Question

Dishs 10-K are provided as supplementary material. 1. Profitability Analysis a. Compute Dish return on assets (ROA) for 2019 and 2018. What trend do you

Dishs 10-K are provided as supplementary material.

1. Profitability Analysis

a. Compute Dish return on assets (ROA) for 2019 and 2018. What trend do you observe in Dish ROA? (2 points)

b. Decompose Dish ROA for 2019 and 2018 to its two main components we learned in class. Comment on which of the two components is causing the trend you observed in question 1(a) (4 points)

c. Identify the two line items in the relevant financial statement that can explain the trend you observed in questions 1(a) and 1(b) (use common size analysis and/or percentage change analysis to show the change). (4 points)

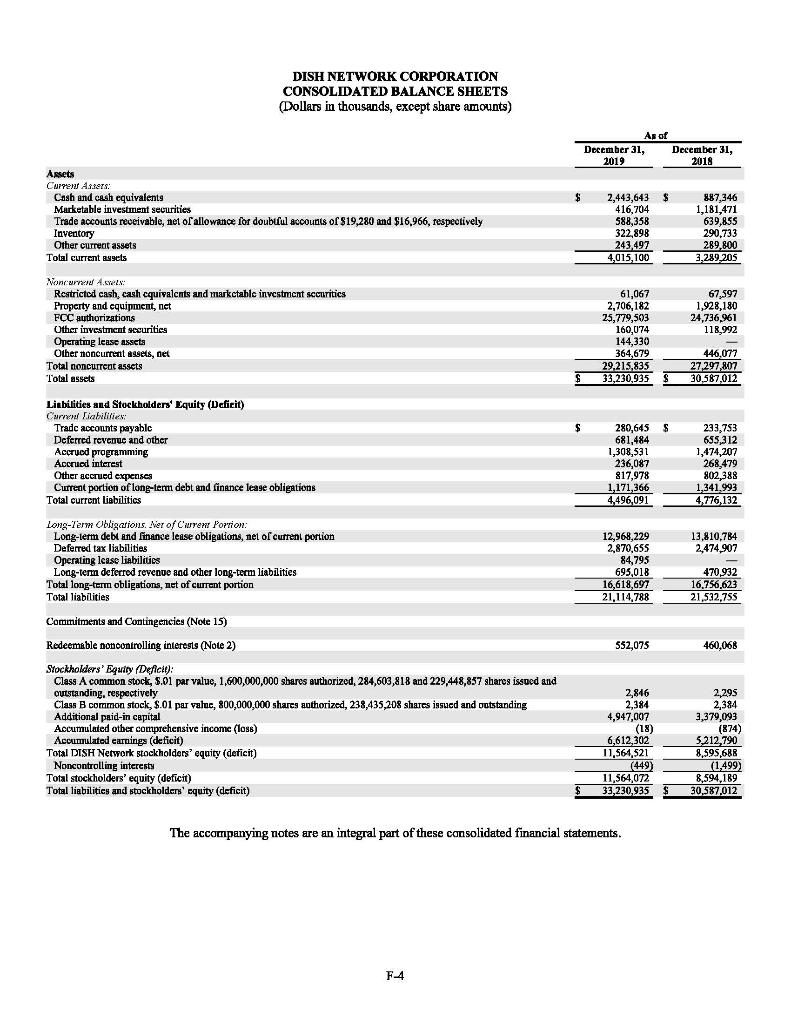

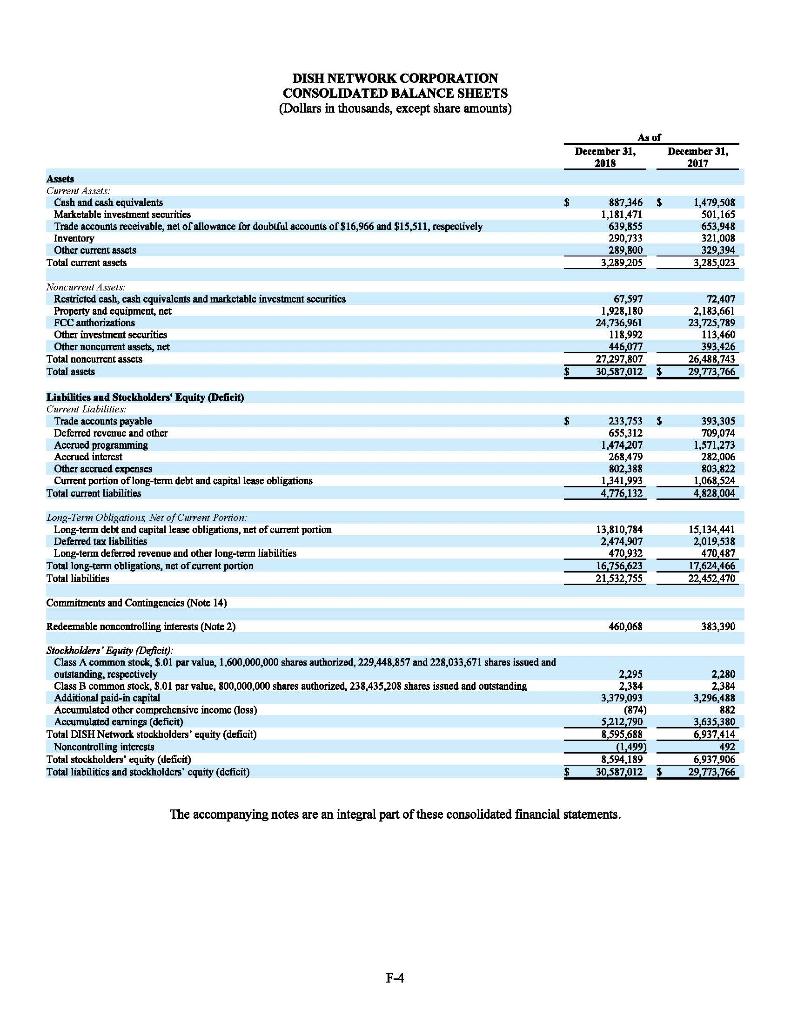

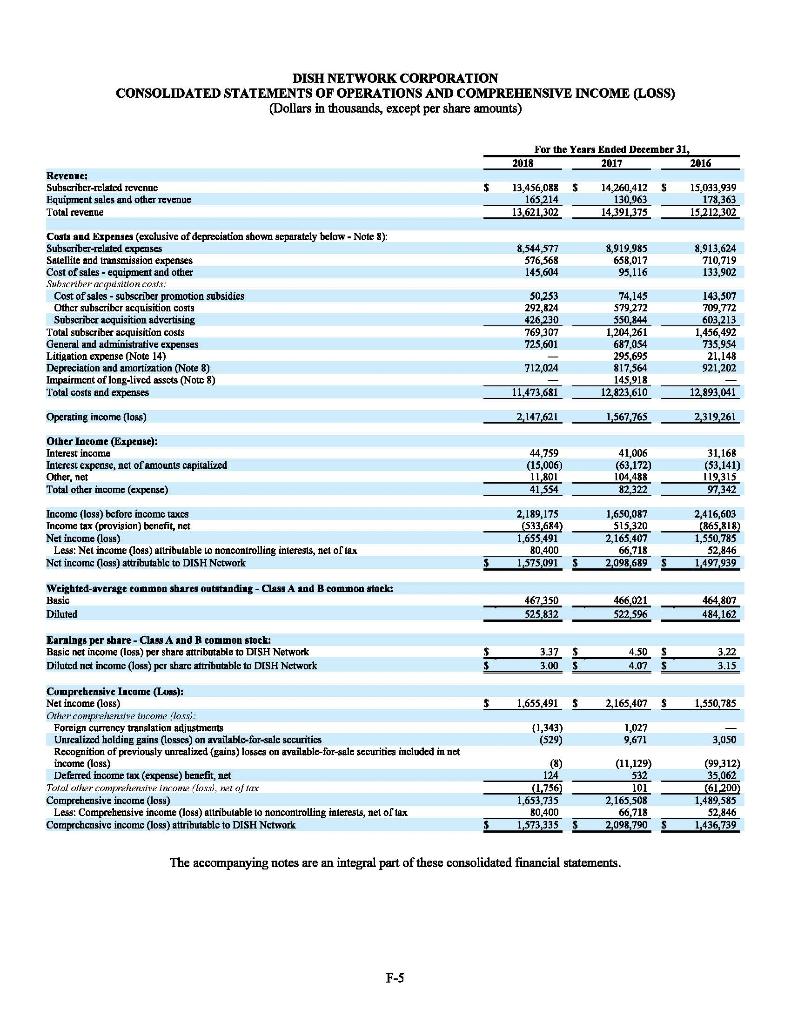

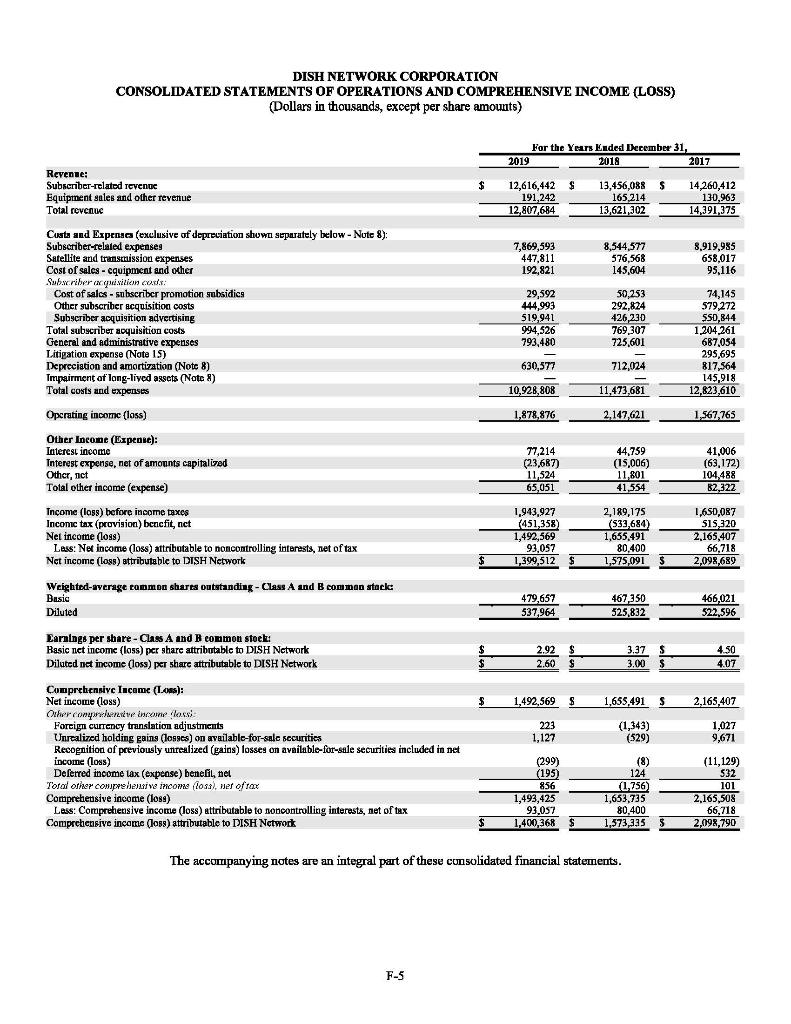

DISH NETWORK CORPORATION CONSOLIDATED BALANCE SHEETS Dollars in thousands, except share amounts) As of December 31, December 31, 2019 2018 $ $ Assets Current Assers: Cash and cash equivalents Marketable investment securities Trade accoufits receivable, net of allowance for doubulul accounts of $19,280 and $16,966, respectively Inventory Other current assets Total current gets 2,443,643 416,704 588,358 322,898 243,497 4,015,100 887,346 1,181,471 639,855 290,733 289,800 3,289.205 61,067 2,706,182 Noncurred 4. cxels: Restricted cash, cash equivalents and markctable investment securities Property and equipment, net FCC authorizations Other investment securities Operatig lease assets Other noncurrent assets, det Total concurrent assets Total assets 67,597 1,928,180 24,736,961 118,992 25,779,503 160,074 144,330 364,679 29,215,835 33,230,935 446,077 27,297,807 30,587,012 $ $ $ Liabilities and Stockholders' Equity (Deficit) Curred Liabilities: Tradc