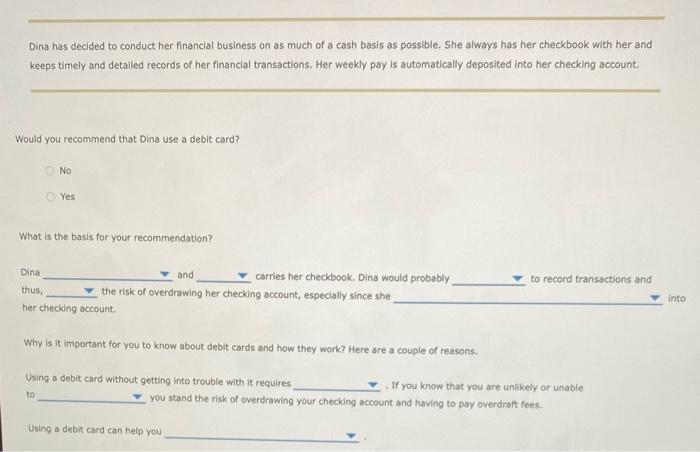

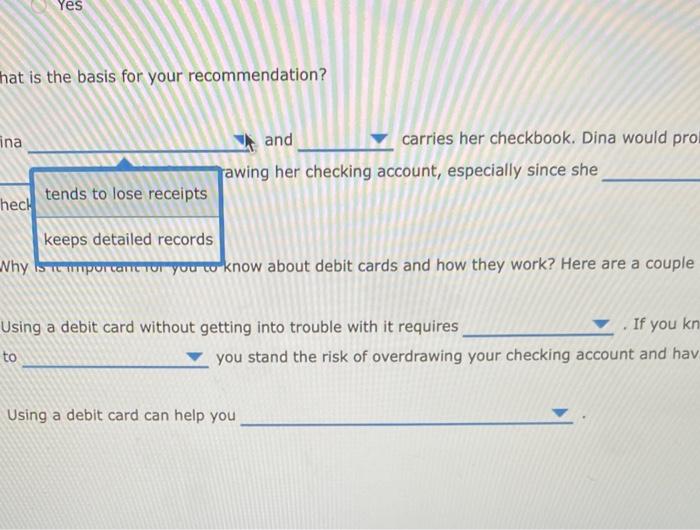

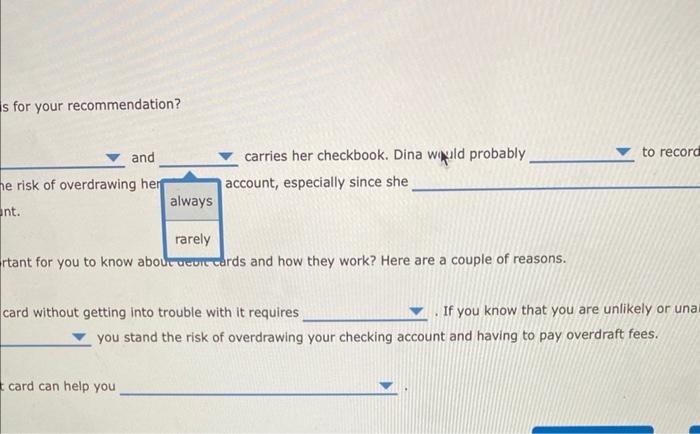

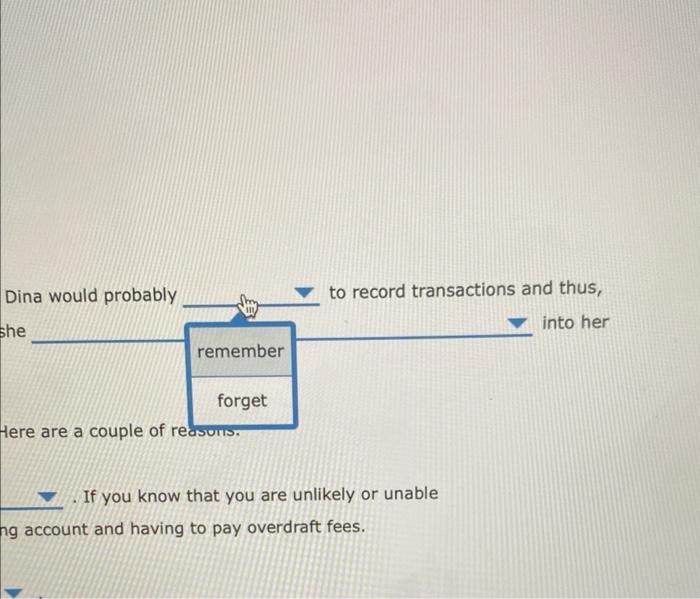

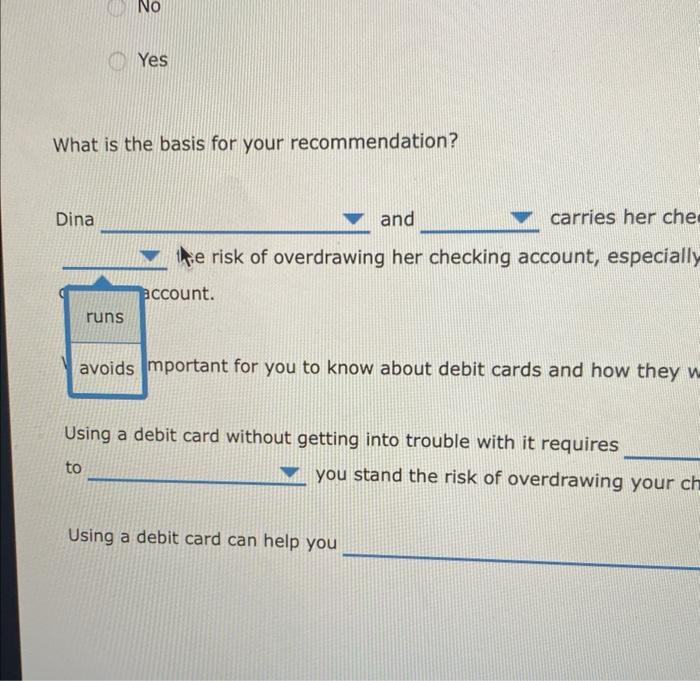

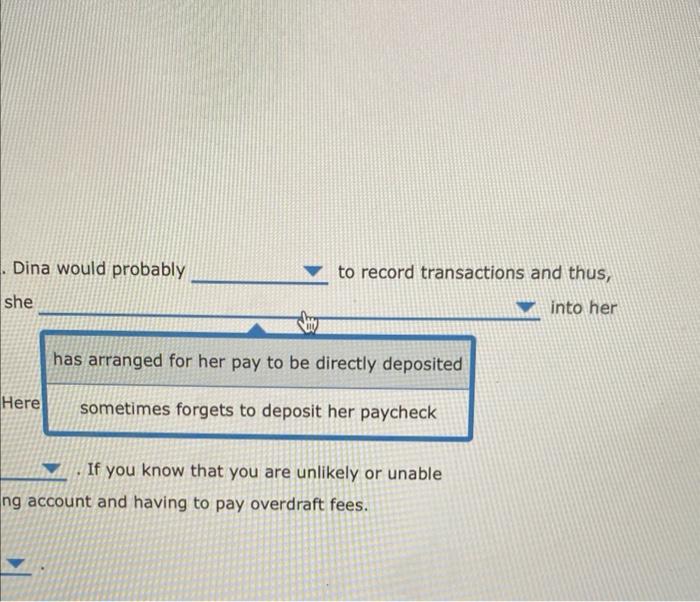

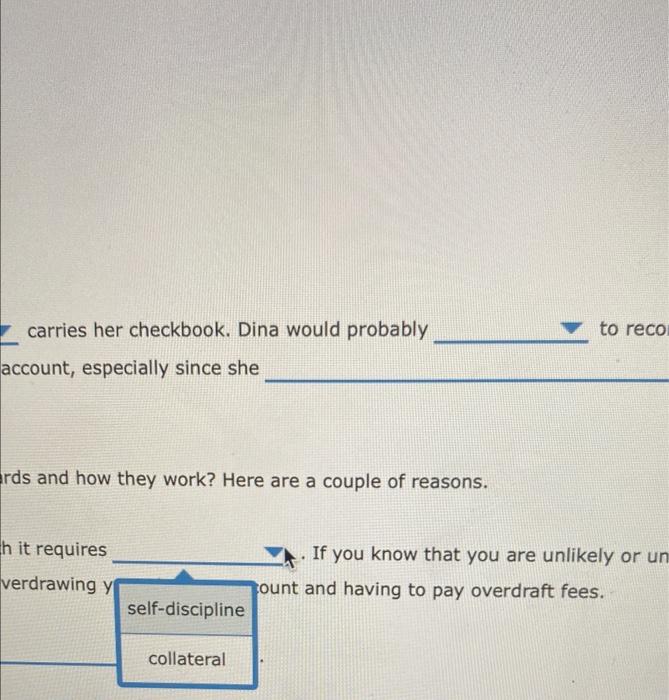

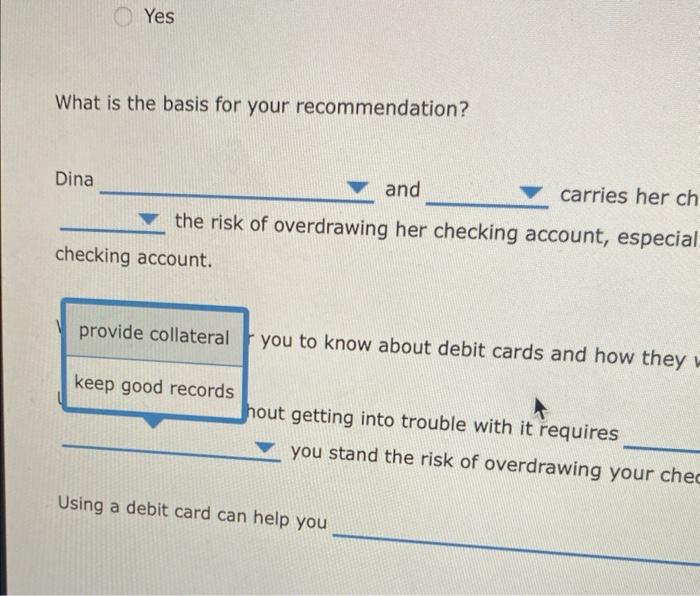

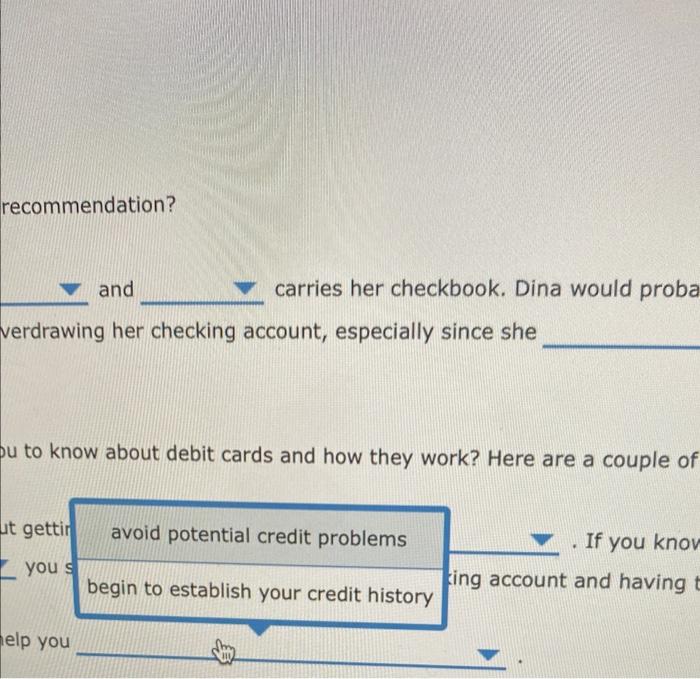

Dina has decided to conduct her financial business on as much of a cash basis as possible. She always has her checkbook with her and keeps timely and detalled records of her financial transactions. Her weekly pay is automatically deposited into her checking account. Would you recommend that Dina use a debit card? No Yes What is the basis for your recommendation? Dina and carries her checkbook, Dina would probably thus, the risk of overdrawing her checking account, especially since she transactions and her checking account. Why is it important for you to know about debit cards and how they work? Here are a couple of reasons. Using a debit card without getting into trouble with it requires If you know that you are unlikely or unable ta you stand