Answered step by step

Verified Expert Solution

Question

1 Approved Answer

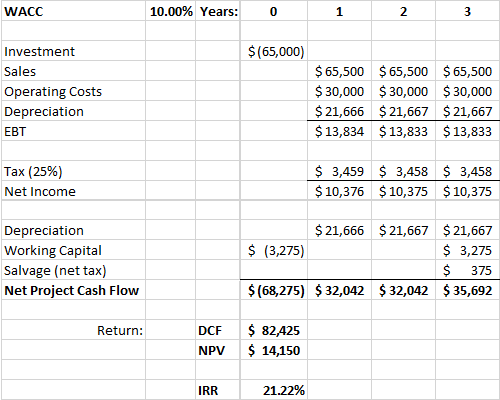

DeVault Services recently hired you as a consultant to help with its capital budgeting process. Below is this analysis: How would you define the risk

DeVault Services recently hired you as a consultant to help with its capital budgeting process. Below is this analysis:

How would you define the risk analysis in this project?

WACC 10.00% Years: 0 2 $ (65,000 Investment Sales Operating Costs Depreciation EBT $65,500$65,500 $65,500 $30,000$30,000 $30,000 $21,666 $21,667 $21,667 $13,834$13,833 $13,833 Tax (25%) Net Income $3,459 3,458 $ 3,458 10,376$10,375 $10,375 Depreciation Working Capital Salvage (net tax) Net Project Cash Flow $21,666 21,667$21,667 S 3,275 $ 375 $(68,275) 32,042 32,042 35,692 $ (3,275) DCF $ 82425 NPV 14,150 Return: IRR 21.22%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started