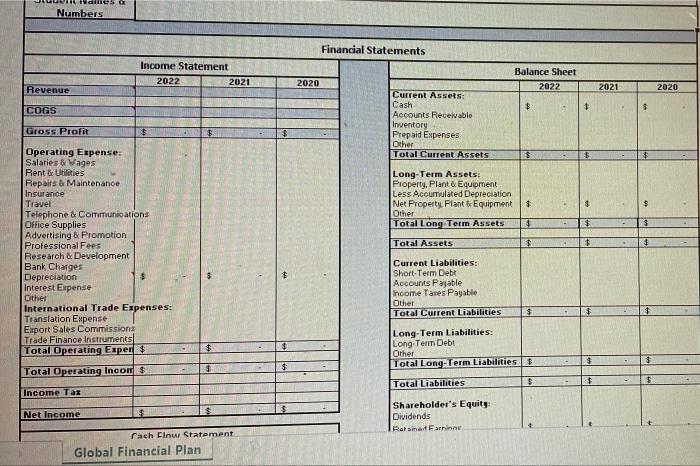

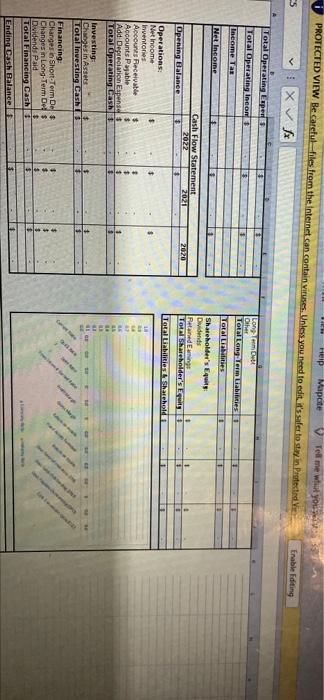

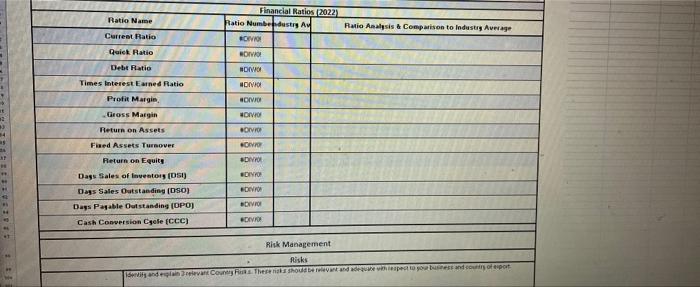

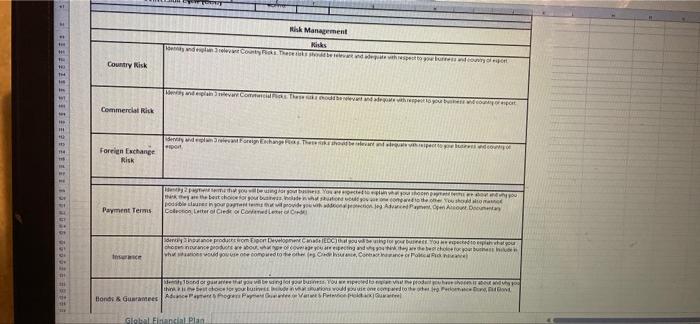

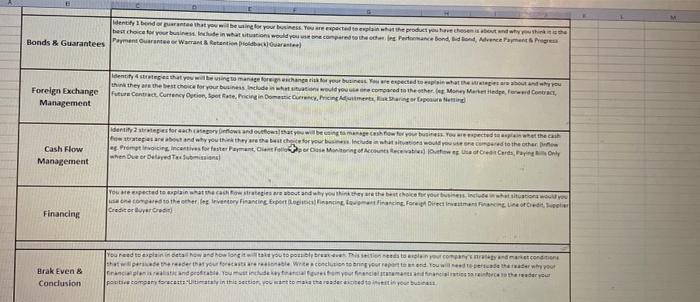

di Numbers Financial Statements Income Statement 2022 2021 2020 Balance Sheet 2022 Revenue 2021 2020 $ $ COGS $ Current Assets: Cash Accounts Receivable Inventory Prepaid Expenses Other Total Current Assets Gross Profit Long-Term Assets: Property, Plant & Equipment Less Accumulated Depreciation Net Property Plant & Equipment Other Total Long Term Assets $ $ $ $ Total Assets Operating Expense: Salaries & Vages Rent & Utilities Repairs & Maintenance Insurance Travel Telephone & Communioations Office Supplies Advertising & Promotion Professional Fees Research & Development Bank Charges Depreciation $ Interest Expense Other International Trade Expenses: Translation Expense Export Sales Commissions Trade Finance Instruments Total Operating Esper Current Liabilities: Short-Term Debt Accounts Payable Income Taxes Payable Other Total Current Liabilities $ Long-Term Liabilities: Long Term Debt Other Total Long-Term Liabilities Total Operating Incom$ Total Liabilities $ $ $ Income Tax Net Income Shareholder's Equity Dividends Raria Earning rach Elnur Statement Global Financial Plan HE HelpMapeite Tell me what you PROTECTED VIEW Be careful-files from the Internet can contain vies. Unless you need to edit safe to stay in Protected X Se ES y Enable Editing Total Operating Esper Total Operating Incor Long Other Total Long Term Liabilities Total Liabilities Income Tas Net Income Cash Flow Statement 2022 2021 Shareholder's Equity Dividends Retained 110eholders is 2020 Opening Balance Foteliabilitatehote Operations: Net Income Inventores Accounts Receivable Accounts Payable Add Depreciation Eapenad 3 Total Operating cash BEEEEEEEEEE Investing Changes in Assets Total Investing Cash Financing Changes Short Term Del Changes in Long-Term Des Dividends Paid Total Financing Cash Ending cash Balance Ratio Name Financial Ratios (2022 Ratio Numbedustry AM Ratio Analysis & Comparison to Industry Average Current Ratio VO DIVO HOW NOVO Quick Ratio Debt Ratio Times Interest Earned Ratio Profit Margin Gross Margin Return on Assets Fixed Assets Turnover SOWO HOWO OVO OVO Return on Equity DIVO DIVO Devo Dags Sales of Inventory (SI) Dags Sales Outstanding (OSO) Das Papable Outstanding (DPO) Cash Conversion Cyele (CCC) DIVO DI 1815 Risk Management Risks Vanden relevant Co. The should be east and adapest to your doctor 1 Nisk Management Misks # Country Risk HI Commercial Rick 10 11 de droghang. The hotel per H T14 Foreign Exchange IS no og YOU the best choice for the you the ho Podpovide you who are lot. Documentary Colection Letter CCO Payment Terms 1036888611 en e prodhouse pochopith