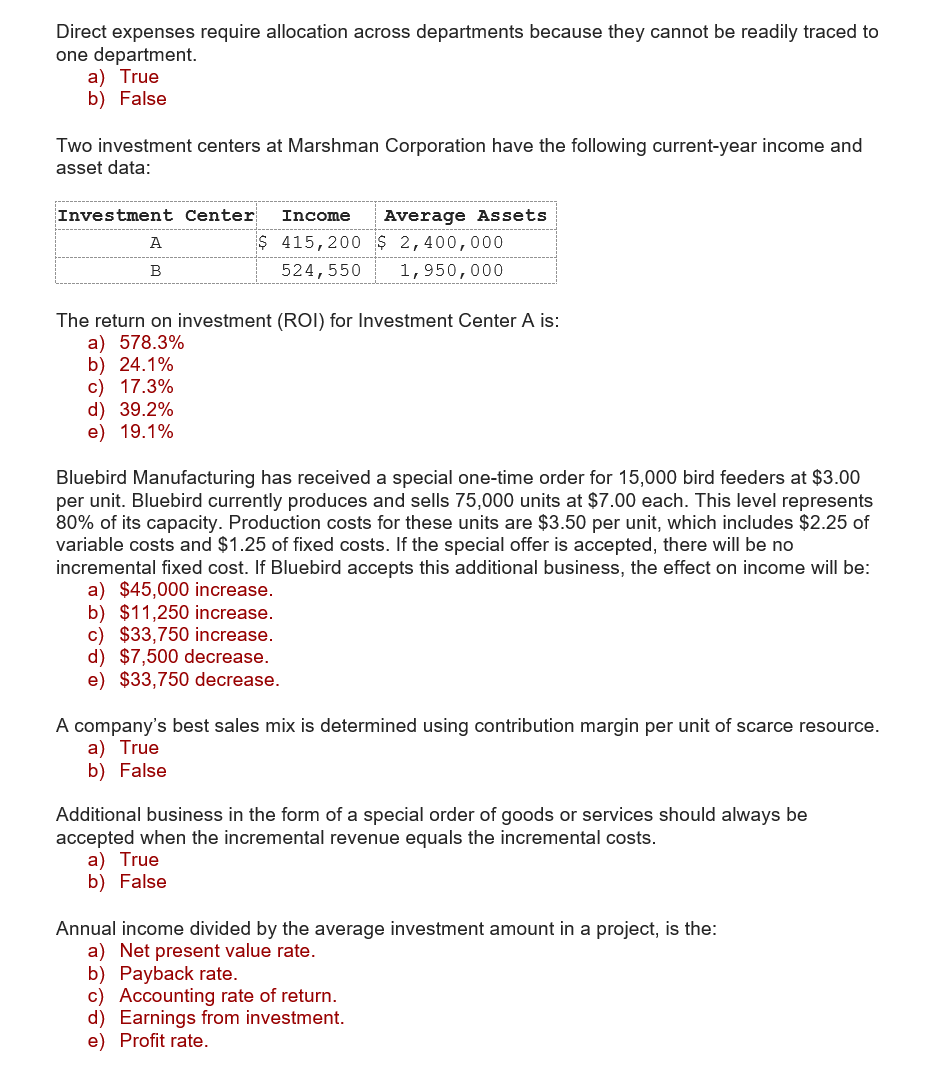

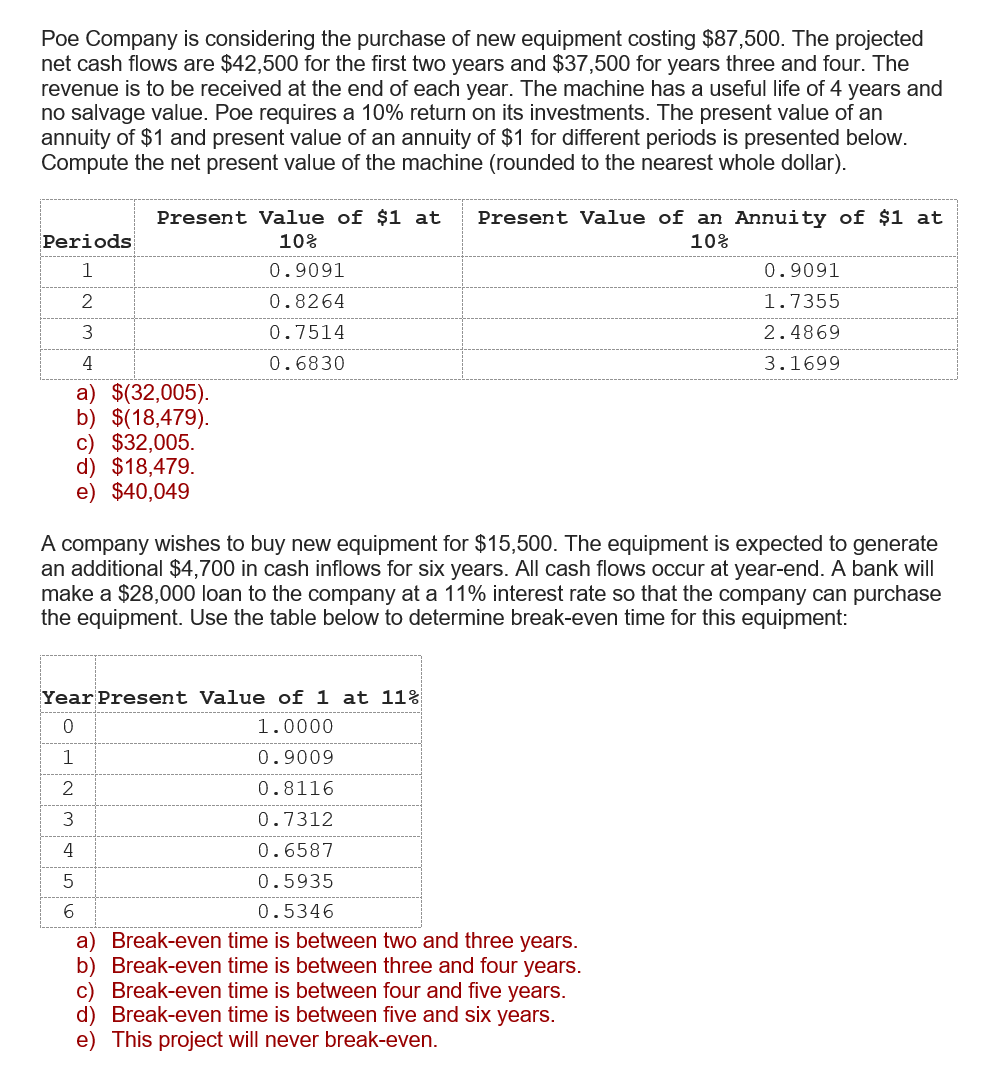

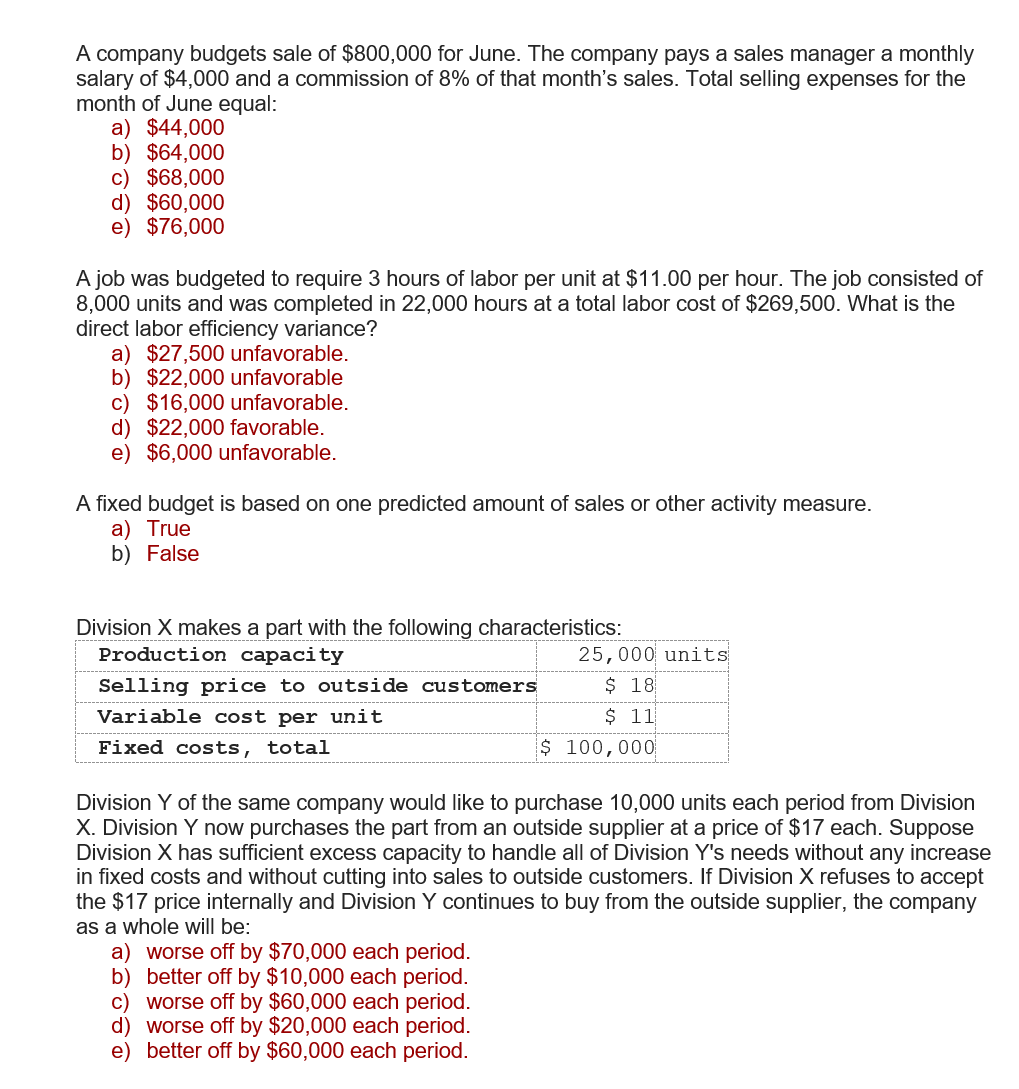

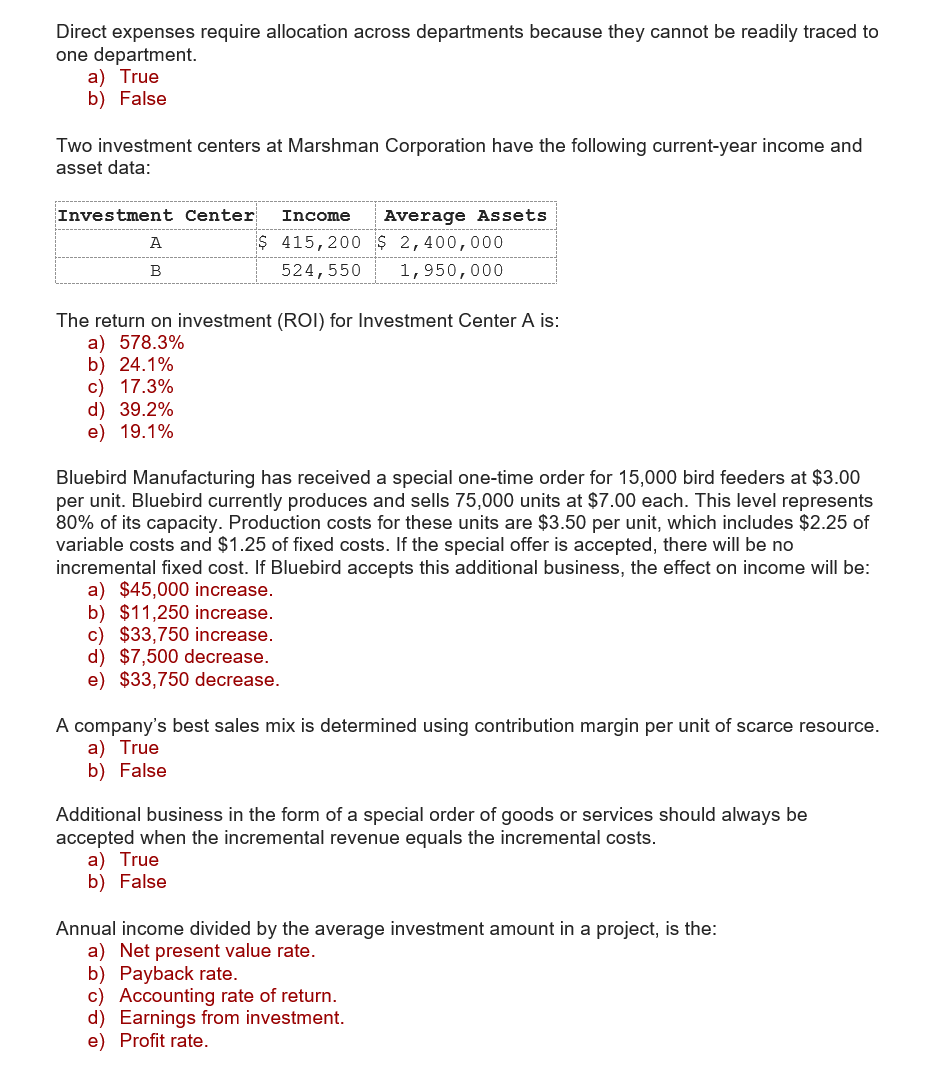

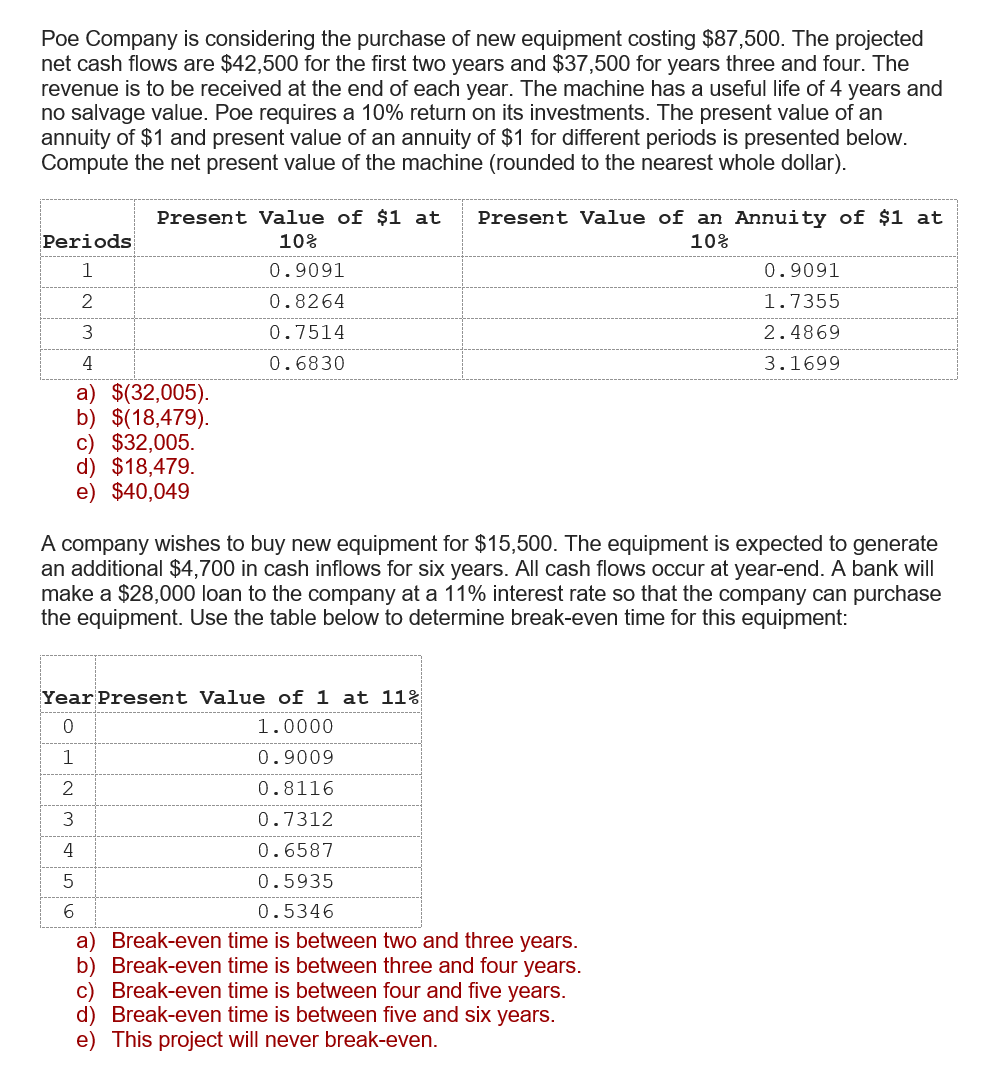

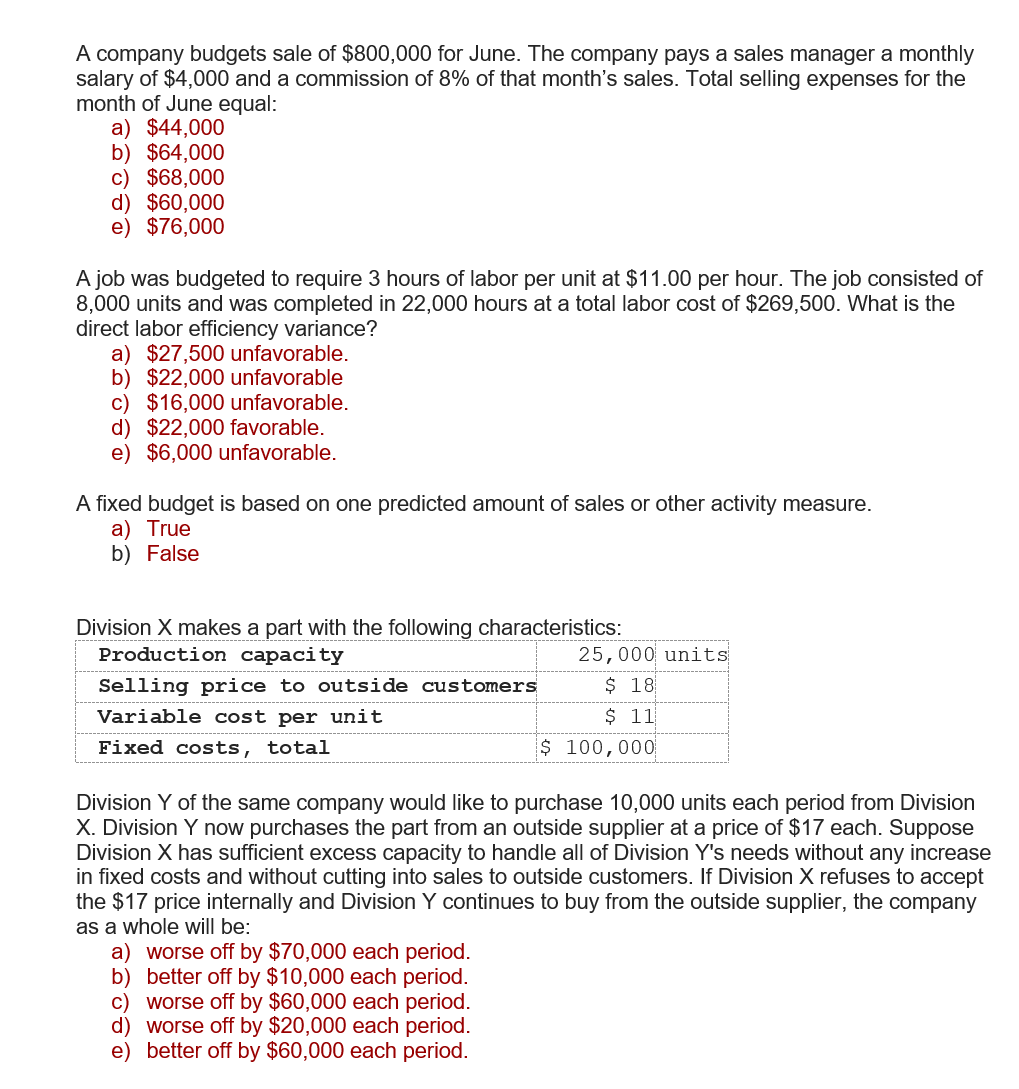

Direct expenses require allocation across departments because they cannot be readily traced to one department a) True b) False Two investment centers at Marshman Corporation have the following current-year income and asset data: Investment Center Income Average Assets A $ 415,200 $ 2,400,000 B 524,550 1,950,000 The return on investment (ROI) for Investment Center A is: a) 578.3% b) 24.1% c) 17.3% d) 39.2% e) 19.1% Bluebird Manufacturing has received a special one-time order for 15,000 bird feeders at $3.00 per unit. Bluebird