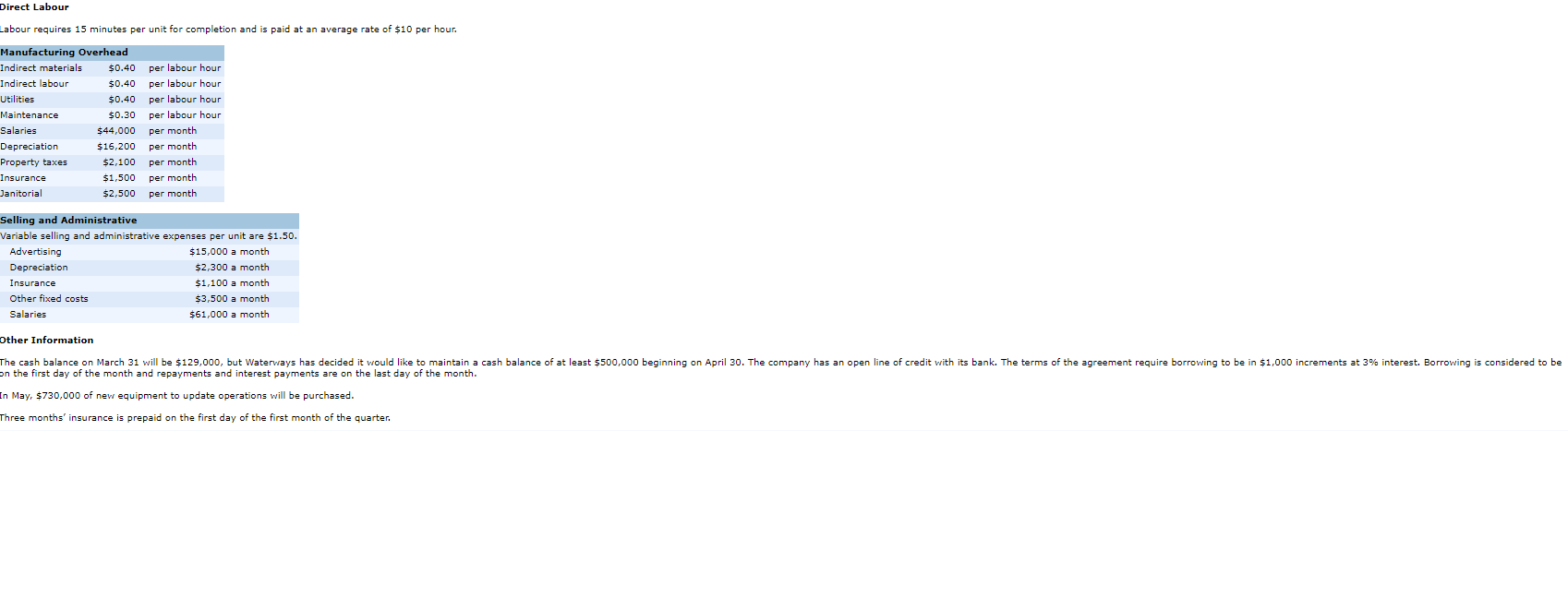

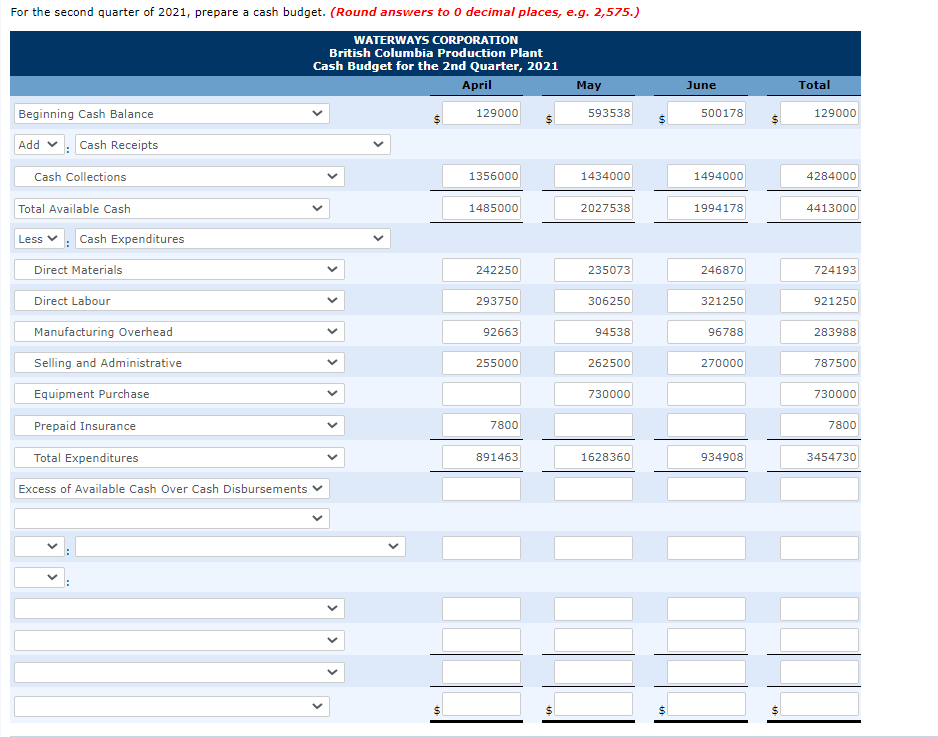

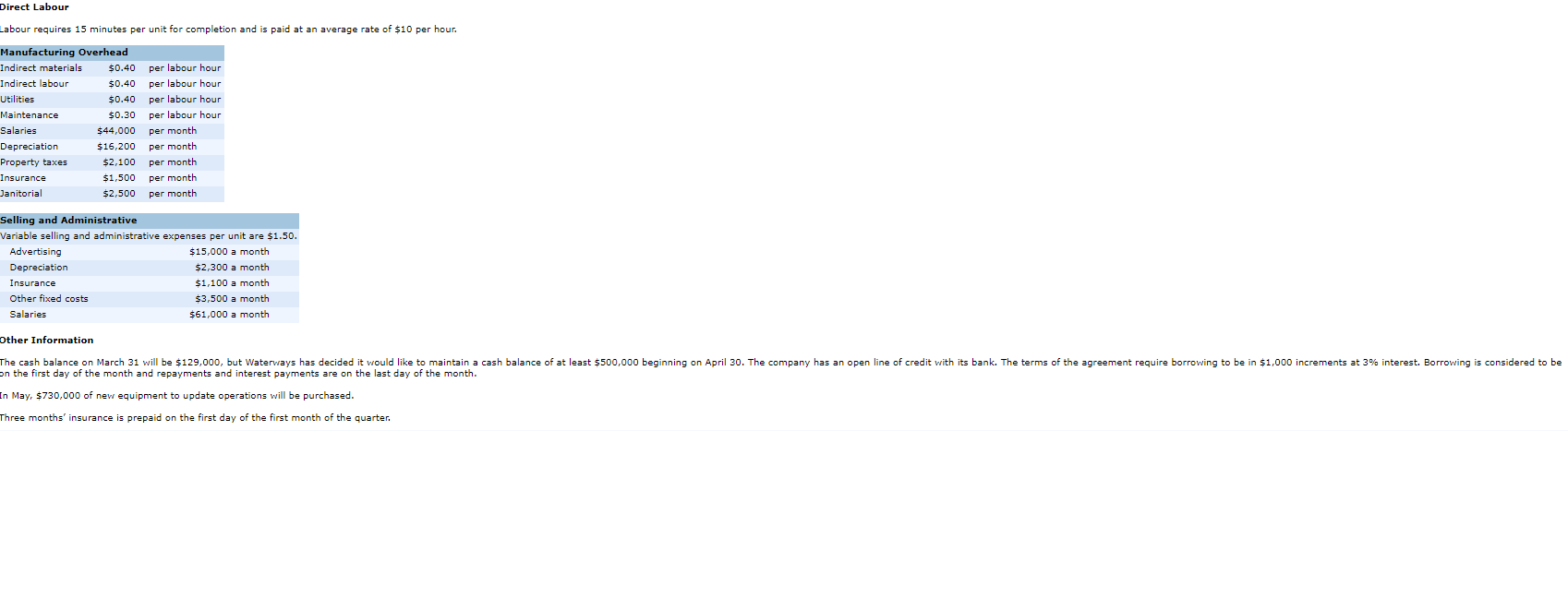

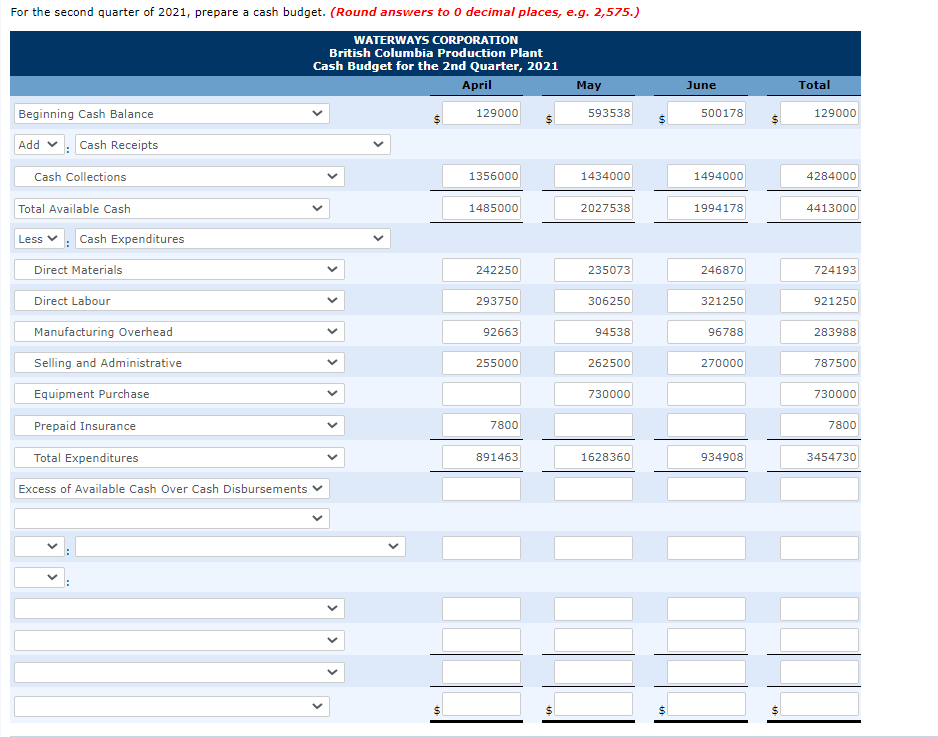

Direct Labour Labour requires 15 minutes per unit for completion and is paid at an average rate of $10 per hour. Manufacturing Overhead Indirect materials $0.40 per labour hour Indirect labour $0.40 per labour hour Utilities $0.40 per labour hour Maintenance $0.30 per labour hour Salaries $44,000 per month Depreciation $16,200 per month Property taxes $2,100 per month Insurance $1,500 per month Janitorial $2,500 per month Selling and Administrative Variable selling and administrative expenses per unit are $1.50. Advertising $15,000 a month Depreciation $2,300 a month Insurance $1,100 a month Other fixed costs $3,500 a month Salaries $61,000 a month Other Information The cash balance on March 31 will be $129,000, but Waterways has decided it would like to maintain a cash balance of at least $500,000 beginning on April 30. The company has an open line of credit with its bank. The terms of the agreement require borrowing to be in $1,000 increments at 3% interest. Borrowing is considered to be on the first day of the month and repayments and interest payments