Question

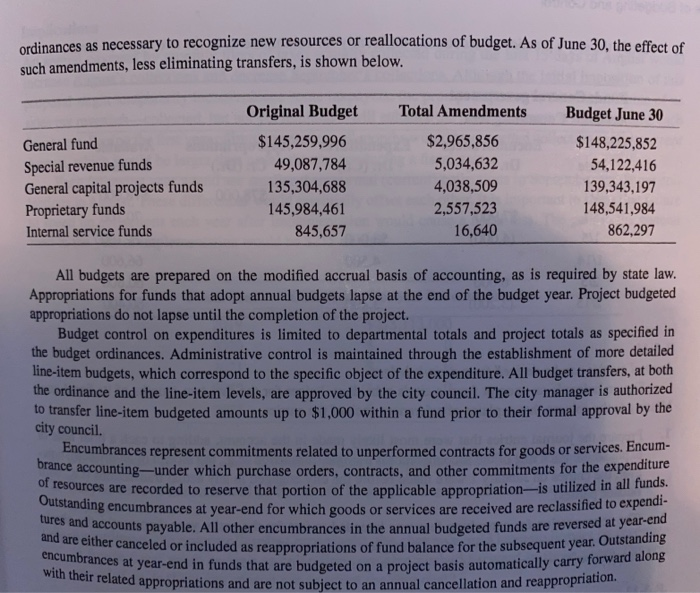

Different types of funds justify different practices as to budgets and commitments. Review the budget note to the Smith City's financial statements presented in the

Different types of funds justify different practices as to budgets and commitments.

Review the budget note to the Smith City's financial statements presented in the previous problem. Assume that the city engaged in the following transactions in 2020 and 2021:

In 2020, it signed a service contract with a private security company. The company agreed to provide security services to the city's for one year at a cost of $72,000 ($6,000 per month.) By year end the company provided, and paid for, services for three months.

In 2021, the company preformed, and the city paid for, the remaining nine months of the contract. However, because of the agreed-upon changes in the services provided by the company, the total charges for 2021 were reduced from $54,000 to $50,000.

- The city properly budgeted for the services and appropriated the funds consistent with policies set forth in the note. Prepare all the budgetary, encumbrance, and expenditure entries relating to the service contract that would be required in 2020 and 202 In 1020, when the city signed the contract, it appropriated the entire $72,000. Then, at the start of 2021, inasmuch as the city expended only $18,000 in 2020, it reappropriated $54,000.

- Assume first that the contract was accounted for in the smiths general fund.

- Assume next that it was accounted for in a capital projects fund established for the construction of its Walnut Creek Amphitheatre. The city prepares annual financial statements for capital project funds, but it does not close out its accounts. Moreover, it prepares budgets for the entire project, not for particular periods. The project was started in 2020 and completed in 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started