what you cho nuevo pecting and the Who would you mwed to other source, Concerts hondergang Dunia the ocesor your devis would Hond & Gurmees Aduceres hegeysowe produire other to Global Financial Plan denti bandor that you with sing for your business. You are expected to the product you have chosen and within best choice for your buschade in what it would you to compared to the Perime Bond, dond, Advancement Press Bonds & Guarantees Poment Guarantee Warrant & Retention baru Foreign Exchange Management Identify that you will be using to manage for changer le pour business. You weespected to what I want you think they are the best choice for your business Includes who would you use come to the other. Menn Marte Hedgeford Contract Future Contact Curteney Ocion, Boot Rate Pricing in Domen Pricing tagapour end Identity 2 pes for each sportows and every will be show for your business Tourepected to let the wees are band why you think they are the beach your bets we curred to the other ng Prom Incentives for faster amant, Center Mor of Account Cards Only when weer betydemissions Cash Flow Management You expected to explain the core about and why you thithe choice for your senses you onto the other lectory Financing porn aning. For time in Creditorer Financing Hrak Even& Conclusion You need to powand how long you to prove the data con conditions shat reader that you were We conclusion to not report and you wider who and audiomyour financiare there your attain the section you tharded to you di Numbers Financial Statements Income Statement 2022 2021 2020 Balance Sheet 2022 Revenue 2021 2020 $ $ COGS $ Current Assets: Cash Accounts Receivable Inventory Prepaid Expenses Other Total Current Assets Gross Profit Long-Term Assets: Property, Plant & Equipment Less Accumulated Depreciation Net Property Plant & Equipment Other Total Long Term Assets $ $ $ $ Total Assets Operating Expense: Salaries & Vages Rent & Utilities Repairs & Maintenance Insurance Travel Telephone & Communioations Office Supplies Advertising & Promotion Professional Fees Research & Development Bank Charges Depreciation $ Interest Expense Other International Trade Expenses: Translation Expense Export Sales Commissions Trade Finance Instruments Total Operating Esper Current Liabilities: Short-Term Debt Accounts Payable Income Taxes Payable Other Total Current Liabilities $ Long-Term Liabilities: Long Term Debt Other Total Long-Term Liabilities Total Operating Incom$ Total Liabilities $ $ $ Income Tax Net Income Shareholder's Equity Dividends Raria Earning rach Elnur Statement Global Financial Plan HE HelpMapeite Tell me what you PROTECTED VIEW Be careful-files from the Internet can contain vies. Unless you need to edit safe to stay in Protected X Se ES y Enable Editing Total Operating Esper Total