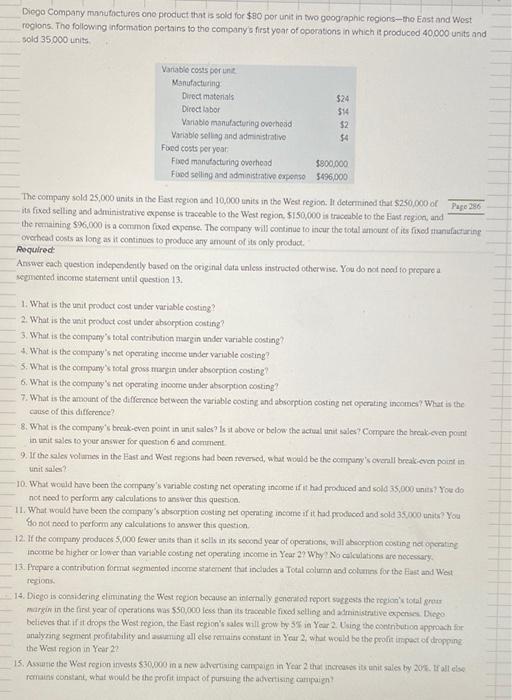

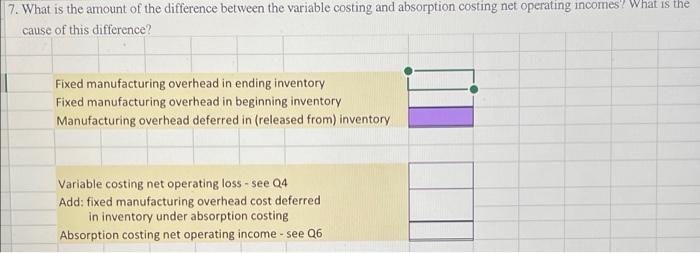

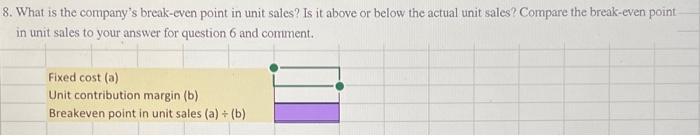

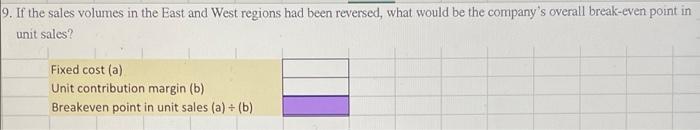

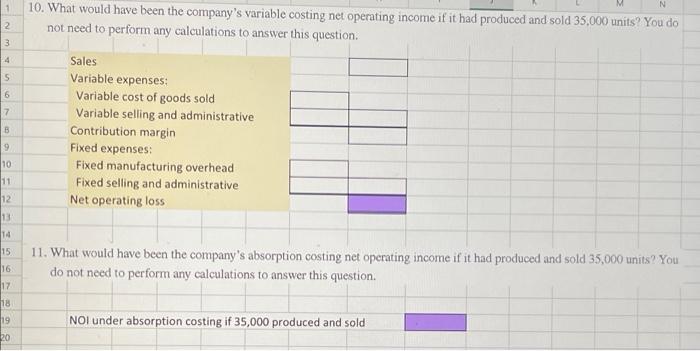

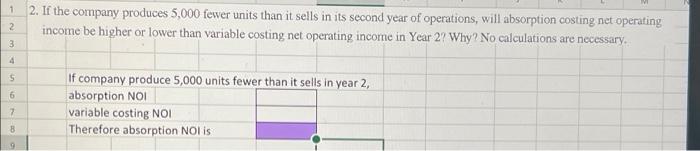

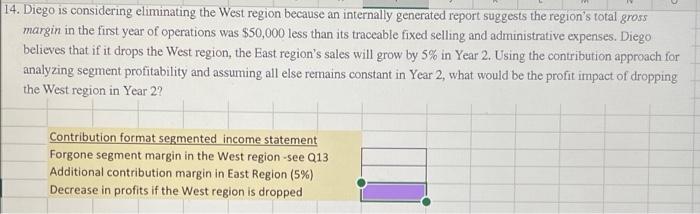

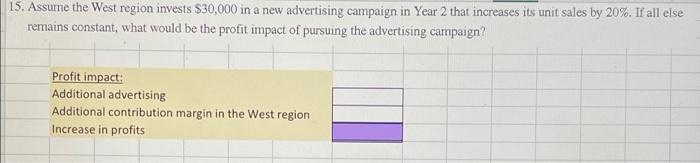

Diego Company manufactures ono product that is sold for $80 por unit in two goographic regions--the East and West rogions. The following information pertains to the company's first year of operations in which it produced 40000 units and sold 35,000 units Variable costs bort Manufacturing Direct materials $24 Dicoct abor $14 Variable manufacturing overhead $2 Variable selling and administrative $4 Foed costs per year Fored manufacturing overhead $800,000 Food selling and administrative expenso 5496000 The company sold 25,000 units in the East region and 10,000 units in the West region. Il determined that $250,000 Page 286 its fixed selling and administrative expense is traccable to the West region 5150,000 is truccable to the East region, and the remaining 596.000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead conts as long as it continues to produce any amount of its only product Required Answer cach question independently based on the original data unless instructed otherwise. You do not need to prepare a segmented income statement until question 13. 1. What is the unit product cost under variable costing? 2. What is the unit product cost under absorption conting? 3. What is the company's total contribution margin under variable costing 4. What is the company's net operating income under variable costing? 3. What is the company's total gross margin under absorption costing? 6. What is the company's net operating income under absorption costing? 7. What is the amount of the difference between the variable costing and absorption conting net operating incomes? What is the cause of this difference? 8. What is the company's break-even point in unit sales? Is it above or below the actual unit ales? Compare the break-even point in unit sales to your answer for question and comment 9. If the les volumes in the East and West regions had been revmed, what would be the company's overall break-even point in unit sales? 10. What would have been the company's variable couting net operating income if it had produced and sold 35,000 units? You do not need to perform any calculations to answer this question 11. What would have been the company's absorption costing net operating income if it had produced and sold 35.000 units? You Ho not need to perform any calculations to answer this question 12. If the company produces 5,000 fewer units than it sells in its second year of operations will albeception costing net operating income be higher or lower than variahlo costing net operating income in Year 2? Why No calculations are necessary 13. Prepare a contribution format segmented income staternent that includes a Total column and counters for the East and West 14. Diogo is considering eliminating the West region because an internally onerated report soreets the region's total groen margin in the first year of operations was $50,000 less than its traceable fixed selling and administrative expenses Diego believes that if it drops the West region the East repion's sales will grow by 5% in Your 2. Using the contribution approach for analyzine segment profitability and awuning ull else remains constant in Your 2. what would be the peolit impact of dropping the West region in Year 2? 