Question

Dextra Computing sells merchandise for $20,000 cash on September 30 (cost of merchandise is $12,000). Dextra collects 9% sales tax. Record the entry for

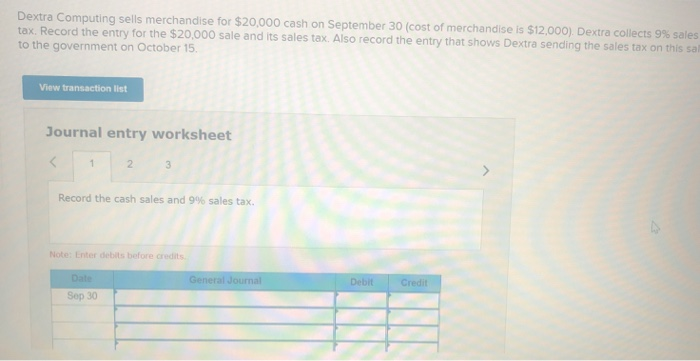

Dextra Computing sells merchandise for $20,000 cash on September 30 (cost of merchandise is $12,000). Dextra collects 9% sales tax. Record the entry for the $20,000 sale and its sales tax. Also record the entry that shows Dextra sending the sales tax on this sal to the government on October 15. View transaction list Journal entry worksheet 3 Record the cash sales and 9% sales tax. Note: Enter debits before credits Date General Journal Debit Credit Sep 30

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Journal September 30 Cash 21800 Sales 20000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App