accounts payable Deferred revenue and other Accrued programming Accrued interest Other accrued expenses Current portion of long-term debt and finance leage obligations Total current liabilities 280,645 681,484 1,308,531 236,087 817,978 1,171,366 4,496,091 233,753 655,312 1,474 207 268,479 802,388 1,341.993 4,776,132 13.810,784 2,474,907 Long-Term Obligations. Ner of Currenr Portion: Long-term debt and finance lease obligations, net of current portion Deferred tax liabilities Operating lease liabilities Long-term deferred revenue and other long-term liabilities Total long-term obligations, net of current portion Total liabilities 12,968,220 2,870,655 84,795 695,018 16,618,697 21,114,788 470,932 16.756.623 21,532,755 Commitments and Contingencies (Note 15) 552,075 460,068 Redeemable noncontrolling interests (Note 2) Stockholders' Equity (Deficit): Class A commion stock, 8.01 par value, 1,600,000,000 shares authorized, 284,603,818 and 229,448,857 shares issued and outstanding, respectively Class B common stock, $.01 par valec, 800,000,000 sharcs aothorized, 238,435,208 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive income (loss) Accumulated earnings (deficit) Total DISH Network stockholders' equity (deficit) Noncontrolling interest Total stockholders' equity (deficit) Total liabilities and stockholders' equity (deficit) 2,846 2,384 4,947,007 (18) 6,612,302 11,564,521 (449) 11,564,072 33,230,935 2,295 2,384 3,379,093 (874) 5,212,790 8,595,68R (1,499) 8,594,189 30,587,012 $ The accompanying notes are an integral part of these consolidated financial statements. F-4 DISH NETWORK CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars in thousands, except share amounts) As of Deeember 31, 2018 December 31, 2017 $ Assets Current Arts: Cush and cash equivalents Marketable investment securities Trade accounts receivable, net of allowance for doubul accounts of $16,966 