Question

Given the following expected cash flow stream, determine the IRR of the proposed investment in an income producing property and determine whether or not

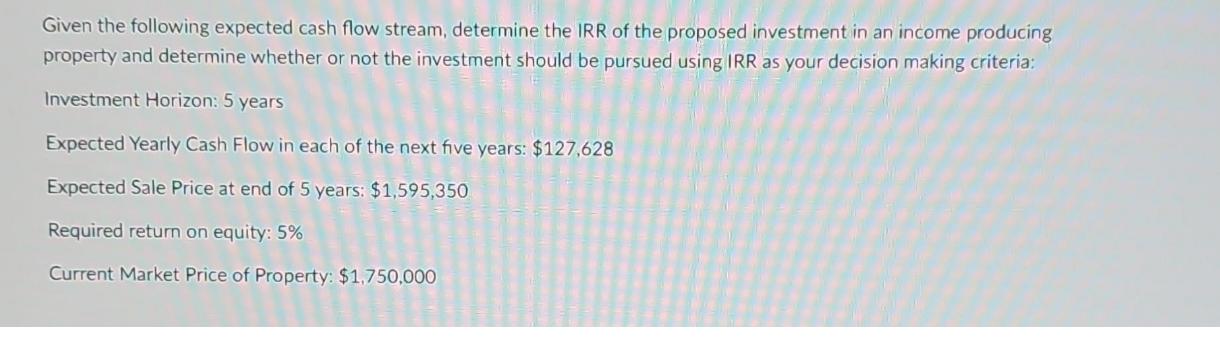

Given the following expected cash flow stream, determine the IRR of the proposed investment in an income producing property and determine whether or not the investment should be pursued using IRR as your decision making criteria: Investment Horizon: 5 years Expected Yearly Cash Flow in each of the next five years: $127,628 Expected Sale Price at end of 5 years: $1,595,350 Required return on equity: 5% Current Market Price of Property: $1,750,000

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the R of the proposed investment in an incomeproducing property we need to cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App