are on the last day of the month. In May, $730,000 of new equipment to update operations will be purchased. Three months' insurance is prepaid on the first day of the first month of the quarter. For the second quarter of 2021, prepare a cash budget. (Round answers to 0 decimal places, e.g. 2,575.) WATERWAYS CORPORATION British Columbia Production Plant Cash Budget for the 2nd Quarter, 2021 April May June Total Beginning Cash Balance 129000 593538 500178 129000 $ $ $ $ Add Cash Receipts Cash Collections 1356000 1434000 1494000 4284000 Total Available Cash 1485000 2027538 1994178 4413000 Less Cash Expenditures Direct Materials 242250 235073 246870 724193 Direct Labour 293750 306250 321250 921250 Manufacturing Overhead 92663 94538 96788 283988 Selling and Administrative 255000 262500 270000 787500 Equipment Purchase 730000 730000 Prepaid Insurance 7800 7800 Total Expenditures 891463 1628360 934908 3454730 Excess of Available Cash Over Cash Disbursements $ $ Beginning Cash Balance Borrowings Cash Collections Direct Labour Direct Materials Cash Expenditures Prepaid Insurance Ending Cash Balance Equipment Purchase Excess of Available Cash Over Cash Disbursements Financing Interest Manufacturing Overhead Cash Receipts Repayments