15. Assume the West region invests $30,000 in a new advertising campaign in Year 2 that increases its unit sales by 20. trallelse roman constant, what would be the profit impact of pursuing the advertising campaign 7. What is the amount of the difference between the variable costing and absorption costing net operating incomes! What is the cause of this difference? Fixed manufacturing overhead in ending inventory Fixed manufacturing overhead in beginning inventory Manufacturing overhead deferred in (released from) inventory Variable costing net operating loss - see Q4 Add: fixed manufacturing overhead cost deferred in inventory under absorption costing Absorption costing net operating income - see Q6 8. What is the company's break-even point in unit sales? Is it above or below the actual unit sales? Compare the break-even point in unit sales to your answer for question 6 and comment. Fixed cost (a) Unit contribution margin (b) Breakeven point in unit sales (a)+(b) 9. If the sales volumes in the East and West regions had been reversed, what would be the company's overall break-even point in unit sales? Fixed cost (a) Unit contribution margin (b) Breakeven point in unit sales (a) + (b) 1 10. What would have been the company's variable costing net operating income if it had produced and sold 35,000 units? You do not need to perform any calculations to answer this question. 2 3 5 6 7 B Sales Variable expenses: Variable cost of goods sold Variable selling and administrative Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative Net operating loss 9 10 11 12 13 14 15 16 11. What would have been the company's absorption costing net operating income if it had produced and sold 35,000 units? You do not need to perform any calculations to answer this question. 17 18 19 20 NOI under absorption costing if 35,000 produced and sold 1 2. If the company produces 5,000 fewer units than it sells in its second year of operations, will absorption costing net operating income be higher or lower than variable costing net operating income in Year 2? Why? No calculations are necessary. 2 3 4 S 6 If company produce 5,000 units fewer than it sells in year 2, absorption NOI variable costing NOI Therefore absorption NOI IS 7 9 14. Diego is considering eliminating the West region because an internally generated report suggests the region's total gross margin in the first year of operations was $50,000 less than its traceable fixed selling and administrative expenses. Diego believes that if it drops the West region, the East region's sales will grow by 5% in Year 2. Using the contribution approach for analyzing segment profitability and assuming all else remains constant in Year 2, what would be the profit impact of dropping the West region in Year 2? Contribution format segmented income statement Forgone segment margin in the West region -see 213 Additional contribution margin in East Region (5%) Decrease in profits if the West region is dropped 15. Assume the West region invests $30,000 in a new advertising campaign in Year 2 that increases its unit sales by 20%. If all else remains constant, what would be the profit impact of pursuing the advertising campaign? Profit impact: Additional advertising Additional contribution margin in the West region Increase in profits