Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine whether the share is overvalued, undervalued or fairly valued, by comparing the justified price-to-sales (P/S) with the market P/S of each share. Use

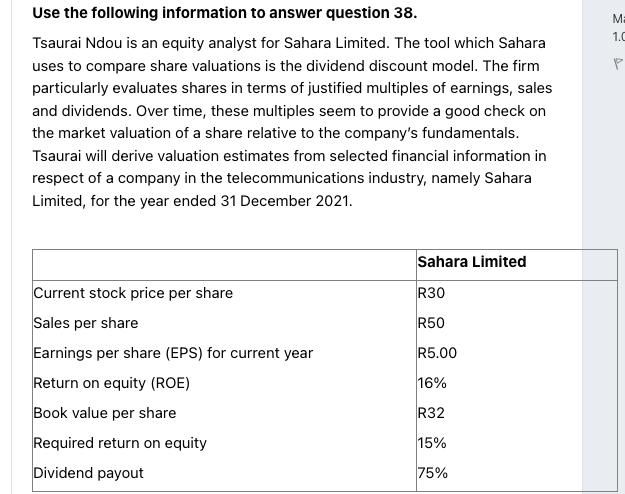

Determine whether the share is overvalued, undervalued or fairly valued, by comparing the justified price-to-sales (P/S) with the market P/S of each share. Use the following information to answer question 38. Tsaurai Ndou is an equity analyst for Sahara Limited. The tool which Sahara uses to compare share valuations is the dividend discount model. The firm particularly evaluates shares in terms of justified multiples of earnings, sales and dividends. Over time, these multiples seem to provide a good check on the market valuation of a share relative to the company's fundamentals. Tsaurai will derive valuation estimates from selected financial information in respect of a company in the telecommunications industry, namely Sahara Limited, for the year ended 31 December 2021. Current stock price per share Sales per share Earnings per share (EPS) for current year Return on equity (ROE) Book value per share Required return on equity Dividend payout Sahara Limited R30 R50 R5.00 16% R32 15% 75% Ma 1.0 P

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Sahara Limiteds share is overvalued undervalued or fairly valued we need to com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started