Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determining the Required Rate of Return for your chosen stock by using the Capital Asset Pricing Model. *For the CAPM, assume that the Risk

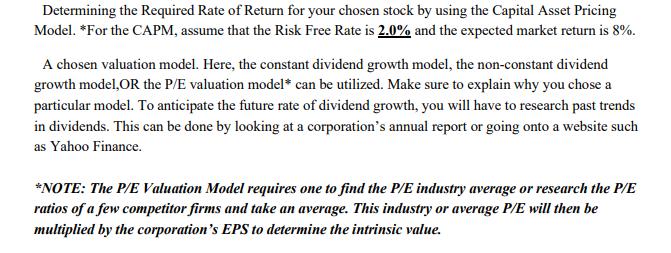

Determining the Required Rate of Return for your chosen stock by using the Capital Asset Pricing Model. *For the CAPM, assume that the Risk Free Rate is 2.0% and the expected market return is 8%. A chosen valuation model. Here, the constant dividend growth model, the non-constant dividend growth model, OR the P/E valuation model* can be utilized. Make sure to explain why you chose a particular model. To anticipate the future rate of dividend growth, you will have to research past trends in dividends. This can be done by looking at a corporation's annual report or going onto a website such as Yahoo Finance. *NOTE: The P/E Valuation Model requires one to find the P/E industry average or research the P/E ratios of a few competitor firms and take an average. This industry or average P/E will then be multiplied by the corporation's EPS to determine the intrinsic value. - Book Value per share - Market Value per share (find it through a stock quote search) - P/E Ratio

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solution The Capital Asset Pricing Model CAPM is a model that helps to determine the required rate of return for a stock based on its risk The CAPM assumes that the riskfree rate is 20 and the expecte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started