Answered step by step

Verified Expert Solution

Question

1 Approved Answer

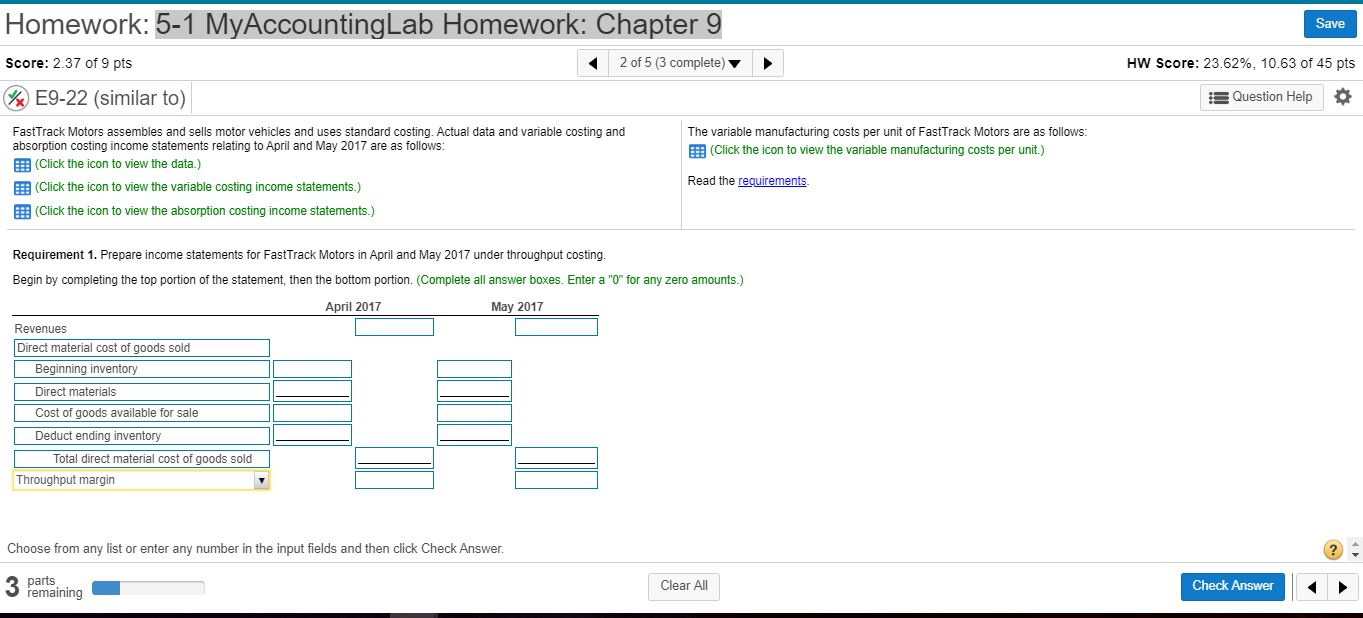

Direct Material cost of goods sold? Beginning inventory? Direct materials? Cost of Goods available for sale? Deduct ending inventory? Total Direct material cost of goods

Direct Material cost of goods sold?

Beginning inventory?

Direct materials?

Cost of Goods available for sale?

Deduct ending inventory?

Total Direct material cost of goods sold?

Throughput margin?

Manufacturing Costs?

Other operating costs?