currently produces and sells 75,000 units at $7.00 each. This level represents 80% of its capacity. Production costs for these units are $3.50 per unit, which includes $2.25 of variable costs and $1.25 of fixed costs. If the special offer is accepted, there will be no incremental fixed cost. If Bluebird accepts this additional business, the effect on income will be: a) $45,000 increase. b) $11,250 increase. c) $33,750 increase. d) $7,500 decrease. e) $33,750 decrease. A company's best sales mix is determined using contribution margin per unit of scarce resource. a) True b) False Additional business in the form of a special order of goods or services should always be accepted when the incremental revenue equals the incremental costs. a) True b) False Annual income divided by the average investment amount in a project, is the: a) Net present value rate. b) Payback rate. c) Accounting rate of return. d) Earnings from investment. e) Profit rate. Poe Company is considering the purchase of new equipment costing $87,500. The projected net cash flows are $42,500 for the first two years and $37,500 for years three and four. The revenue is to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Poe requires a 10% return on its investments. The present value of an annuity of $1 and present value of an annuity of $1 for different periods is presented below. Compute the net present value of the machine (rounded to the nearest whole dollar). Periods 1 Present Value of $1 at 10% 0.9091 0.8264 0.7514 Present Value of an Annuity of $1 at 10% 0.9091 1.7355 2.4869 3.1699 2 3 0.6830 4 a) $(32,005). b) $(18,479). c) $32,005. d) $18,479. e) $40,049 A company wishes to buy new equipment for $15,500. The equipment is expected to generate an additional $4,700 in cash inflows for six years. All cash flows occur at year-end. A bank will make a $28,000 loan to the company at a 11% interest rate so that the company can purchase the equipment. Use the table below to determine break-even time for this equipment: AWN Year Present Value of 1 at 11% 0 1.0000 1 0.9009 2 0.8116 3 0.7312 4 0.6587 5 0.5935 6 0.5346 a) Break-even time is between two and three years. b) Break-even time is between three and four years. c) Break-even time is between four and five years. d) Break-even time is between five and six years. e) This project