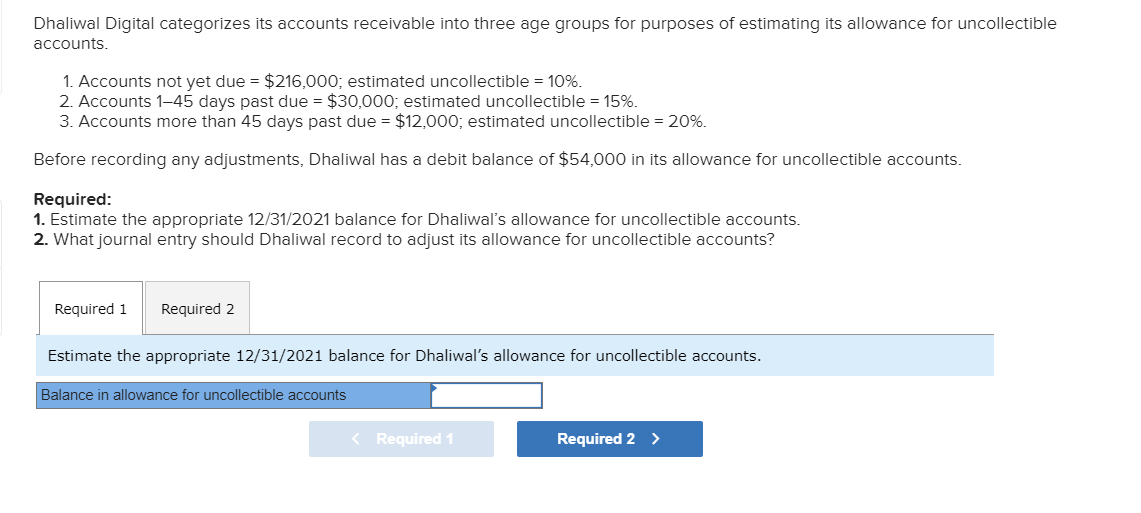

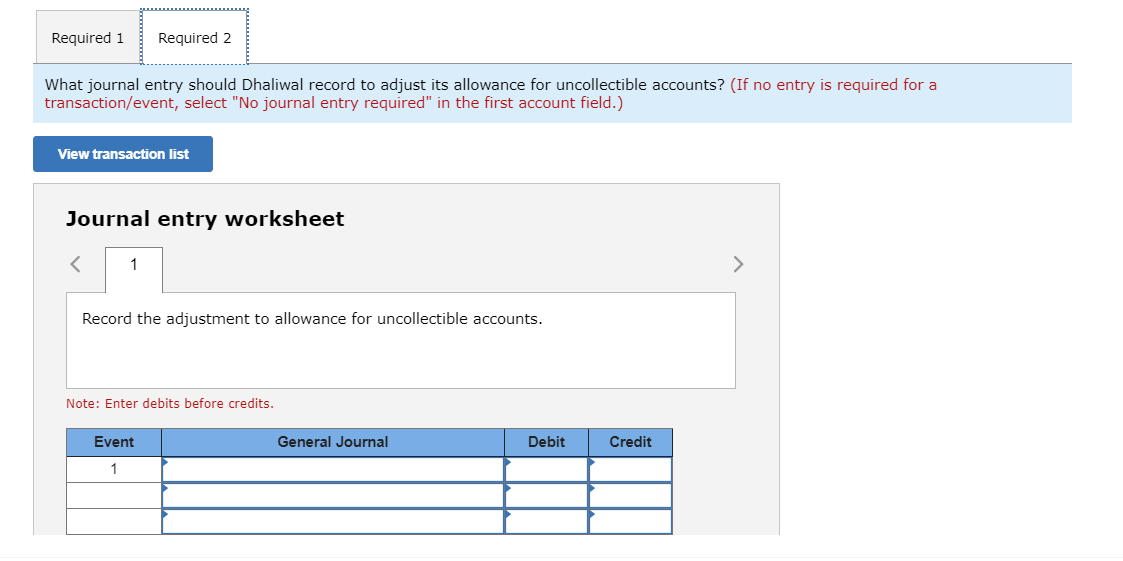

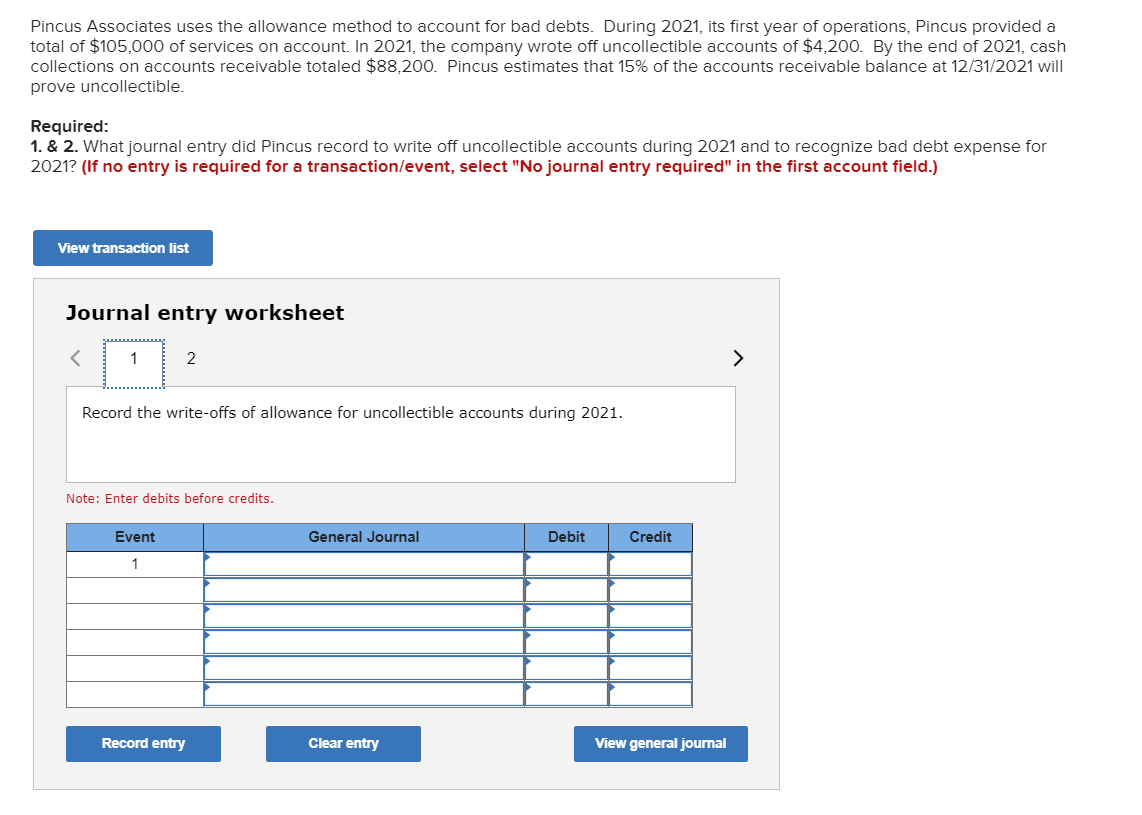

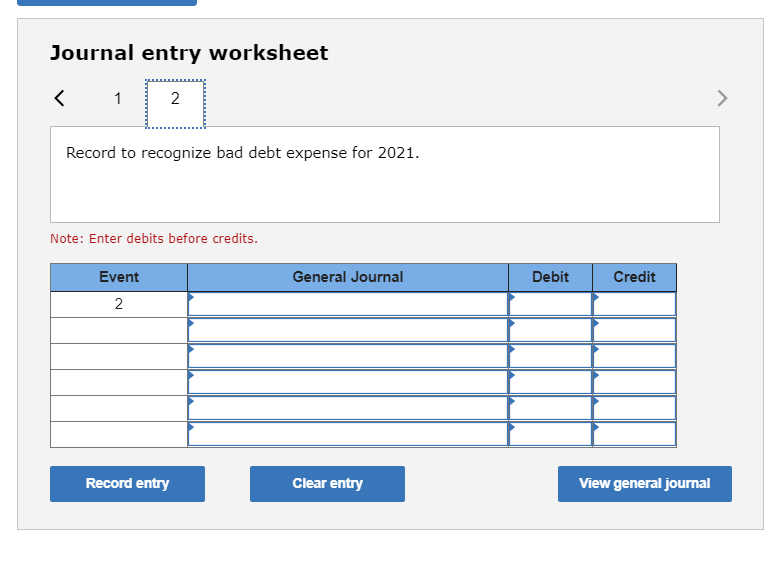

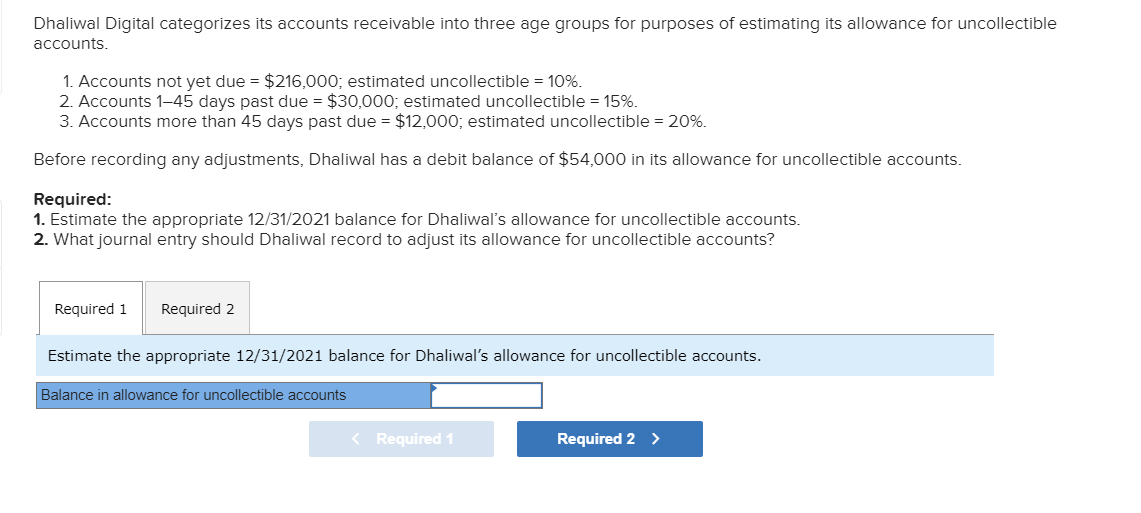

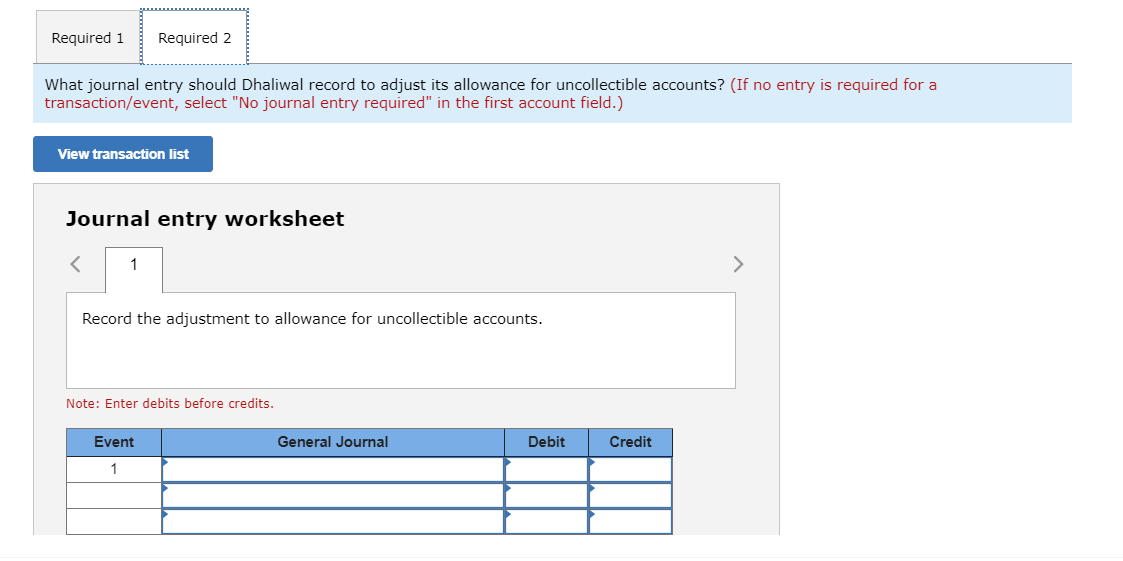

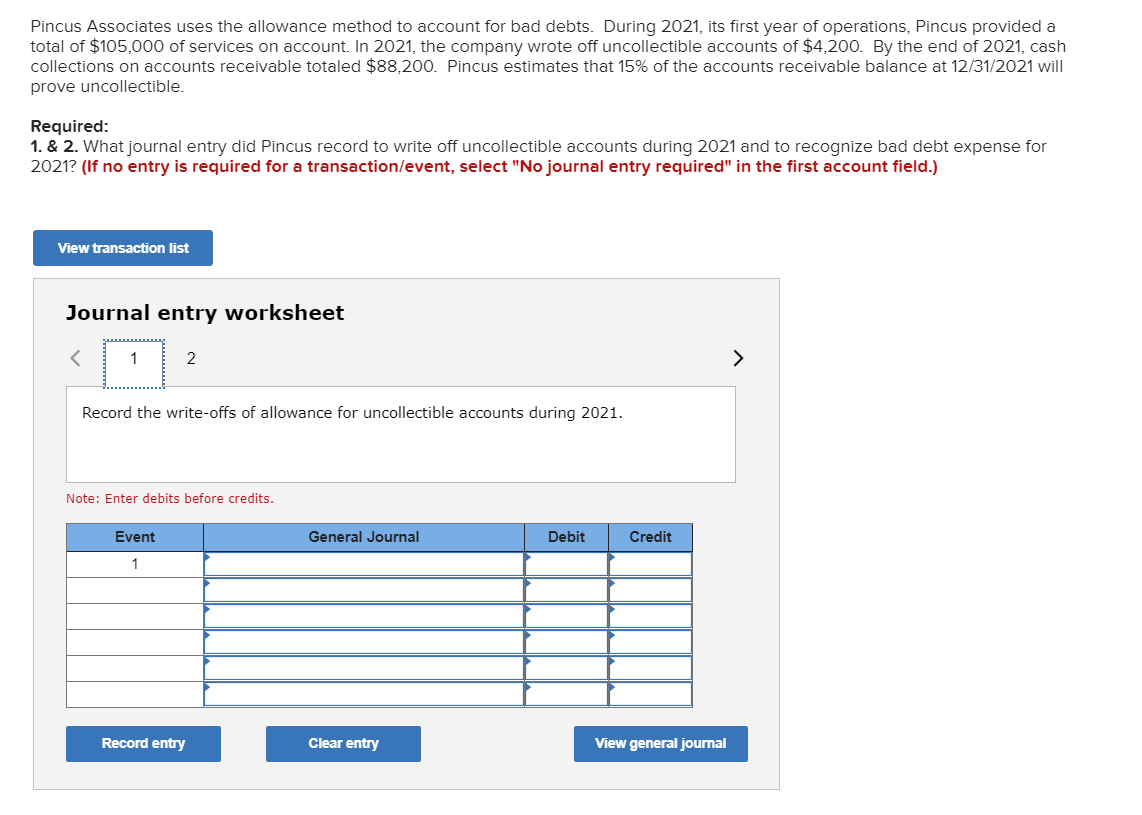

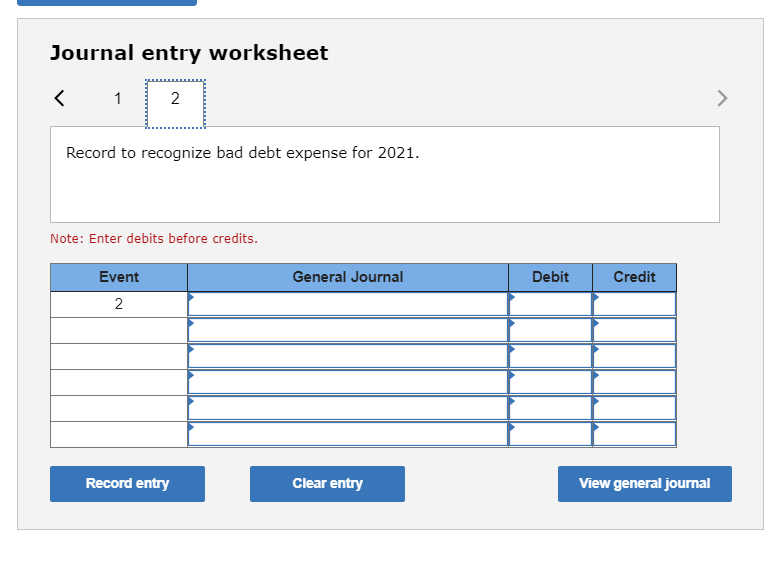

Dhaliwal Digital categorizes its accounts receivable into three age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due = $216,000, estimated uncollectible = 10%. 2. Accounts 1-45 days past due = $30,000; estimated uncollectible = 15%. 3. Accounts more than 45 days past due = $12,000; estimated uncollectible = 20%. Before recording any adjustments, Dhaliwal has a debit balance of $54,000 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2021 balance for Dhaliwal's allowance for uncollectible accounts. 2. What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? Required 1 Required 2 Estimate the appropriate 12/31/2021 balance for Dhaliwal's allowance for uncollectible accounts. Balance in allowance for uncollectible accounts Required 1 Required 2 > Required 1 Required 2 What journal entry should Dhaliwal record to adjust its allowance for uncollectible accounts? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the adjustment to allowance for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit Pincus Associates uses the allowance method to account for bad debts. During 2021, its first year of operations, Pincus provided a total of $105,000 of services on account. In 2021, the company wrote off uncollectible accounts of $4,200. By the end of 2021, cash collections on accounts receivable totaled $88,200. Pincus estimates that 15% of the accounts receivable balance at 12/31/2021 will prove uncollectible. Required: 1. & 2. What journal entry did Pincus record to write off uncollectible accounts during 2021 and to recognize bad debt expense for 2021? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the write-offs of allowance for uncollectible accounts during 2021. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet Record to recognize bad debt expense for 2021. Note: Enter debits before credits. General Journal Debit Credit Event 2 Record entry Clear entry View general journal