Answered step by step

Verified Expert Solution

Question

1 Approved Answer

determining what the Fica payable is? Jim Adams calculates and records the unemployment taxes paid by employers, and Waren's portion of the FICA payroll tax.

determining what the Fica payable is?

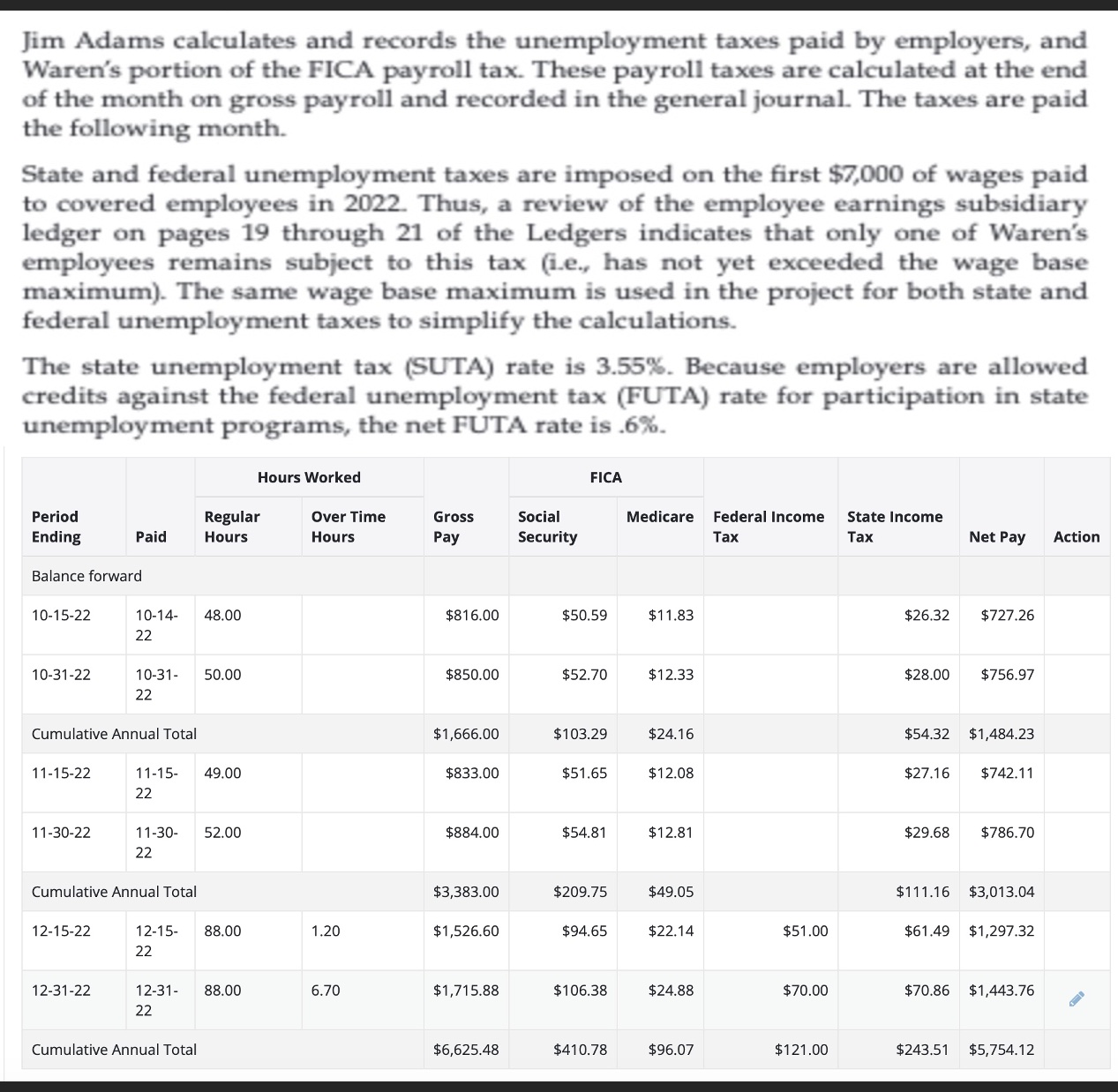

Jim Adams calculates and records the unemployment taxes paid by employers, and Waren's portion of the FICA payroll tax. These payroll taxes are calculated at the end of the month on gross payroll and recorded in the general journal. The taxes are paid the following month. State and federal unemployment taxes are imposed on the first $7,000 of wages paid to covered employees in 2022. Thus, a review of the employee earnings subsidiary ledger on pages 19 through 21 of the Ledgers indicates that only one of Waren's employees remains subject to this tax (i.e., has not yet exceeded the wage base maximum). The same wage base maximum is used in the project for both state and federal unemployment taxes to simplify the calculations. The state unemployment tax (SUTA) rate is 3.55%. Because employers are allowed credits against the federal unemployment tax (FUTA) rate for participation in state unemployment programs, the net FUTA rate is .6%. Period Ending Regular Hours Hours Worked FICA Over Time Hours Gross Pay Social Security Medicare Federal Income State Income Tax Tax Net Pay Action Paid Balance forward 10-15-22 10-14- 48.00 22 $816.00 $50.59 $11.83 $26.32 $727.26 10-31-22 10-31- 22 50.00 $850.00 $52.70 $12.33 $28.00 $756.97 Cumulative Annual Total $1,666.00 $103.29 $24.16 $54.32 $1,484.23 11-15-22 11-15- 49.00 $833.00 $51.65 $12.08 $27.16 $742.11 22 11-30-22 11-30- 22 52.00 $884.00 $54.81 $12.81 $29.68 $786.70 Cumulative Annual Total $3,383.00 $209.75 $49.05 $111.16 $3,013.04 12-15-22 12-15- 88.00 1.20 $1,526.60 $94.65 $22.14 $51.00 $61.49 $1,297.32 22 12-31-22 12-31- 22 88.00 6.70 $1,715.88 $106.38 $24.88 $70.00 $70.86 $1,443.76 Cumulative Annual Total $6,625.48 $410.78 $96.07 $121.00 $243.51 $5,754.12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started