Answered step by step

Verified Expert Solution

Question

1 Approved Answer

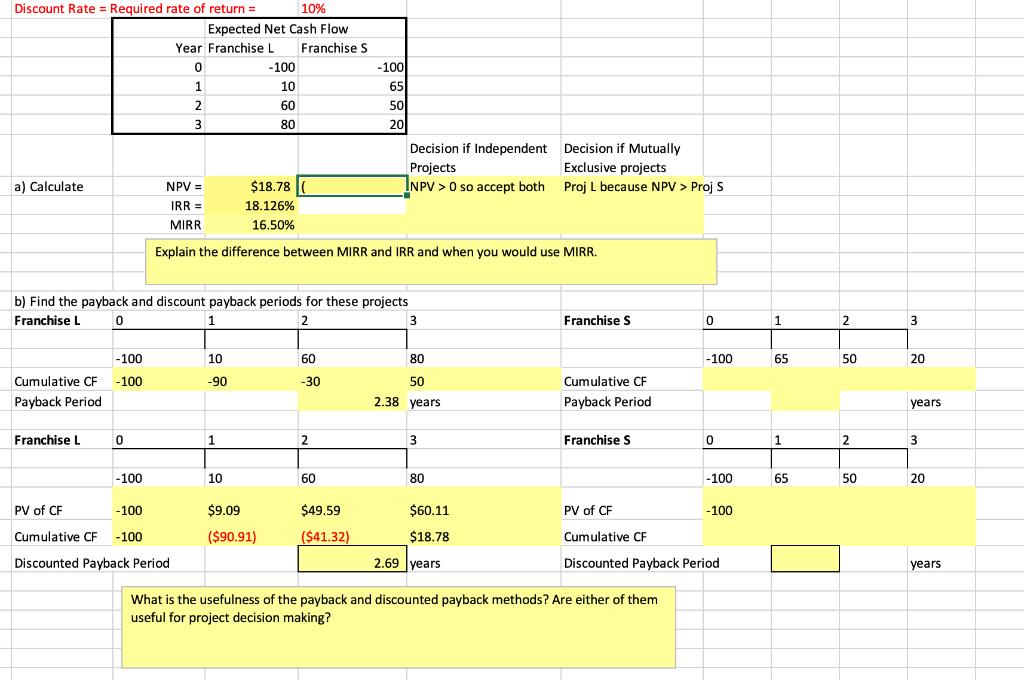

Discount Rate Required rate of return = 10% Expected Net Cash Flow Year Franchise L Franchise S 0 -100 -100 1 10 65 2

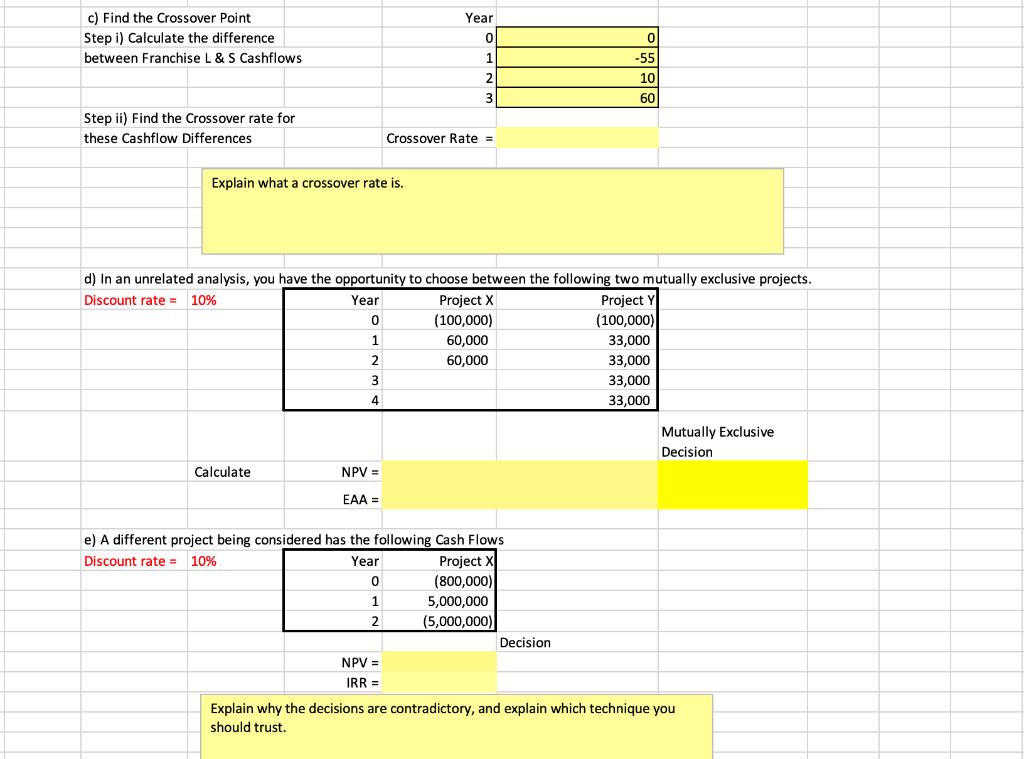

Discount Rate Required rate of return = 10% Expected Net Cash Flow Year Franchise L Franchise S 0 -100 -100 1 10 65 2 60 50 3 80 20 a) Calculate NPV = $18.78 IRR= MIRR 18.126% 16.50% Decision if Independent Decision if Mutually Projects Exclusive projects INPV >0 so accept both Proj L because NPV > Proj S Explain the difference between MIRR and IRR and when you would use MIRR. 0 b) Find the payback and discount payback periods for these projects Franchise L 1 2 3 Franchise S 0 1 2 3 -100 10 60 80 -100 65 50 20 Cumulative CF -100 -90 -30 50 Payback Period 2.38 years Cumulative CF Payback Period years Franchise L 0 1 2 3 Franchise S 0 1 2 3 -100 10 60 80 -100 65 50 20 PV of CF -100 $9.09 $49.59 $60.11 PV of CF -100 Cumulative CF -100 ($90.91) ($41.32) $18.78 Cumulative CF Discounted Payback Period 2.69 years years Discounted Payback Period What is the usefulness of the payback and discounted payback methods? Are either of them useful for project decision making? c) Find the Crossover Point Step i) Calculate the difference between Franchise L & S Cashflows Step ii) Find the Crossover rate for Year 0 0 1 -55 2 10 3 60 Crossover Rate = these Cashflow Differences Explain what a crossover rate is. d) In an unrelated analysis, you have the opportunity to choose between the following two mutually exclusive projects. Discount rate = 10% Year 0 Project X (100,000) Project Y (100,000) 1 60,000 33,000 2 60,000 33,000 3 33,000 4 33,000 Mutually Exclusive Decision Calculate NPV = EAA = e) A different project being considered has the following Cash Flows Discount rate = 10% Project X Year 0 (800,000) 1 5,000,000 2 (5,000,000) Decision NPV = IRR= Explain why the decisions are contradictory, and explain which technique you should trust.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION The payback period and discounted payback period are financial metrics used to evaluate the profitability of investments The payback period measures the time it takes for an investment to gen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started