Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Devil Apps, Inc. (DA) is a publicly-traded company with 25 million shares outstanding that is in the business of selling discounted mobile phone software

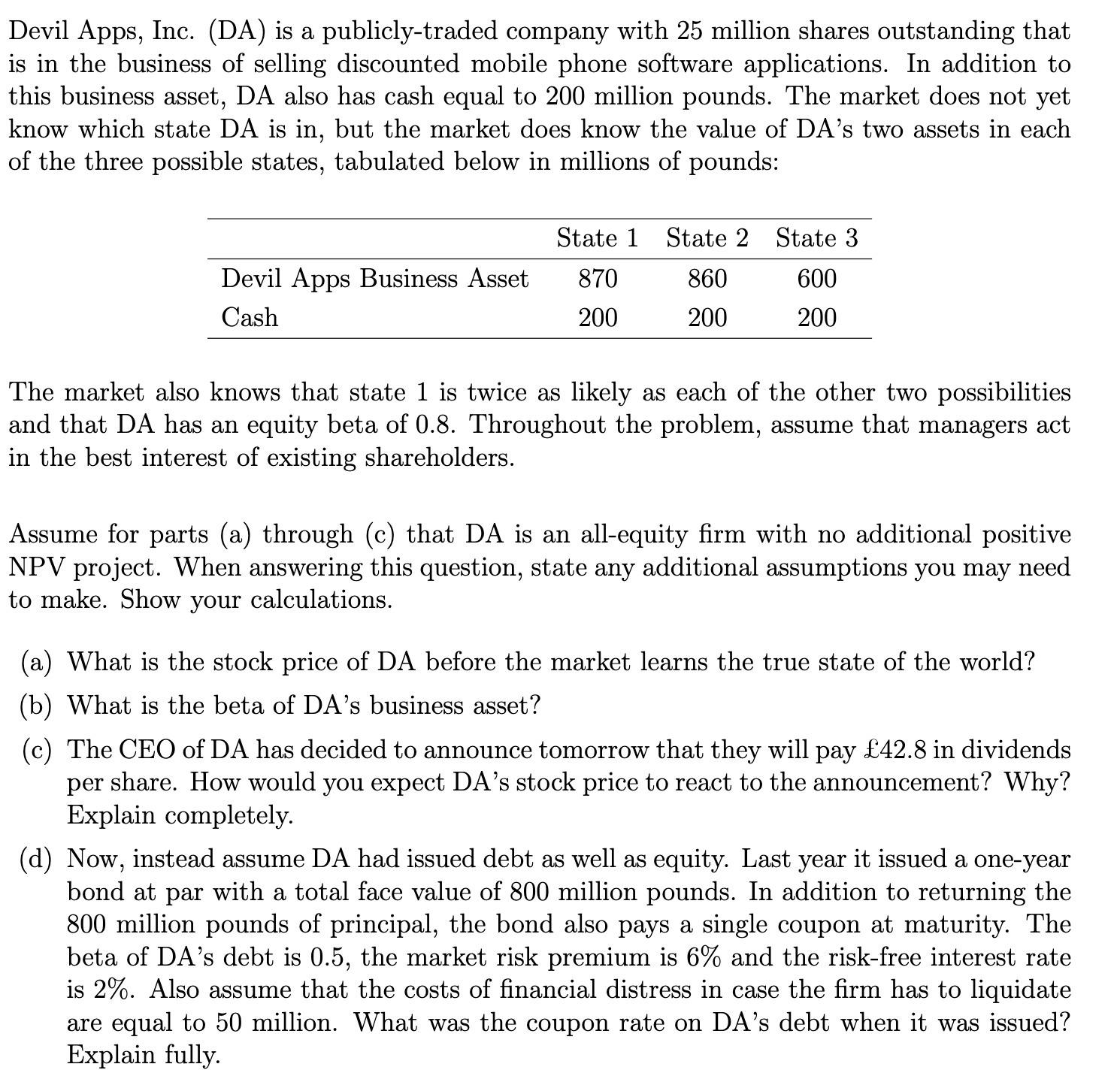

Devil Apps, Inc. (DA) is a publicly-traded company with 25 million shares outstanding that is in the business of selling discounted mobile phone software applications. In addition to this business asset, DA also has cash equal to 200 million pounds. The market does not yet know which state DA is in, but the market does know the value of DA's two assets in each of the three possible states, tabulated below in millions of pounds: Devil Apps Business Asset Cash State 1 State 2 State 3 870 860 600 200 200 200 The market also knows that state 1 is twice as likely as each of the other two possibilities and that DA has an equity beta of 0.8. Throughout the problem, assume that managers act in the best interest of existing shareholders. Assume for parts (a) through (c) that DA is an all-equity firm with no additional positive NPV project. When answering this question, state any additional assumptions you may need to make. Show your calculations. (a) What is the stock price of DA before the market learns the true state of the world? (b) What is the beta of DA's business asset? (c) The CEO of DA has decided to announce tomorrow that they will pay 42.8 in dividends per share. How would you expect DA's stock price to react to the announcement? Why? Explain completely. (d) Now, instead assume DA had issued debt as well as equity. Last year it issued a one-year bond at par with a total face value of 800 million pounds. In addition to returning the 800 million pounds of principal, the bond also pays a single coupon at maturity. The beta of DA's debt is 0.5, the market risk premium is 6% and the risk-free interest rate is 2%. Also assume that the costs of financial distress in case the firm has to liquidate are equal to 50 million. What was the coupon rate on DA's debt when it was issued? Explain fully.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To determine the stock price of DA before the market learns the true state of the world we need to calculate the expected value of the stock price based on the probabilities of each state L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started