Answered step by step

Verified Expert Solution

Question

1 Approved Answer

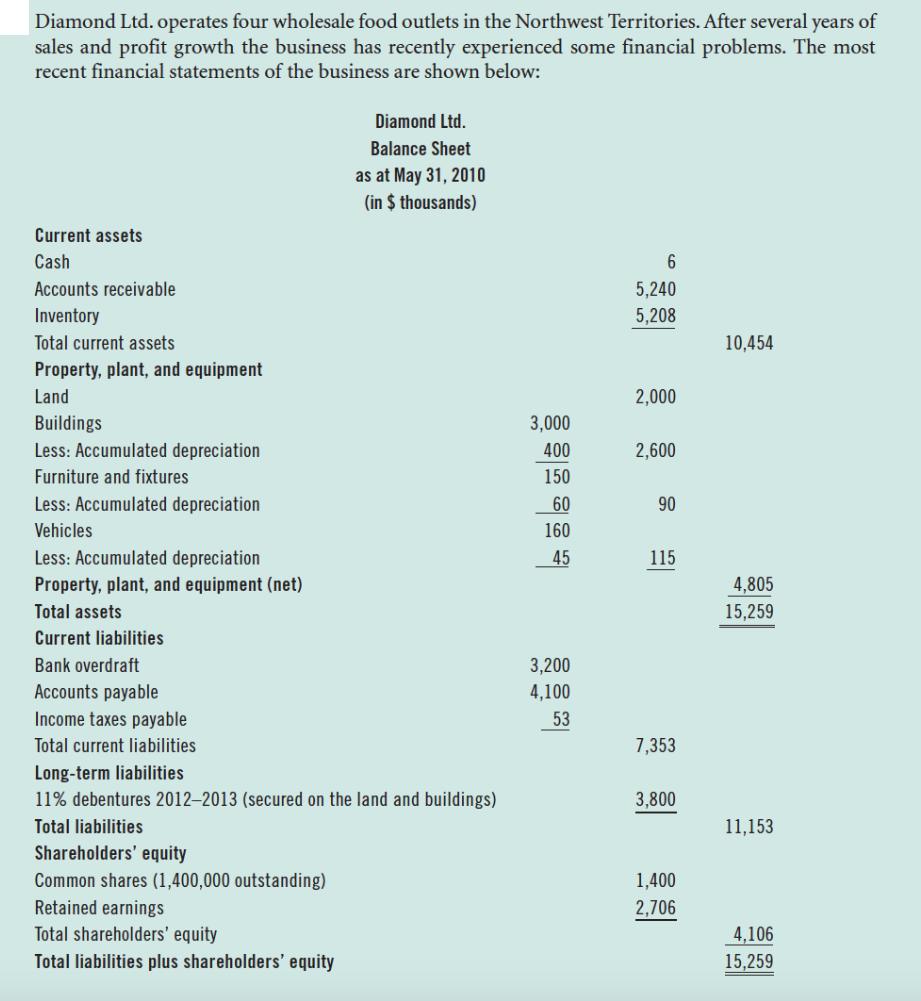

Diamond Ltd. operates four wholesale food outlets in the Northwest Territories. After several years of sales and profit growth the business has recently experienced

