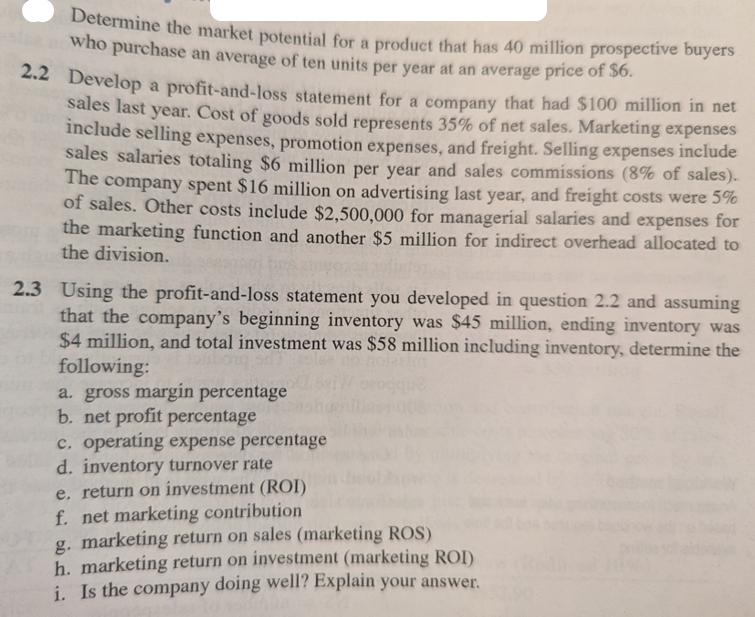

Determine the market potential for a product that has 40 million prospective buyers who purchase an average of ten units per year at an average price of $6. 2.2 Develop a profit-and-loss statement for a company that had $100 million in net sales last year. Cost of goods sold represents 35% of net sales. Marketing expenses include selling expenses, promotion expenses, and freight. Selling expenses include sales salaries totaling $6 million per year and sales commissions (8% of sales). The company spent $16 million on advertising last year, and freight costs were 5% of sales. Other costs include $2,500,000 for managerial salaries and expenses for the marketing function and another $5 million for indirect overhead allocated to the division. 2.3 Using the profit-and-loss statement you developed in question 2.2 and assuming that the company's beginning inventory was $45 million, ending inventory was $4 million, and total investment was $58 million including inventory, determine the following: a. gross margin percentage b. net profit percentage c. operating expense percentage d. inventory turnover rate e. return on investment (ROI) f. net marketing contribution g. marketing return on sales (marketing ROS) h. marketing return on investment (marketing ROI) i. Is the company doing well? Explain your answer.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 21 Market potential calculation Market potential Number of prospective buyers x Average units purchased per year x Average price Market potential 40 million x 10 x 6 Market potential 24 billi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started