Diamonds audit committee concluded that a continuity payment made to growers in August 2010 of approximately $20 million and a momentum payment made to growers in August/ September 2011 of approximately $60 million were not accounted for in the correct periods.

Calculate the effect of Diamonds incorrect recording of the August 2010 and August/September 2011 payments on the pretax income for the years ending July 31, 2010 and July 31, 2011, respectively. Explain and provide supporting calculations, if any.

For this requirement, assume that Diamond sold all the walnuts purchased during a fiscal year in that year itself (i.e., there is no inventory brought forward from the previous fiscal year or carried forward to the subsequent fiscal year).

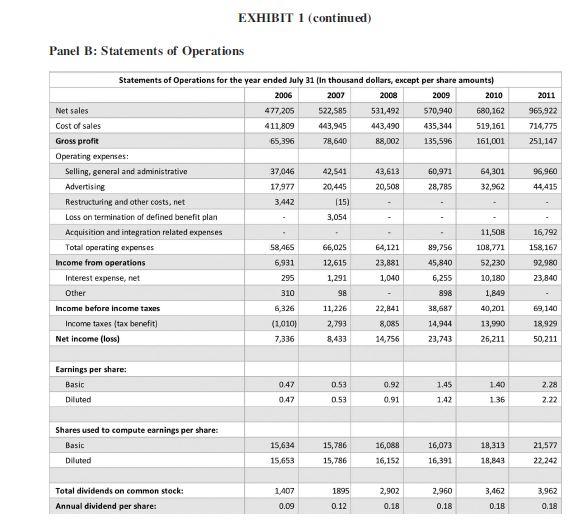

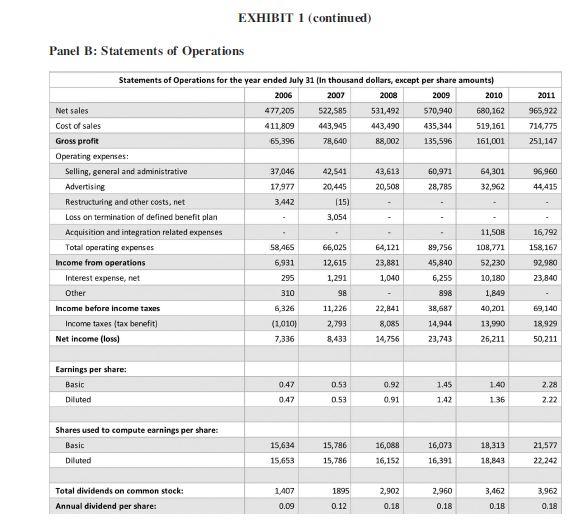

EXHIBIT 1 (continued) Panel B: Statements of Operations Statements of Operations for the year ended July 31 (In thousand dollars, except per share amounts) 2006 2010 2011 477,205 411,809 65,396 2007 522,585 443,945 78,640 2008 531,492 443,490 88,002 2009 570,940 435,344 135,596 680,262 519,161 161,001 965,922 714,775 251,147 37,046 43,613 20,508 60,971 28,785 64,301 32,962 96,960 44.415 17,977 3,442 42,541 20,445 (15) 3,054 - Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Advertising Restructuring and other costs, net Loss on termination of defined benefit plan Acquisition and integration related expenses Total operating expenses Income from operations Interest expense, net Other Income before income taxes Income taxes (tax benefit) Net income (loss) 58.465 6.931 295 310 66,025 12,615 1,291 98 64,121 23,881 1,040 89,756 45,840 6,255 898 16,792 158,167 92,980 23,840 11,503 108,771 52,230 10,180 1,849 40,201 13,990 25,211 6,326 11,226 22,841 38,687 14,944 59,140 18,929 (2010) 7,336 2,793 8,433 8,085 14,756 23,743 50,211 Earnings per share: Basic Diluted 0.92 0.47 0.47 0.53 0.53 1.45 1.42 1.40 136 2.28 2.22 0.91 Shares used to compute earnings per share: Basic Diluted 15,634 15,653 15,786 15,786 16,088 16,152 16,073 16,391 18,313 18,843 21,577 22.242 1895 3,962 Total dividends on common stock: Annual dividend per share: 1,407 0.09 2,902 0.18 2,960 0.18 3,462 0.18 0.12 0.18 EXHIBIT 1 (continued) Panel B: Statements of Operations Statements of Operations for the year ended July 31 (In thousand dollars, except per share amounts) 2006 2010 2011 477,205 411,809 65,396 2007 522,585 443,945 78,640 2008 531,492 443,490 88,002 2009 570,940 435,344 135,596 680,262 519,161 161,001 965,922 714,775 251,147 37,046 43,613 20,508 60,971 28,785 64,301 32,962 96,960 44.415 17,977 3,442 42,541 20,445 (15) 3,054 - Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Advertising Restructuring and other costs, net Loss on termination of defined benefit plan Acquisition and integration related expenses Total operating expenses Income from operations Interest expense, net Other Income before income taxes Income taxes (tax benefit) Net income (loss) 58.465 6.931 295 310 66,025 12,615 1,291 98 64,121 23,881 1,040 89,756 45,840 6,255 898 16,792 158,167 92,980 23,840 11,503 108,771 52,230 10,180 1,849 40,201 13,990 25,211 6,326 11,226 22,841 38,687 14,944 59,140 18,929 (2010) 7,336 2,793 8,433 8,085 14,756 23,743 50,211 Earnings per share: Basic Diluted 0.92 0.47 0.47 0.53 0.53 1.45 1.42 1.40 136 2.28 2.22 0.91 Shares used to compute earnings per share: Basic Diluted 15,634 15,653 15,786 15,786 16,088 16,152 16,073 16,391 18,313 18,843 21,577 22.242 1895 3,962 Total dividends on common stock: Annual dividend per share: 1,407 0.09 2,902 0.18 2,960 0.18 3,462 0.18 0.12 0.18