and $15,511, respectively Inventory Other current assets Total current aggets 887,346 $ 1,181,471 639,855 290,733 289,800 3,289,205 1,479,508 501,165 653,948 321,008 329,394 3,285,023 Noncurrent els Restricto cash, cash cquivalents and marketable investment sccuritics Property and equipment, net FOC authorizations Other investment securities Other noncurrent assets, niet Total concurrent assets Total aysets 67,597 1,928,180 24,736,961 118,992 446,077 27.297,807 30,587,012 72,407 2,183,661 23,725,789 113,460 393,426 26,488,743 29, 773,766 $ $ S Liabilities and Stuckholders' Equity (Deficit) Current Liabilities: Trade accounts payable Dcfcrrcd revenue and other Accrued programming Accrued interest Other accrued expenses Current portion of long-term debt and capital lease obligations Total current Liabilities 233,753 $ 655,312 1,474,207 268,479 802,388 1,341,993 4.776,132 393,305 709,074 1,571,273 282,006 803,822 1,068,524 4.828,004 Long-Term Obligations Ner of Cwrenr Porrion. Long-term debt and capital lease obligations, net of current portion Deferred tax liabilities Long-term deferred revenue and other long-term liabilities Total long-term obligations, net of current portion Total liabilities 13,810,784 2,474,907 470,932 16756, 623 21,532,753 15,134,441 2,019,538 470,487 17,624,466 22,452,470 Commitments and Contingencies (Note 14) Redeemable noncontrolling interests (Note 2) 460,068 383.390 Stockholders' Equity (Derfictt) Class A common stock, S.01 par value, 1.600,000,000 shares authorized, 229,448,857 and 228,033,671 shares issued and outstanding, respectively Class B common stock, 8.01 par value, 800,000,000 sbares authorized, 238,435,208 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive income (losa) Accumulated caming (deficit) Total DISH Network stockholders' equity (deficit) Noncontrolling interests Total stockholders' equity (deficit) Total liabilitics