Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the NPV for the Electrobicycle project. Use the annual project cash flow from the table above. For the required rate of return, use

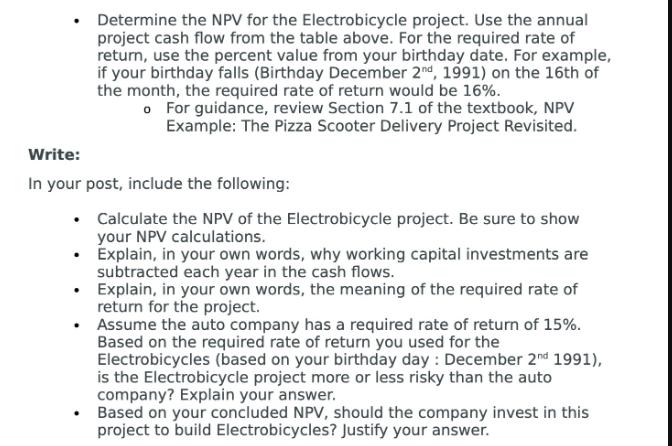

Determine the NPV for the Electrobicycle project. Use the annual project cash flow from the table above. For the required rate of return, use the percent value from your birthday date. For example, if your birthday falls (Birthday December 2nd, 1991) on the 16th of the month, the required rate of return would be 16%. o For guidance, review Section 7.1 of the textbook, NPV Example: The Pizza Scooter Delivery Project Revisited. Write: In your post, include the following: Calculate the NPV of the Electrobicycle project. Be sure to show your NPV calculations. Explain, in your own words, why working capital investments are subtracted each year in the cash flows. . Explain, in your own words, the meaning of the required rate of return for the project. Assume the auto company has a required rate of return of 15%. Based on the required rate of return you used for the Electrobicycles (based on your birthday day: December 2nd 1991), is the Electrobicycle project more or less risky than the auto company? Explain your answer. Based on your concluded NPV, should the company invest in this project to build Electrobicycles? Justify your answer.

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the Electrobicycle project well use the following steps 1 Determine the cash flows for each year based on the provided table 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started