Selling and Administrative Total Available Cash Total Expenditures Total Financing Direct Labour Labour requires 15 minutes per unit for completion and is paid at an average rate of $10 per hour. Manufacturing Overhead Indirect materials $0.40 per labour hour Indirect labour $0.40 per labour hour Utilities $0.40 per labour hour Maintenance $0.30 per labour hour Salaries $44,000 per month Depreciation $16,200 per month Property taxes $2,100 per month Insurance $1,500 per month Janitorial $2,500 per month Selling and Administrative Variable selling and administrative expenses per unit are $1.50. Advertising $15,000 a month Depreciation $2,300 a month Insurance $1,100 a month Other fixed costs $3,500 a month Salaries $61,000 a month Other Information The cash balance on March 31 will be $129,000, but Waterways has decided it would like to maintain a cash balance of at least $500,000 beginning on April 30. The company has an open line of credit with its bank. The terms of the agreement require borrowing to be in $1,000 increments at 3% interest. Borrowing is considered to be on the first day of the month and repayments and interest payments are on the last day of the month. In May, $730,000 of new equipment to update operations will be purchased. Three months' insurance is prepaid on the first day of the first month of the quarter. For the second quarter of 2021, prepare a cash budget. (Round answers to 0 decimal places, e.g. 2,575.) WATERWAYS CORPORATION British Columbia Production Plant Cash Budget for the 2nd Quarter, 2021 April May June Total Beginning Cash Balance 129000 593538 500178 129000 $ $ $ $ Add Cash Receipts Cash Collections 1356000 1434000 1494000 4284000 Total Available Cash 1485000 2027538 1994178 4413000 Less Cash Expenditures Direct Materials 242250 235073 246870 724193 Direct Labour 293750 306250 321250 921250 Manufacturing Overhead 92663 94538 96788 283988 Selling and Administrative 255000 262500 270000 787500 Equipment Purchase 730000 730000 Prepaid Insurance 7800 7800 Total Expenditures 891463 1628360 934908 3454730 Excess of Available Cash Over Cash Disbursements $ $ Beginning Cash Balance Borrowings Cash Collections Direct Labour Direct Materials Cash Expenditures Prepaid Insurance Ending Cash Balance Equipment Purchase Excess of Available Cash Over Cash Disbursements Financing Interest Manufacturing Overhead Cash Receipts Repayments Selling and Administrative Total Available Cash Total Expenditures Total Financing