the risk of overdrawing your checking account and having to pay overdraft fees. Using a deblt card can help you nat is the basis for your recommendation? carries her checkbook. Dina would pro 'awing her checking account, especially since she Why is. ITmportam to you know about debit cards and how they work? Here are a couple Using a debit card without getting into trouble with it requires If you kn you stand the risk of overdrawing your checking account and hav Using a debit card can help you is for your recommendation? and carries her checkbook. Dina wigld probably to recorc g hel account, especially since she itant for you to know abourcueviccards and how they work? Here are a couple of reasons. card without getting into trouble with it requires If you know that you are unlikely or una you stand the risk of overdrawing your checking account and having to pay overdraft fees. card can help you to record transactions and thus, ere are a couple of reasuns. If you know that you are unlikely or unable Yes What is the basis for your recommendation? Dina and carries her che Whe risk of overdrawing her checking account, especially ccount. mportant for you to know about debit cards and how they Using a debit card without getting into trouble with it requires to you stand the risk of overdrawing your ch Using a debit card can help you Dina would probably to record transactions and thus, she has arranged for her pay to be directly deposited If you know that you are unlikely or unable ng account and having to pay overdraft fees. carries her checkbook. Dina would probably to reco account, especially since she irds and how they work? Here are a couple of reasons. hit requires . If you know that you are unlikely or ur verdrawing y ount and having to pay overdraft fees. Yes What is the basis for your recommendation? Dina and carries her ch the risk of overdrawing her checking account, especial checking account. you to know about debit cards and how they lout getting into trouble with it requires you stand the risk of overdrawing your che Using a debit card can help you recommendation? and carries her checkbook. Dina would proba verdrawing her checking account, especially since she to know about debit cards and how they work? Here are a couple of