Operating Incor Long Other Total Long Term Liabilities Total Liabilities Income Tas Net Income Cash Flow Statement 2022 2021 Shareholder's Equity Dividends Retained 110eholders is 2020 Opening Balance Foteliabilitatehote Operations: Net Income Inventores Accounts Receivable Accounts Payable Add Depreciation Eapenad 3 Total Operating cash BEEEEEEEEEE Investing Changes in Assets Total Investing Cash Financing Changes Short Term Del Changes in Long-Term Des Dividends Paid Total Financing Cash Ending cash Balance Ratio Name Financial Ratios (2022 Ratio Numbedustry AM Ratio Analysis & Comparison to Industry Average Current Ratio VO DIVO HOW NOVO Quick Ratio Debt Ratio Times Interest Earned Ratio Profit Margin Gross Margin Return on Assets Fixed Assets Turnover SOWO HOWO OVO OVO Return on Equity DIVO DIVO Devo Dags Sales of Inventory (SI) Dags Sales Outstanding (OSO) Das Papable Outstanding (DPO) Cash Conversion Cyele (CCC) DIVO DI 1815 Risk Management Risks Vanden relevant Co. The should be east and adapest to your doctor 1 Nisk Management Misks # Country Risk HI Commercial Rick 10 11 de droghang. The hotel per H T14 Foreign Exchange IS no og YOU the best choice for the you the ho Podpovide you who are lot. Documentary Colection Letter CCO Payment Terms 1036888611 en e prodhouse pochopith what you cho nuevo pecting and the Who would you mwed to other source, Concerts hondergang Dunia the ocesor your devis would Hond & Gurmees Aduceres hegeysowe produire other to Global Financial Plan denti bandor that you with sing for your business. You are expected to the product you have chosen and within best choice for your buschade in what it would you to compared to the Perime Bond, dond, Advancement Press Bonds & Guarantees Poment Guarantee Warrant & Retention baru Foreign Exchange Management Identify that you will be using to manage for changer le pour business. You weespected to what I want you think they are the best choice for your business Includes who would you use come to the other. Menn Marte Hedgeford Contract Future Contact Curteney Ocion, Boot Rate Pricing in Domen Pricing tagapour end Identity 2 pes for each sportows and every will be show for your business Tourepected to let the wees are band why you think they are the beach your bets we curred to the other ng Prom Incentives for faster amant, Center Mor of Account Cards Only when weer betydemissions Cash Flow Management You expected to explain the core about and why you thithe choice for your senses you onto the other lectory Financing porn aning. For time in Creditorer Financing Hrak Even& Conclusion You need to powand how long you to prove the data con conditions shat reader that you were We conclusion to not report and you wider who and audiomyour financiare there your attain the section you tharded to you