Answered step by step

Verified Expert Solution

Question

1 Approved Answer

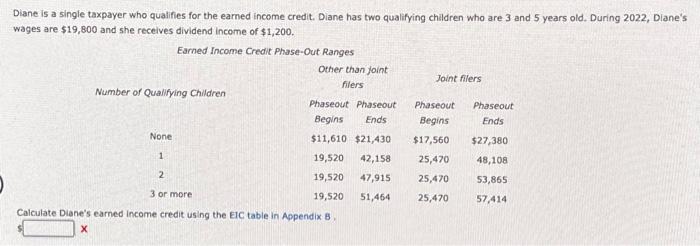

Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During

Diane is a single taxpayer who qualifies for the earned income credit. Diane has two qualifying children who are 3 and 5 years old. During 2022, Diane's wages are $19,800 and she receives dividend income of $1,200. Number of Qualifying Children None Earned Income Credit Phase-Out Ranges 1 2 3 or more Other than joint filers Phaseout Phaseout Begins Ends $11,610 $21,430 19,520 42,158 19,520 47,915 19,520 51,464 Calculate Diane's earned income credit using the EIC table in Appendix B. X Joint filers Phaseout Begins $17,560 25,470 25,470 25,470 Phaseout Ends $27,380 48,108 53,865 57,414

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started