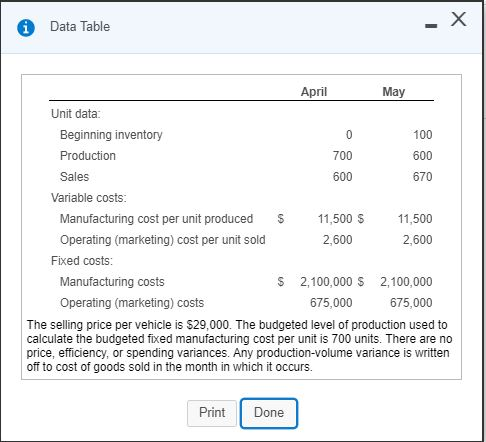

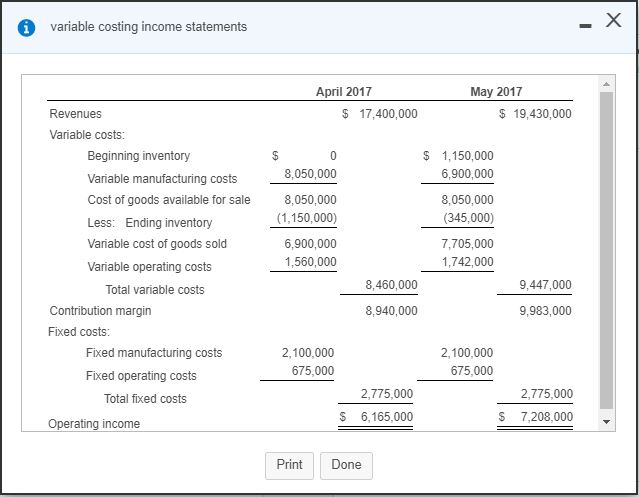

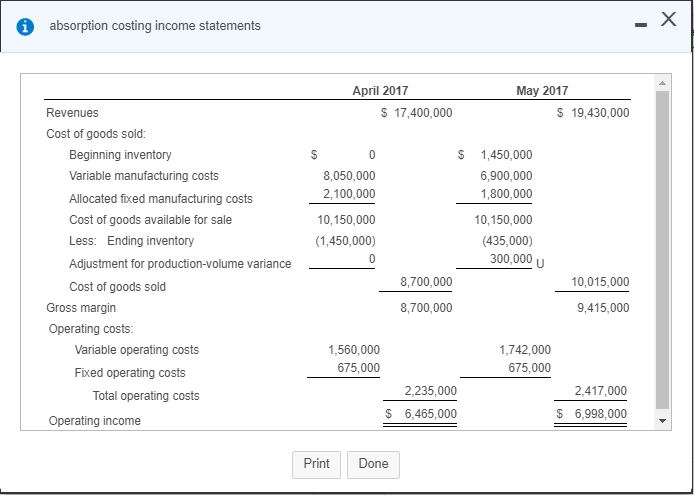

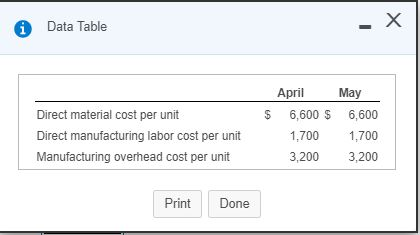

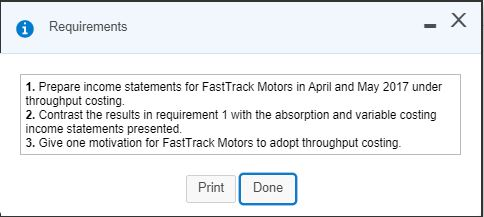

Homework: 5-1 My AccountingLab Homework: Chapter 9 Save Score: 2.37 of 9 pts 2 of 5 (3 complete) HW Score: 23.62%, 10.63 of 45 pts W E9-22 (similar to) 3 Question Help o The variable manufacturing costs per unit of FastTrack Motors are as follows: (Click the icon to view the variable manufacturing costs per unit.) FastTrack Motors assembles and sells motor vehicles and uses standard costing. Actual data and variable costing and absorption costing income statements relating to April and May 2017 are as follows: E: (Click the icon to view the data.) E (Click the icon to view the variable costing income statements.) (Click the icon to view the absorption costing income statements.) Read the requirements Requirement 1. Prepare income statements for FastTrack Motors in April and May 2017 under throughput costing. Begin by completing the top portion of the statement, then the bottom portion. (Complete all answer boxes. Enter a "0" for any zero amounts.) April 2017 May 2017 Revenues Direct material cost of goods sold Beginning inventory Direct materials Cost of goods available for sale Deduct ending inventory Total direct material cost of goods sold Throughput margin Choose from any list or enter any number in the input fields and then click Check Answer. parts remaining Clear All Check Answer Data Table April May Unit data: Beginning inventory 100 Production 700 600 Sales 600 670 Variable costs: Manufacturing cost per unit produced $ 11,500 S 11,500 Operating (marketing) cost per unit sold 2,600 2,600 Fixed costs: Manufacturing costs $ 2,100,000 $ 2,100,000 Operating (marketing) costs 675,000 675,000 The selling price per vehicle is $29,000. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 700 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. Print Done variable costing income statements April 2017 $ 17,400,000 May 2017 $ 19,430,000 $ 1,150,000 6,900,000 Revenues Variable costs: Beginning inventory Variable manufacturing costs Cost of goods available for sale Less: Ending inventory Variable cost of goods sold Variable operating costs Total variable costs Contribution margin Fixed costs: Fixed manufacturing costs Fixed operating costs Total fixed costs Operating income $ 8,050,000 8,050,000 (1,150,000) 6,900,000 1,560,000 8,050,000 (345,000) 7,705,000 1,742,000 8,460,000 8,940,000 9,447,000 9,983,000 2,100,000 675,000 2,775,000 $ 6,165,000 2,100,000 675,000 2,775,000 $ 7,208,000 Print Done i absorption costing income statements April 2017 $ 17,400,000 May 2017 $ 19,430,000 $ 0 8,050,000 2,100,000 10,150,000 (1,450,000) $ 1,450,000 6,900,000 1,800,000 10,150,000 (435,000) 300,000 Revenues Cost of goods sold: Beginning inventory Variable manufacturing costs Allocated fixed manufacturing costs Cost of goods available for sale Less: Ending inventory Adjustment for production-volume variance Cost of goods sold Gross margin Operating costs: Variable operating costs Fixed operating costs Total operating costs Operating income 8,700,000 8,700,000 10,015,000 9,415,000 1,560,000 675,000 2,235,000 $ 6,465,000 1,742,000 675,000 2,417,000 $ 6,998,000 Print Done Data Table x $ Direct material cost per unit Direct manufacturing labor cost per unit Manufacturing overhead cost per unit April 6,600 $ 1,700 3,200 May 6,600 1,700 3,200 Print Done Requirements 1. Prepare income statements for FastTrack Motors in April and May 2017 under throughput costing. 2. Contrast the results in requirement 1 with the absorption and variable costing income statements presented. 3. Give one motivation for FastTrack Motors to adopt throughput costing. Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started