Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Direct write - off method Journalize the following transactions, using the direct write - off method of accounting for uncollectible receivables. Question Content Area Mar.

Direct writeoff method

Journalize the following transactions, using the direct writeoff method of accounting for uncollectible receivables.

Question Content Area

Mar. : Received $ from Shawn McNeely and wrote off the remainder owed of $ as uncollectible. If an amount box does not require an entry, leave it blank.

DateAccountDebitCredit

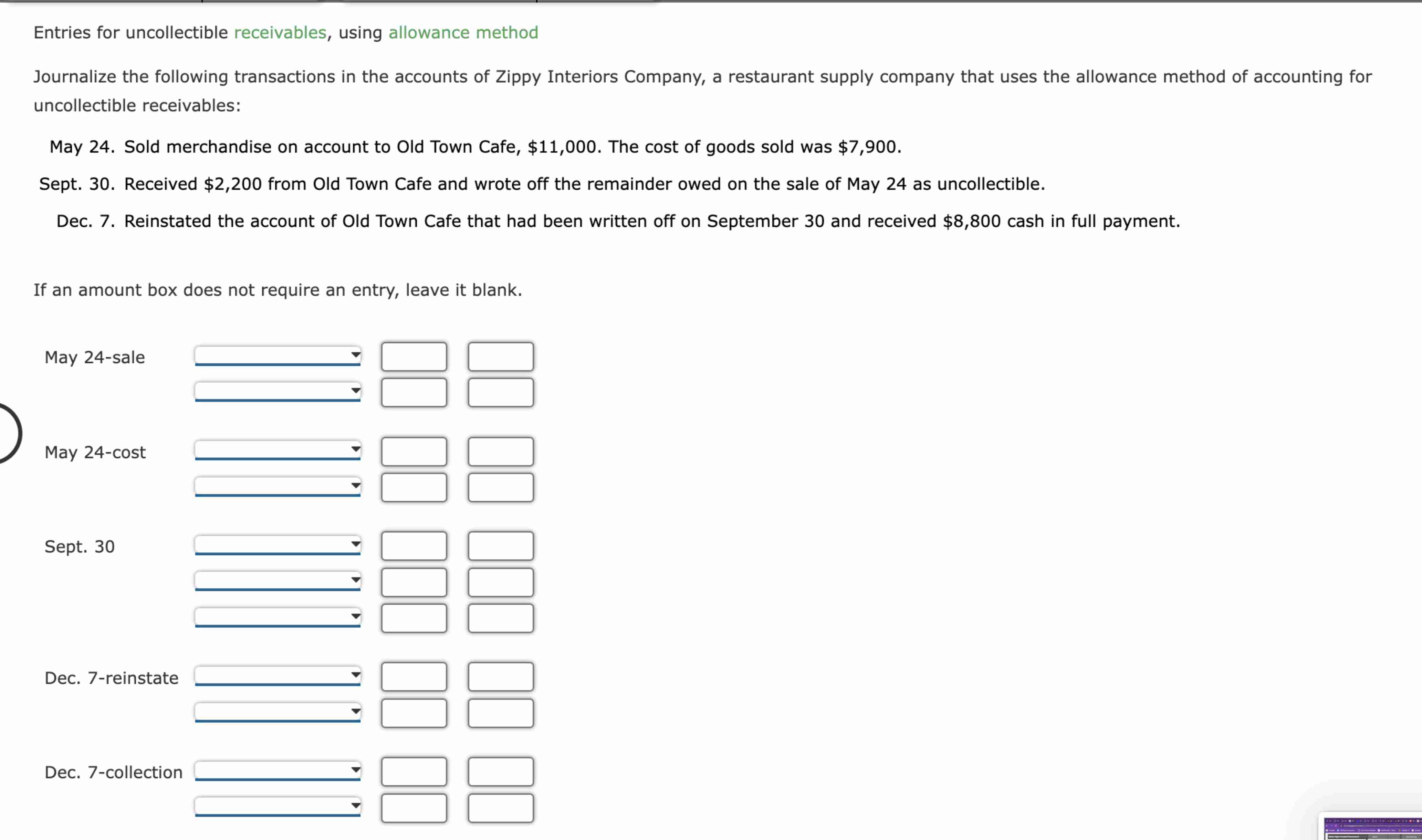

Mar. Entries for uncollectible receivables, using allowance method

Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for

uncollectible receivables:

May Sold merchandise on account to Old Town Cafe, $ The cost of goods sold was $

Sept. Received $ from Old Town Cafe and wrote off the remainder owed on the sale of May as uncollectible.

Dec. Reinstated the account of Old Town Cafe that had been written off on September and received $ cash in full payment.

If an amount box does not require an entry, leave it blank.

May sale

May cost

Sept.

Dec. reinstate

Dec. collection

fill in

Question Content Area

July : Reinstated the account of Shawn McNeely and received $ cash in full payment. If an amount box does not require an entry, leave it blank.

DateAccountDebitCredit

July

July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started