Answered step by step

Verified Expert Solution

Question

1 Approved Answer

|| |||DIO 1 litolo 1 Paragrafo Still 13) 13. You find that the stocks of companies that announce acquisitions exhibit positive abnormal returns (e.g., they

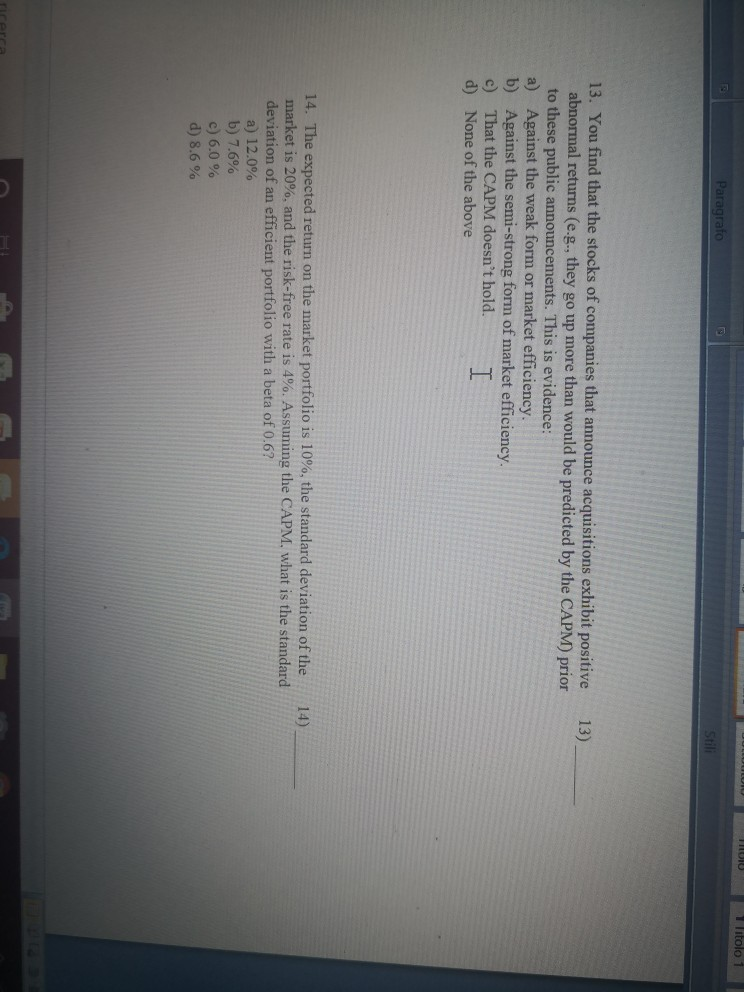

|| |||DIO 1 litolo 1 Paragrafo Still 13) 13. You find that the stocks of companies that announce acquisitions exhibit positive abnormal returns (e.g., they go up more than would be predicted by the CAPM) prior to these public announcements. This is evidence: a) Against the weak form or market efficiency. b) Against the semi-strong form of market efficiency. That the CAPM doesn't hold. I None of the above 14) 14. The expected return on the market portfolio is 10%, the standard deviation of the market is 20%, and the risk-free rate is 4%. Assuming the CAPM, what is the standard deviation of an efficient portfolio with a beta of 0.6? a) 12.0% b) 7.6% c) 6.0 % d) 8.6 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started