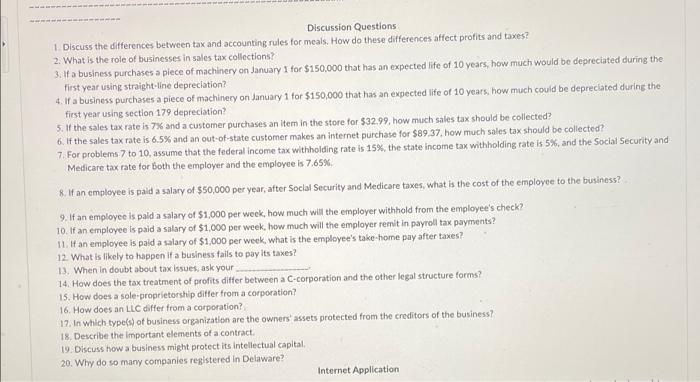

Discussion Questions 1. Discuss the differences between tax and accounting rules for meals. How do these differences affect profits and taxes? 2. What is the role of businesses in sales tax collections? 3. If a business purchases a piece of machinery on lanuary 1 foe $150,000 that has an expected life of 10 years, how much would be depreciated during the first year using straight-line depreciation? 4. If a business purchases a piece of machinery on january 1 for $150,000 that has an expected life of 10 years. how much could be depreclated during the first year using section 179 depreciation? 5. If the sales tax rate is 7% and a customer purchases an item in the store for $32.99, how much sales tax should be collected? 6. If the sales tax rate is 6.5% and an out-of-state customer makes an internet purchase for $89.37, how much sales tax should be collected? 7. For problems 7 to 10 , assume that the federal income tax withholding rate is 15%, the state income tax withholding rate is 5%, and the Social Security and Medicare tax rate for both the employer and the employee is 7.65%. 8. If an employee is paid a salary of $50,000 per year, after Soclal Security and Medicare taxes, what is the cost of the employee to the business? 9. If an employec is pald a salary of $1,000 per week, how much will the employer withhold from the employee's check? 10. If an employee is paid a salary of $1,000 per week, how much will the employer remit in payroll tax payments? 11. If an employee is paid a salary of $1,000 per week, what is the employee's take-home pay after taxes? 12. What is likely to happen if a business fails to pay its taxes? 13. When in doubt about tax issues, ask your 14. How does the tax treatment of profits differ between a C-corporation and the other legal structure forms? 15. How does a sole-proprietorship differ from a corporation? 16. How does an Lle differ from a corporation? 17. In which type(s) of business organization are the owners' assets protected from the creditors of the business? 18. Describe the important elements of a contract. 19. Discuss how a business might protect its intellectual capital, 20. Why do so many companies registered in Delaware? Internet Application