Question

DFH plc manufactures and sells three products that use the same production facilities. The annual budget has just been prepared and the projected sales, selling

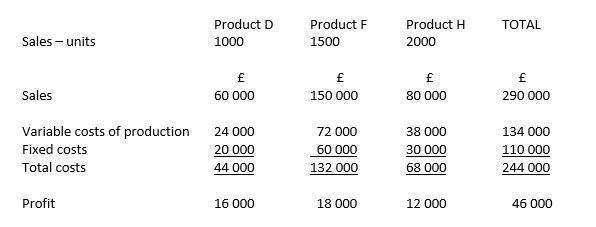

DFH plc manufactures and sells three products that use the same production facilities. The annual budget has just been prepared and the projected sales, selling prices, manufacturing costs and expenses resulted in the following projections of the profit that would be generated in 2014.

The total fixed costs of the company had been apportioned to products on the basis of the direct labour hours used to manufacture each product. The company only manufactures products when they are ordered and hold no finished goods in stock. The sales forecasts mean that the direct labour hours in 2014 would total 11 000 direct labour hours.

However, in the last months of 2013, it was found that the direct labour hours available in 2014 would be reduced to only 8 000 direct labour hours. Despite looking at all the possible ways to increase the direct labour hours available, it was not possible to increase the hours available in 2014.

Required

(a) What quantity of the products should be made and sold to maximise the companys profit? It is not possible to sell more than the number of units of the three products shown in the original budget. The fixed costs of the company will not be reduced as a result of the decreased number of direct labour hours.

(b) Alternatively, the selling price per unit of each of the three products could be increased by 10 per cent but it is expected that this will reduce the number of units sold by 30 per cent. However, this would mean that DFH plc would be able to manufacture all the units that are expected to be ordered during 2014. What will be the total profit of the company if the prices are increased?

Product D Product F Product H TOTAL - units Sales 1000 1500 2000 Sales 150 000 290 000 60000 80 000 Variable costs of production 38 000 24 000 72000 134 000 Fixed costs 30 000 20 000 60 000 110 000 Total costs 44 000 244 000 132 000 68 000 Profit 12 000 16 000 18 000 46 000 Product D Product F Product H TOTAL - units Sales 1000 1500 2000 Sales 150 000 290 000 60000 80 000 Variable costs of production 38 000 24 000 72000 134 000 Fixed costs 30 000 20 000 60 000 110 000 Total costs 44 000 244 000 132 000 68 000 Profit 12 000 16 000 18 000 46 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started