Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine whether the following items included in Wong Company's January bank reconciliation will require adjustments on Wong's books and indicate the amount of any necessary

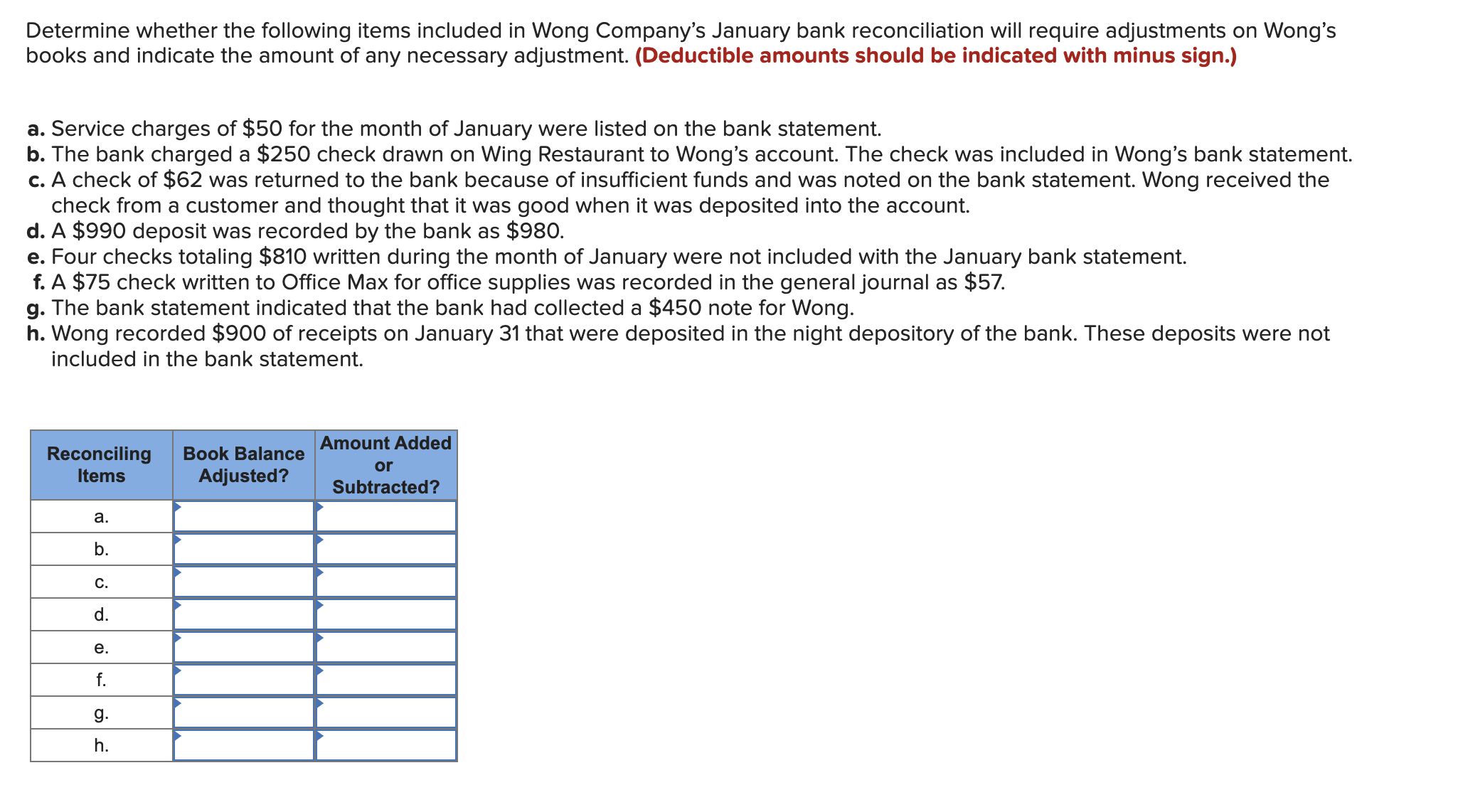

Determine whether the following items included in Wong Company's January bank reconciliation will require adjustments on Wong's books and indicate the amount of any necessary adjustment. (Deductible amounts should be indicated with minus sign.) a. Service charges of $50 for the month of January were listed on the bank statement. b. The bank charged a $250 check drawn on Wing Restaurant to Wong's account. The check was included in Wong's bank statement. c. A check of $62 was returned to the bank because of insufficient funds and was noted on the bank statement. Wong received the check from a customer and thought that it was good when it was deposited into the account. d. A $990 deposit was recorded by the bank as $980. e. Four checks totaling $810 written during the month of January were not included with the January bank statement. f. A $75 check written to Office Max for office supplies was recorded in the general journal as $57. g. The bank statement indicated that the bank had collected a $450 note for Wong. h. Wong recorded $900 of receipts on January 31 that were deposited in the night depository of the bank. These deposits were not included in the bank statement

Determine whether the following items included in Wong Company's January bank reconciliation will require adjustments on Wong's books and indicate the amount of any necessary adjustment. (Deductible amounts should be indicated with minus sign.) a. Service charges of $50 for the month of January were listed on the bank statement. b. The bank charged a $250 check drawn on Wing Restaurant to Wong's account. The check was included in Wong's bank statement. c. A check of $62 was returned to the bank because of insufficient funds and was noted on the bank statement. Wong received the check from a customer and thought that it was good when it was deposited into the account. d. A $990 deposit was recorded by the bank as $980. e. Four checks totaling $810 written during the month of January were not included with the January bank statement. f. A $75 check written to Office Max for office supplies was recorded in the general journal as $57. g. The bank statement indicated that the bank had collected a $450 note for Wong. h. Wong recorded $900 of receipts on January 31 that were deposited in the night depository of the bank. These deposits were not included in the bank statement Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started