Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Develop a spreadsheet with which you can evaluate the acceptability of this proposal. Calculate the net present value (NPV) and the internal rate of return

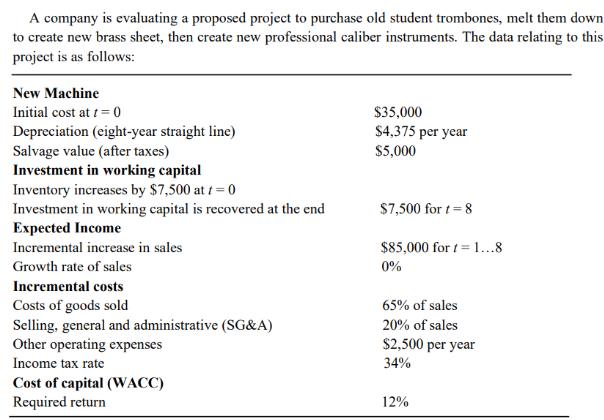

A company is evaluating a proposed project to purchase old student trombones, melt them down to create new brass sheet, then create new professional caliber instruments. The data relating to this project is as follows: New Machine Initial cost at t = 0 Depreciation (eight-year straight line) Salvage value (after taxes) Investment in working capital Inventory increases by $7,500 at t=0 Investment in working capital is recovered at the end Expected Income Incremental increase in sales Growth rate of sales Incremental costs Costs of goods sold Selling, general and administrative (SG&A) Other operating expenses Income tax rate Cost of capital (WACC) Required return $35,000 $4,375 per year $5,000 $7,500 for t=8 $85,000 for t=1...8 0% 65% of sales 20% of sales $2,500 per year 34% 12%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To evaluate the proposed project we can calculate the relevant financial metrics such as net present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started