Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Diana and Ryan Workman were marrled on January 1 of last year. Ryan has an ergh - y ar - old son, Jorge, from his

Diana and Ryan Workman were marrled on January of last year. Ryan has an erghyarold son, Jorge, from his prewous

manriage. Diana works as a computer programmer at Dataflie Incorporated Dl earning a salary of $ Ryan is selt

employed and runs a day care center. The Workmans reported the following financlal information pertaining to thelr

activites during the current year.

a Dians eamed a $ salary for the year:

b Disns borrowed $ from DI to purchsse s car. Dl chsiged her percent Interest $ on the losn, which Disns

psid on December Di would have charged Disns $ if interest hsd been csiculsted st the spplicsble federsi

interest rate. Assume that tax avordance was not a movve for the losn.

c Ryan recelved $ In alimony and $ in chlid support payments from his former spouse. They dlvorced in

d Ryan won a $ cash prize at his churchsponsored Bingo game.

e The Workmans recelved $ of interest from carporste bonds snd $ of interest from munkipgl bond. Ryan

owned these bonds before he mamed Dalna.

f The couple bought shares of ABC incorporated stock tor $ per share on July The stock was worth $ a share

on December The stock psid a dividend of $ per ghare on December

Ryan's father passed away on Aprll He inherited cash of $ from his father and his baseball card collection,

valued at $ As the beneficlary of his father's ife Insurance pollcy. Ryan also recelved $

h The couple spent a weekend in Aplanuc City movember and came home with greas gambling winnings of $

Diana recelved $ cash for reaching years of cominuous service at Dl

J Diana was hit and injured by a crunk drver whle crossing a street at a crosswalk. she was unable to work for a month.

She recelved $ from her disability insurance. DI paid the premiums for Diana, but it reported the amount of the

premlums as compensation to Dlana on her yearend

k The drunk drlver who hit Diana in part uj was requifed to pay her $ medical costs, $ for the emouonal

trauma she suffered from the accident, and $ for punitive damages.

For meeting her performsnce gosls thls yesr. Disns wss informed on December that she would recelve o $

yeatend bonus. Di located in Housson, Toxas mal'sd Disna's bonus check from its payroll processing center Tampa

Flonda an December Diana didn't receNe the check at home unul January

m Rysan is percent owner of MNO Incorporsted. Subchspter $ corporstion. The compsny reparted ordinary

business income for the yesr of $ Rysn scquired the MNO stock two yesrs

n Ryan's day care business collected $ in revenues. In addition. customers owed him $ ar yearend. During

the year. Ryan spent $ for supplies. $ tor utlithes, $ for rent, and $ for miscellaneous

expenses One customer gove him use of their vocstion home for s week worth $ j in exchsinge for Rysn

allowing their child to sttend the doy care center free of charge Rysn sccounts for his business sctivitles using the cssh

method of accouning.

Diana's employer pays the couple's annual health insurance premiums of $ for a qualfied plan.

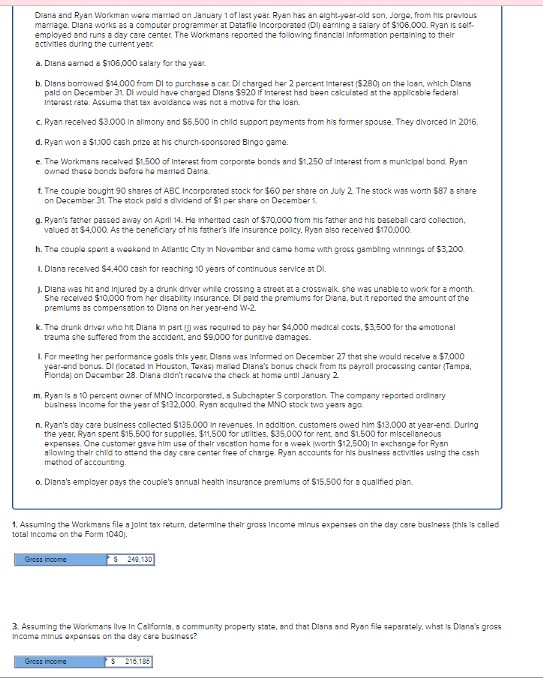

Assuming the Workmsns file ofoint tox return, determine their gross Income minus expenses on the dsy care business fthls is csiled

total Income on the Form

Assuming the Workmans Itve In Csifomis. community property state, and tha: Disns and Ryan file sepsrately, whst is Disns's gross

income minus expenses on the day care business?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started