Question

Determine the Weighted Average CM of TGM for these products. Round to nearest $0.01. Based on the given sales mix, what is the total

Determine the Weighted Average CM of TGM for these products. Round to nearest $0.01.

Based on the given sales mix, what is the total number of units required to break-even? Round to the nearest unit.

If the target sales mix is achieved and 280,000 total units are sold, what is the estimated profit after tax?

TGM expects the target sales mix can be achieved and 300,000 total units will be sold in the upcoming year. TGM's managers also believe that a $1.50 per unit increase in the current estimated sales price of the Euro product can be obtained by investing in a $100,000 sales campaign. If no other assumptions are changed, what is the impact upon total expected before tax profits if the price increase and sales campaign are implemented? Use a positive number to indicate an increase in expected profits and a negative number to indicate a decrease in expected profits.

In FY2023 TGM sold 110,000 units of the Original; 70,000 units of the Euro and 20,000 units of the Pacific. For FY2024, TGM anticipates a change in import tariffs that will increase the variable cost of the Euro product by $2.00 per unit. TGM is also planning for total units sales to increase by 5% in FY2024, but expects the sales mix to equal the FY2023 actual results. No other changes from FY2023 are anticipated, what is the total number of units required to break-even for FY2024?

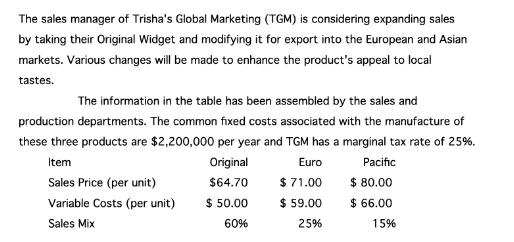

The sales manager of Trisha's Global Marketing (TGM) is considering expanding sales by taking their Original Widget and modifying it for export into the European and Asian markets. Various changes will be made to enhance the product's appeal to local tastes. The information in the table has been assembled by the sales and production departments. The common fixed costs associated with the manufacture of these three products are $2,200,000 per year and TGM has a marginal tax rate of 25%. Item Original $64.70 Sales Price (per unit) Variable Costs (per unit) $ 50.00 Sales Mix 60% Euro $ 71.00 $ 59.00 25% Pacific $ 80.00 $ 66.00 15%

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine the Weighted Average Contribution Margin CM of TGM for these products Calculate the weighted average based on the given sales mix For the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started