will never break-even. A company budgets sale of $800,000 for June. The company pays a sales manager a monthly salary of $4,000 and a commission of 8% of that month's sales. Total selling expenses for the month of June equal: a) $44,000 b) $64,000 c) $68,000 d) $60,000 e) $76,000 A job was budgeted to require 3 hours of labor per unit at $11.00 per hour. The job consisted of 8,000 units and was completed in 22,000 hours at a total labor cost of $269,500. What is the direct labor efficiency variance? a) $27,500 unfavorable. b) $22,000 unfavorable c) $16,000 unfavorable. d) $22,000 favorable. e) $6,000 unfavorable. A fixed budget is based on one predicted amount of sales or other activity measure. a) True b) False Division X makes a part with the following characteristics: Production capacity 25,000 units Selling price to outside customers $ 18 Variable cost per unit $ 11 Fixed costs, total $ 100,000 Division Y of the same company would like to purchase 10,000 units each period from Division X. Division Y now purchases the part from an outside supplier at a price of $17 each. Suppose Division X has sufficient excess capacity to handle all of Division Y's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division X refuses to accept the $17 price internally and Division Y continues to buy from the outside supplier, the company as a whole will be: a) worse off by $70,000 each period. b) better off by $10,000 each period. c) worse off by $60,000 each period. d) worse off by $20,000 each period. e) better off by $60,000 each period