Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determining the weights when short-selling: Is this correct? I'm wondering if I did this correctly, thus I would love to get an answer. Something tells

Determining the weights when short-selling: Is this correct?

I'm wondering if I did this correctly, thus I would love to get an answer. Something tells me that it can't be this simple

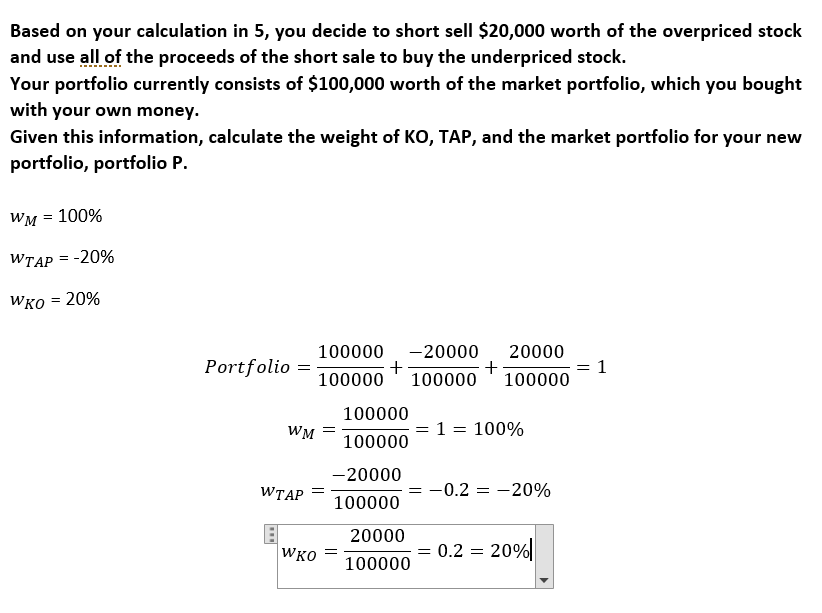

Based on your calculation in 5, you decide to short sell $20,000 worth of the overpriced stock and use all of the proceeds of the short sale to buy the underpriced stock. Your portfolio currently consists of $100,000 worth of the market portfolio, which you bought with your own money. Given this information, calculate the weight of KO, TAP, and the market portfolio for your new portfolio, portfolio P. WM = 100% WTAP = -20% WKO = 20% 100000 -20000 20000 Fortjono = 100000 100000 100000 100000 =1 = 100% WM = 100000 -20000 100000 = -0.2 = -20% 20000 WKO 100000 = 0.2 = 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started