Answered step by step

Verified Expert Solution

Question

1 Approved Answer

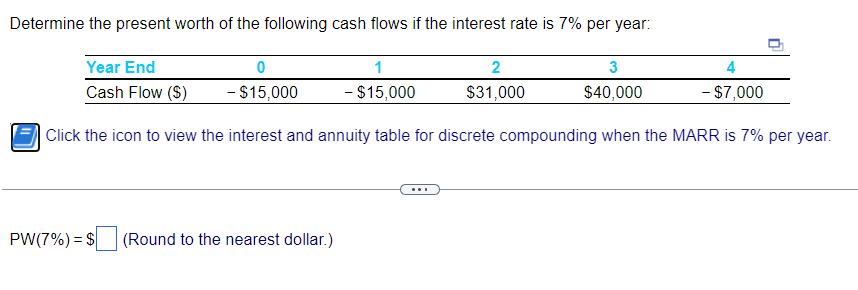

Determine the present worth of the following cash flows if the interest rate is 7% per year: Year End 1 3 4 Cash Flow

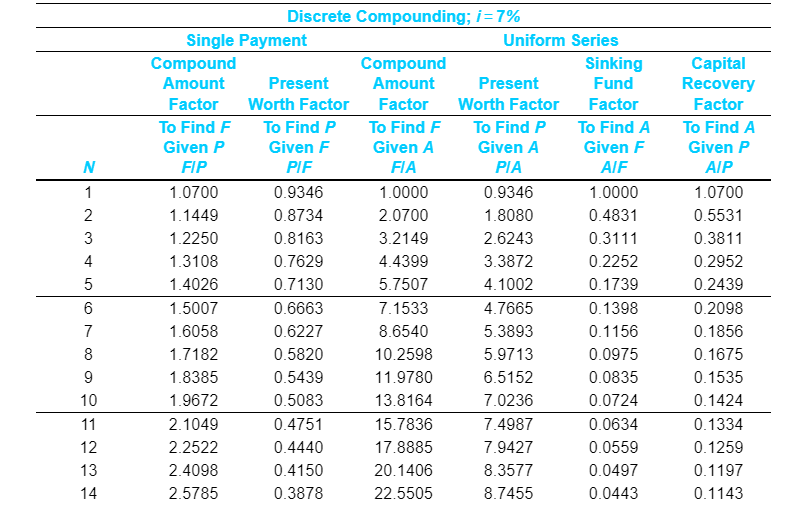

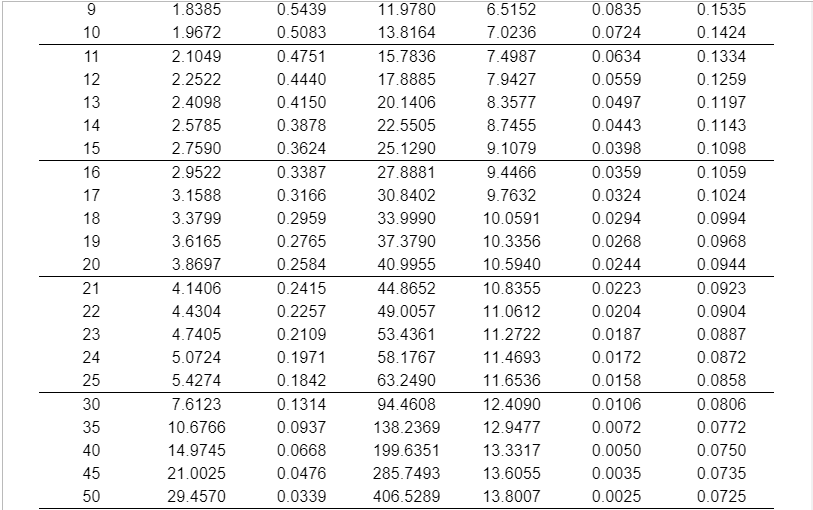

Determine the present worth of the following cash flows if the interest rate is 7% per year: Year End 1 3 4 Cash Flow ($) - $15,000 $40,000 - $7,000 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 7% per year. 0 - $15,000 PW(7%) = $ (Round to the nearest dollar.) 2 $31,000 N 1 2 4 5 6 7 8 9 10 11 12 13 14 Single Payment Compound Amount Factor To Find F Given P FIP 1.0700 1.1449 1.2250 1.3108 1.4026 1.5007 1.6058 Discrete Compounding; i = 7% 1.7182 1.8385 1.9672 2.1049 2.2522 2.4098 2.5785 Present Worth Factor To Find P Given F PIF 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 Compound Amount Factor To Find F Given A FIA 1.0000 2.0700 3.2149 4.4399 5.7507 7.1533 8.6540 10.2598 11.9780 13.8164 15.7836 17.8885 20.1406 22.5505 Uniform Series Present Worth Factor To Find P Given A PIA 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 5.9713 6.5152 7.0236 7.4987 7.9427 8.3577 8.7455 Sinking Fund Factor To Find A Given F AIF 1.0000 0.4831 0.3111 0.2252 0.1739 0.1398 0.1156 0.0975 0.0835 0.0724 0.0634 0.0559 0.0497 0.0443 Capital Recovery Factor To Find A Given P AIP 1.0700 0.5531 0.3811 0.2952 0.2439 0.2098 0.1856 0.1675 0.1535 0.1424 0.1334 0.1259 0.1197 0.1143 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 1.8385 1.9672 2.1049 2.2522 2.4098 2.5785 2.7590 2.9522 3.1588 3.3799 3.6165 3.8697 4.1406 4.4304 4.7405 5.0724 5.4274 7.6123 10.6766 14.9745 21.0025 29.4570 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 0.3624 0.3387 0.3166 0.2959 0.2765 0.2584 0.2415 0.2257 0.2109 0.1971 0.1842 0.1314 0.0937 0.0668 0.0476 0.0339 11.9780 13.8164 15.7836 17.8885 20.1406 22.5505 25.1290 27.8881 30.8402 33.9990 37.3790 40.9955 44.8652 49.0057 53.4361 58.1767 63.2490 94.4608 138.2369 199.6351 285.7493 406.5289 6.5152 7.0236 7.4987 7.9427 8.3577 8.7455 9.1079 9.4466 9.7632 10.0591 10.3356 10.5940 10.8355 11.0612 11.2722 11.4693 11.6536 12.4090 12.9477 13.3317 13.6055 13.8007 0.0835 0.0724 0.0634 0.0559 0.0497 0.0443 0.0398 0.0359 0.0324 0.0294 0.0268 0.0244 0.0223 0.0204 0.0187 0.0172 0.0158 0.0106 0.0072 0.0050 0.0035 0.0025 0.1535 0.1424 0.1334 0.1259 0.1197 0.1143 0.1098 0.1059 0.1024 0.0994 0.0968 0.0944 0.0923 0.0904 0.0887 0.0872 0.0858 0.0806 0.0772 0.0750 0.0735 0.0725

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the present worth of the cash flows we need to discount each cash flow back to its pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started