Question

Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario.

Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. Note: When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINs), replace the Xs as directed, or with any four digits of your choice.

Interview Notes

- SSN: 501-00-XXXX

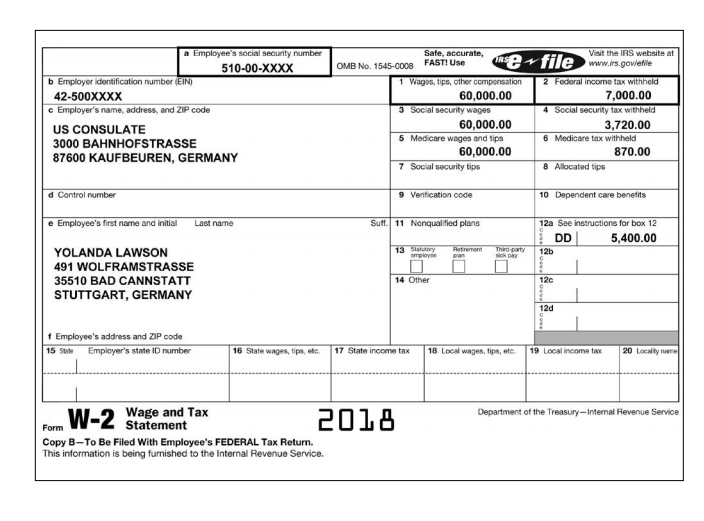

Yolanda is a U.S. citizen, single and has no children. She has lived and worked in Germany since February 1, 2016. She loves her life in Germany and did not return to the U.S. since she moved there. She has no intentions of returning to the U.S. Therefore, she does not maintain an address in the U.S.

She considers herself a resident of Germany. She shares a two-bedroom apartment with her roommate at 491 Wolframstrasse, 35510 Bad Cannstatt, a city district of Stuttgart, Germany.

Income:

Yolandas visa type: Unlimited.

- Yolanda works at the U.S. Consulate and has a Form W-2 for her salary. She earned $60,000 in wages and paid $7,000 in withholding.

- Yolanda loves to shop. In 2018, she decided to get a part-time job at a department store on the weekends so she could use the employee discount on her purchases. Her part-time job with the department store was located at 27-29 Konigstrasse, 70173 Stuttgart, Germany.

- Yolanda earned an equivalent of $3,000 in wages and paid taxes totaling $600 when converted to U.S. dollars. Her taxes were paid to Germany as she earned her income. - Yolanda opened a checking and savings account at a German bank. She earned $150 of interest (converted to U.S. dollars) at the Bank of Stuttgart. She paid foreign tax to Germany on this interest income in the amount of 38.5 euro. The exchange rate on the date she paid the tax was 1 U.S. Dollar (USD) = 1.17 Euro.

- Yolanda was not required to file FinCen Form 114 and she did not receive a distribution, was not a grantor of, nor was she a transferor to a foreign trust.

Yolanda did not itemize in 2017 and does not have enough deductions to itemize in 2018.

Yolanda was covered under a health care plan the entire year that was purchased through her job with the U.S. Consulate.

11. Which sources of Yolanda's income do NOT qualify for the foreign earned income exclusion? (Select all that apply.)

11. Which sources of Yolanda's income do NOT qualify for the foreign earned income exclusion? (Select all that apply.)

A. Interest income from Bank of Stuttgart B. Wages from the department store C. Wages from U.S. Consulate D. All of the above 12. Which sources of Yolanda's income are classified as Passive Category Income? A. Interest income from the Bank of Stuttgart B. Wages from the department store C. Wages from U.S. Consulate D. None of the above 13. The correct amount of foreign earned income excluded from Yolanda's tax return is $________.

14. Which of the following statements is NOT true? A. Yolanda can take the foreign tax credit for the income taxes paid on her interest income from the Bank of Stuttgart and has to file Form 1116. B. Yolanda can claim the foreign earned income exclusion of $3,000 from her part-time job at the department store. Therefore, she cannot take the foreign tax credit for the $600 income taxes from her part-time job at the department store.

C. Yolanda can claim both the foreign tax credit for the $600 paid to Germany and exclude the $3,000 foreign earned income from her part-time job at the department store.

15. Yolanda must include the amount of foreign tax paid to Germany as withheld federal income taxes. True False

rate, CM: Visit the IRS website at 1 efile FAST! Use 510-00-XXXX OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other ccmpensaion 2 Foderal income tax withheld 60,000.00 ty wages 60,000.00 7,000.00 3,720.00 870.00 42-500XXXX c Employer's name, address, and ZIP code US CONSULATE 3000 BAHNHOFSTRASSE 87600 KAUFBEUREN, GERMANY 5 Medicare wages and tips 6 Medicare tax withheld 60,000.00 7 Social security tips 8 Allocated tips d Control number 9 Venfication code 0 Dependent care benetits e Employee's first name and initia Last name 11 Nonqualified plans 12a See instructions for box 12 5,400.00 YOLANDA LAWSON 491 WOLFRAMSTRASSE 35510 BAD CANNSTATT STUTTGART, GERMANY 12b 14 Other 12C 12d fEmployee's address and ZIP code 15 Stae Employer's state ID number 16 State wages, tips, ete 17 State income tax 18 Local wages, tips, ete.19 Local income tax 20 Locality Wage and Tax Statement Department of the Treasury-Internal Revenue Service 201 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue ServiceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started