and stockholders' cquity (dcficit) 2.295 2,384 3,379,093 (874) 5,212,790 8,595,688 (1.499) 8,594,189 30,587,012 5 2,280 2,384 3,296,488 882 3,635,380 6,937,414 492 6,937,906 29 773 766 $ The accompanying notes are an integral part of these consolidated financial statements, F-4 DISH NETWORK CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Dollars in thousands, except per share amounts) For the Years Ended December 31, 2018 2017 2016 $ $ S Revenac; Subscriber-related revenue Equipment sales and other IGYEDUC Total revente 13,456,08% 165,214 13,621 302 14.260,412 130,963 14,391,375 15,093,939 178,363 15 212 302 8,544,577 576,568 145,604 8,919,985 658,017 95.116 8,913,624 710, 719 133,902 Costa and Expenses (exclusive of depreciation shown separately below - Note 8): Subscriber-related expenses Satellite and transmission expenses Cost of sales - equipment and other Subsember a gust once Cost of sales - subscriber promotion subsidies Other subscriber acquisition costs Subscriber acquisition advertising Total subscriber acquisition costs General and administrative expenses Litigation expense (Note 14) Depreciation and amortization (Note 8) Impairment of long-lived assets (Notc 8) Total costs and expenses 50,253 292,824 426,230 769,307 725,601 74,145 579,272 550,844 1,204,261 687.054 295,695 817,564 145,918 12,823,610 143,507 709,772 603,213 1,456,492 735,954 21,148 921,202 712,024 11,473.681 12,893,041 Operating income (lons) 2.147,621 1.567 765 2319261 Other Income (Expense): Interest income Interest expense, act of amounts capitalized Other, net Total other income (expense) 44,759 (15,006) 11,801 41,554 41,006 (63,172) 104.488 82,322 31,168 (53,141) 119315 97,342 Income (los) before income taxes Income tax (provigion) benefit, net Net income (loss) Less: Net income (logs) attributable to noncontrolling interests, niet of tex Net income (loss) attributable to