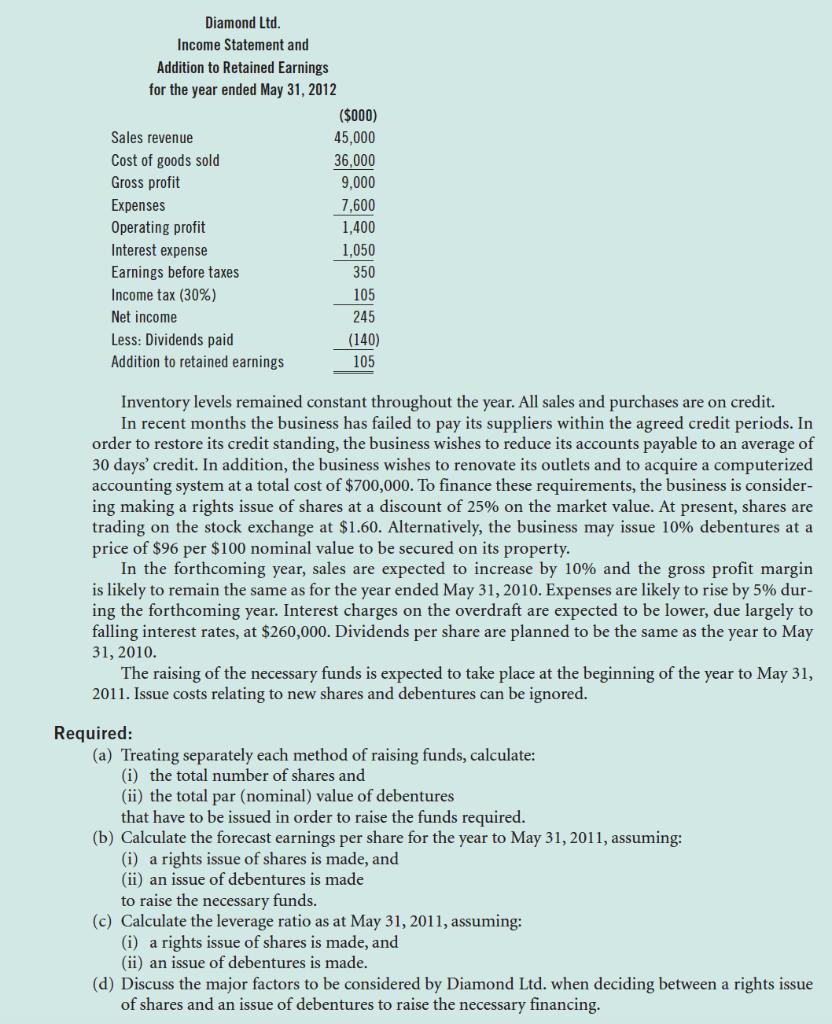

Diamond Ltd. operates four wholesale food outlets in the Northwest Territories. After several years of sales and profit growth the business has recently experienced some financial problems. The most recent financial statements of the business are shown below: Current assets Cash Accounts receivable Inventory Total current assets Property, plant, and equipment Land Buildings Less: Accumulated depreciation Furniture and fixtures Less: Accumulated depreciation. Vehicles Less: Accumulated depreciation Property, plant, and equipment (net) Total assets Current liabilities Bank overdraft Accounts payable Income taxes payable Total current liabilities Long-term liabilities 11% debentures 2012-2013 (secured on the land and buildings) Total liabilities Shareholders' equity Common shares (1,400,000 outstanding) Retained earnings Diamond Ltd. Balance Sheet as at May 31, 2010 (in $ thousands) Total shareholders' equity Total liabilities plus shareholders' equity 3,000 400 150 60 160 45 3,200 4,100 53 6 5,240 5,208 2,000 2,600 90 115 7,353 3,800 1,400 2,706 10,454 4,805 15,259 11,153 4,106 15,259 Diamond Ltd. Income Statement and Addition to Retained Earnings for the year ended May 31, 2012 Sales revenue Cost of goods sold Gross profit Expenses Operating profit Interest expense Earnings before taxes Income tax (30%) Net income Less: Dividends paid Addition to retained earnings ($000) 45,000 36,000 9,000 7,600 1,400 1,050 350 105 245 (140) 105 Inventory levels remained constant throughout the year. All sales and purchases are on credit. In recent months the business has failed to pay its suppliers within the agreed credit periods. In order to restore its credit standing, the business wishes to reduce its accounts payable to an average of 30 days' credit. In addition, the business wishes to renovate its outlets and to acquire a computerized accounting system at a total cost of $700,000. To finance these requirements, the business is consider- ing making a rights issue of shares at a discount of 25% on the market value. At present, shares are trading on the stock exchange at $1.60. Alternatively, the business may issue 10% debentures at a price of $96 per $100 nominal value to be secured on its property. In the forthcoming year, sales are expected to increase by 10% and the gross profit margin is likely to remain the same as for the year ended May 31, 2010. Expenses are likely to rise by 5% dur- ing the forthcoming year. Interest charges on the overdraft are expected to be lower, due largely to falling interest rates, at $260,000. Dividends per share are planned to be the same as the year to May 31, 2010. The raising of the necessary funds is expected to take place at the beginning of the year to May 31, 2011. Issue costs relating to new shares and debentures can be ignored. Required: (a) Treating separately each method of raising funds, calculate: (i) the total number of shares and (ii) the total par (nominal) value of debentures that have to be issued in order to raise the funds required. (b) Calculate the forecast earnings per share for the year to May 31, 2011, assuming: (i) a rights issue of shares is made, and (ii) an issue of debentures is made to raise the necessary funds. (c) Calculate the leverage ratio as at May 31, 2011, assuming: (i) a rights issue of shares is made, and (ii) an issue of debentures is made. (d) Discuss the major factors to be considered by Diamond Ltd. when deciding between a rights issue of shares and an issue of debentures to raise the necessary financing.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a i Funds required A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started