Question: Didi Sdn Bhd (DSB) was incorporated in 2017 and set up a factory in Penang to manufacture disk drives. The company applied for pioneer

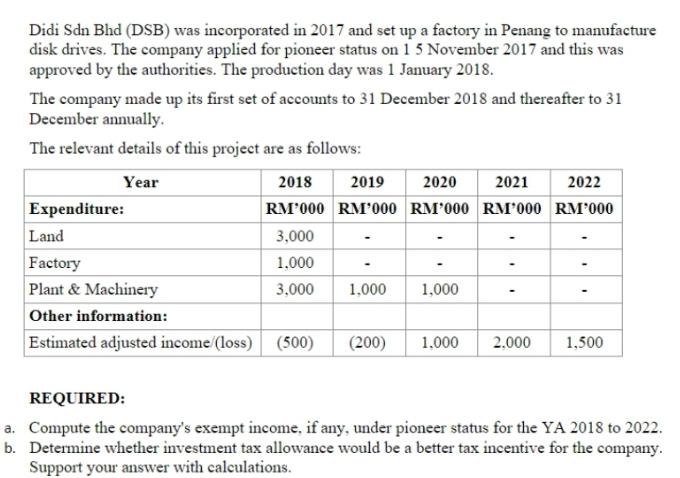

Didi Sdn Bhd (DSB) was incorporated in 2017 and set up a factory in Penang to manufacture disk drives. The company applied for pioneer status on 15 November 2017 and this was approved by the authorities. The production day was 1 January 2018. The company made up its first set of accounts to 31 December 2018 and thereafter to 31 December annually. The relevant details of this project are as follows: Year Expenditure: 2018 2019 2020 2021 2022 RM'000 RM'000 RM'000 RM'000 RM'000 Land Factory Plant & Machinery Other information: Estimated adjusted income/(loss) (500) 3,000 1.000 3,000 - 1,000 (200) 1,000 - 1,000 2.000 1,500 REQUIRED: a. Compute the company's exempt income, if any, under pioneer status for the YA 2018 to 2022. b. Determine whether investment tax allowance would be a better tax incentive for the company. Support your answer with calculations.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step 12 Answer a Compute the companys exempt income if any under pioneer statu... View full answer

Get step-by-step solutions from verified subject matter experts