Question

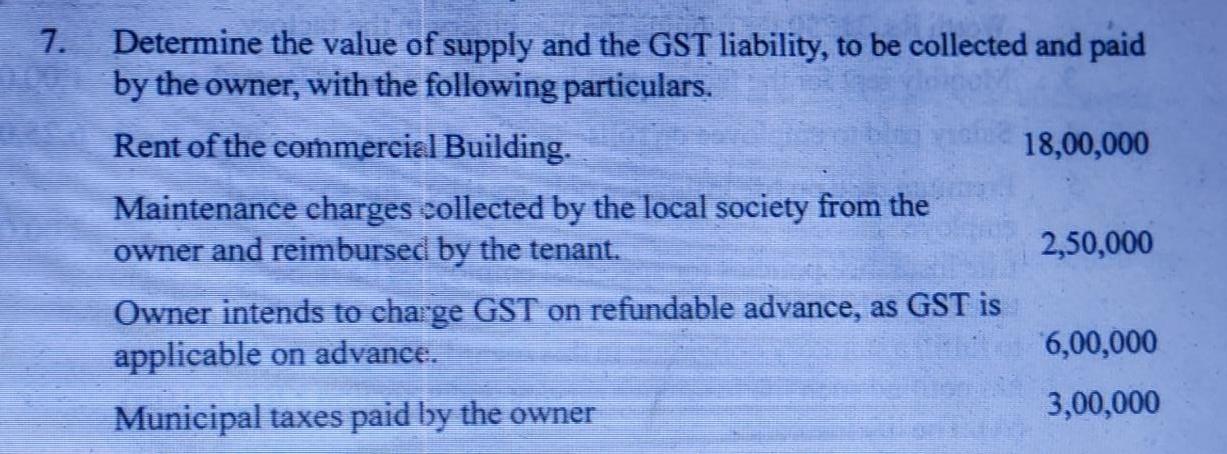

Determine the value of supply and the GST liability, to be collected and paid by the owner, with the following particulars. 7. Rent of

Determine the value of supply and the GST liability, to be collected and paid by the owner, with the following particulars. 7. Rent of the commercial Building. 18,00,000 Maintenance charges collected by the local society from the owner and reimbursed by the tenant. 2,50,000 Owner intends to charge GST on refundable advance, as GST is applicable on advance. 6,00,000 3,00,000 Municipal taxes paid by the owner

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Amount Particulars lays 1800000 Rent of the Commermial Building 250000 Daintenanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Financial Management

Authors: James R Mcguigan, R Charles Moyer, William J Kretlow

10th Edition

978-0324289114, 0324289111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App