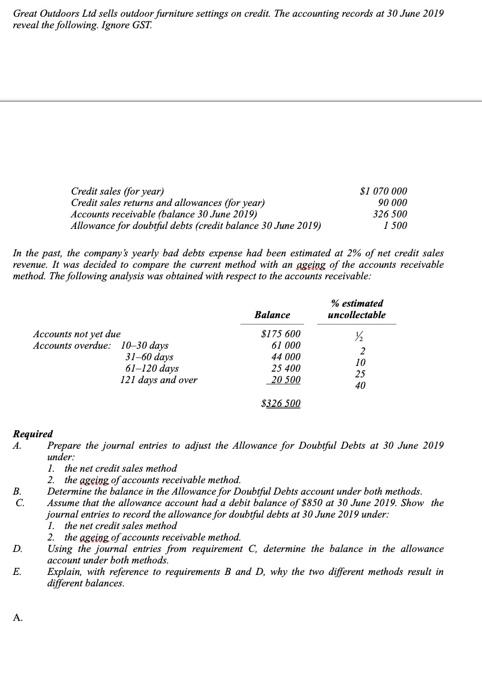

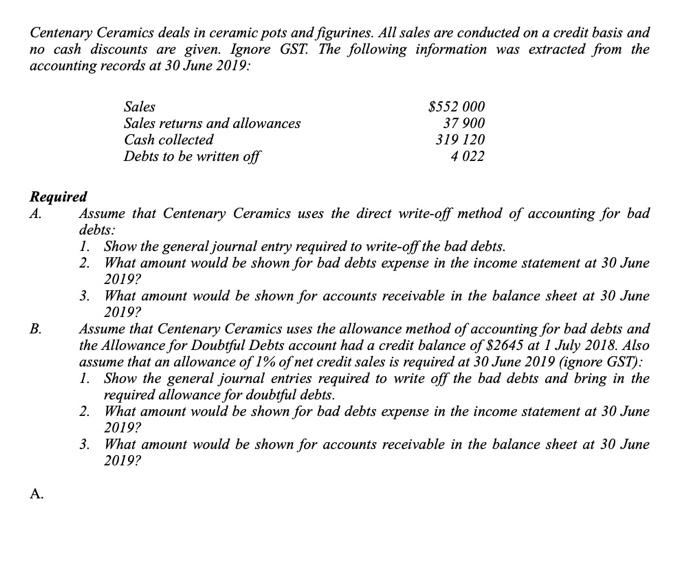

Great Outdoors Lid sells outdoor furniture settings on credit. The accounting records at 30 June 2019 reveal the following. Ignore GST Credit sales (for year) Credit sales returns and allowances (for year) Accounts receivable (balance 30 June 2019) Allowance for doubtful debts (credit balance 30 June 2019) SI 070 000 90 000 326 500 1 500 In the past, the company's yearly bad debts expense had been estimated at 2% of net credit sales revenue. It was decided to compare the current method with an ageing of the accounts receivable method. The following analysis was obtained with respect to the accounts receivable: % estimated uncollectable Accounts nor yer due Accounts overdue: 10-30 days 31-60 days 61-120 days 121 days and over Balance $175 600 61 000 44 000 25 400 20 500 10 25 40 $326 500 Required A. Prepare the journal entries to adjust the Allowance for Doubtful Debts at 30 June 2019 under: 1. the net credit sales method 2. the ageing of accounts receivable method B. Determine the balance in the Allowance for Doubtful Debts account under both methods. c. Assume that the allowance account had a debit balance of $850 at 30 June 2019. Show the journal entries to record the allowance for doubtful debts at 30 June 2019 under: 1. the nel credit sales method 2. the ageing of accounts receivable method. D. Using the journal entries from requirement C determine the balance in the allowance account under both methods E Explain, with reference to requirements B and D. why the two different methods result in different balances. A Centenary Ceramics deals in ceramic pots and figurines. All sales are conducted on a credit basis and no cash discounts are given. Ignore GST. The following information was extracted from the accounting records at 30 June 2019: Sales Sales returns and allowances Cash collected Debts to be written of $552 000 37 900 319 120 4 022 Required A. Assume that Centenary Ceramics uses the direct write-off method of accounting for bad debts: 1. Show the general journal entry required to write-off the bad debts. 2. What amount would be shown for bad debts expense in the income statement at 30 June 2019? 3. What amount would be shown for accounts receivable in the balance sheet at 30 June 2019? B. Assume that Centenary Ceramics uses the allowance method of accounting for bad debts and the Allowance for Doubtful Debts account had a credit balance of $2645 at 1 July 2018. Also assume that an allowance of 1% of net credit sales is required at 30 June 2019 (ignore GST): 1. Show the general journal entries required to write off the bad debts and bring in the required allowance for doubtful debts. 2. What amount would be shown for bad debts expense in the income statement at 30 June 2019? 3. What amount would be shown for accounts receivable in the balance sheet at 30 June 2019? A