Question

Dex Co. is a nonpublic company that began operations on January 1, Year 3. Dex decided to prepare cash-basis financial statements. On the first

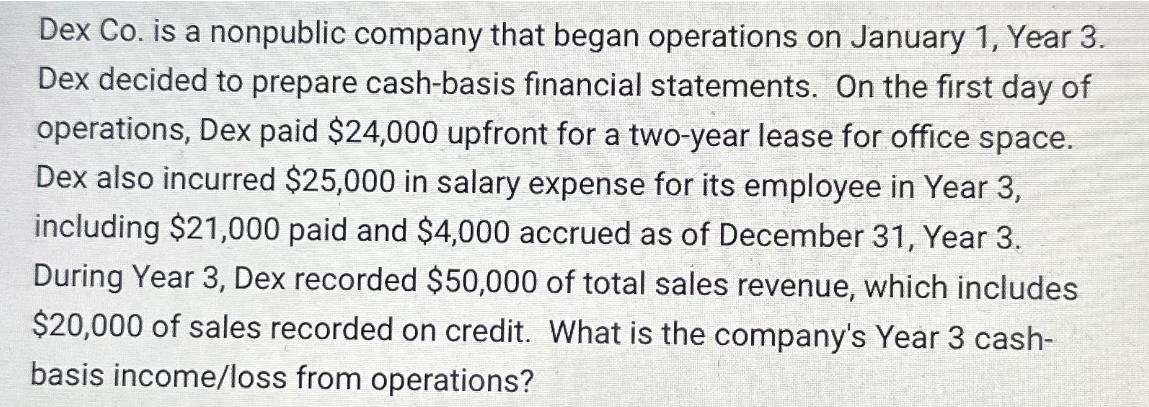

Dex Co. is a nonpublic company that began operations on January 1, Year 3. Dex decided to prepare cash-basis financial statements. On the first day of operations, Dex paid $24,000 upfront for a two-year lease for office space. Dex also incurred $25,000 in salary expense for its employee in Year 3, including $21,000 paid and $4,000 accrued as of December 31, Year 3. During Year 3, Dex recorded $50,000 of total sales revenue, which includes $20,000 of sales recorded on credit. What is the company's Year 3 cash- basis income/loss from operations?

Step by Step Solution

3.55 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Revenue Total sales revenue recorded during Year 3 50000 Sales recorded on credit 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial And Managerial Accounting The Financial Chapters

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

6th Edition

978-0134486840, 134486838, 134486854, 134486846, 9780134486833, 978-0134486857

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App