Question

Required 1. Calculate the Current Tax Expense for 20X8 2. Determine the impact of prior year 20X7 return-to-provision adjustments on current year tax expense 3.

Required

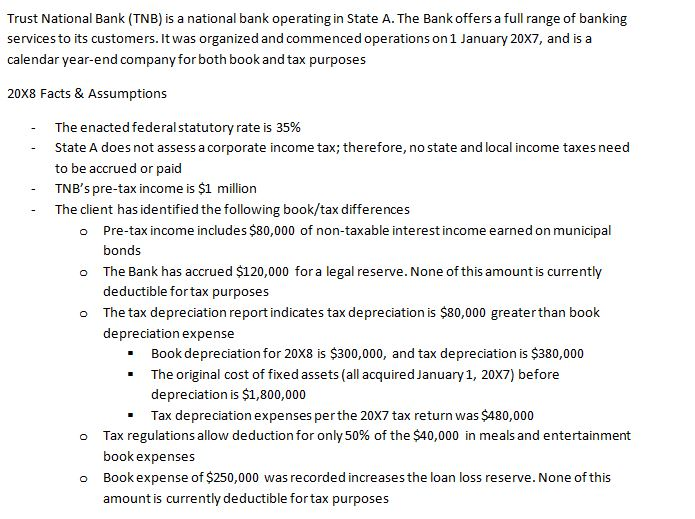

1. Calculate the Current Tax Expense for 20X8

2. Determine the impact of prior year 20X7 return-to-provision adjustments on current year tax expense

3. Please note the 20X7 tax return is filed during 20X8 and the 20X7 return to provision (RTP) adjustments are included with the 20X8 tax provision calculation

4. Calculate the total current tax expense for 20X8

5. Prepare the roll forward of deferred tax balances at 31 December 20X8 and calculate deferred tax expense

6. Calculate total tax expense and the effective tax rate. Prepare the effective tax rate reconciliation

7. Determine what journal entries TNB would have made to record the 20X8 tax provision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started