DISH Network 2,189,175 (533,684) 1,655,491 80,400 1.575,091 1,650,087 $15.320 2,165,407 66,718 2,098 689 2,416,603 (865,818) 1,550,785 52,846 1.491 939 $ S Weighted average common shares outstanding - Class A and B common stock Basic Diluted 467,350 525.832 466,021 522.596 464,807 484,162 Earnlngs per share - Class A and B common stock: Basic net income (losa) per share attributable to DISH Network Diluted net incomc (loss) per share attributable to DISH Network $ $ 3.37 5 3.00 $ 4.50 4.07 S S 3.22 3.15 $ 1,655,491 S 2,165,407 $ 1,550,785 (1,343) (529) 1,027 9,671 3,050 Comprehensive Income (Las): Net income (loks) Other comparere come lacsi Foreign currency translation adjustments Unicalized holding gains (losses) on availablo-for-sale sccuritics Recognition of previously unrcalized (gains) losses on available-for-sale securities included in det income (loss) Deferred income tax (expense) benefit, met Total our coma erite income (Loss), we offrex Comprehensive income (los) Less: Comprehensive income (loss) attributable to non controlling interests, net of tax Comprchcnsive income (loss) attributable to DISH Network (8) 124 (1.756) 1,653,735 80,400 1,573,335 (11,129) 532 101 2,165,508 66, 718 2,098 790 (99,312) 35,062 (61 200) 1,489,585 52,846 1.436 739 $ S S The accompanying notes are an integral part of these consolidated financial statements. F-5 DISH NETWORK CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Dollars in thousands, except per share amounts) For the Year Ended December 31, 2019 2018 2017 $ $ Revente: Subscriber-related revenge Equipment Sales and other revenue Total revenue 12,616,442 191,242 12,807,684 13,456,088 165 214 13,621,302 14,260,412 130.963 14,391,375 7,869,593 447,811 192,821 8,544,577 576,568 145,604 8,919,985 658,017 95,116 Custa and Expenses (exclusive of depreciation shown separately below - Note 8): Subscriber-related expenses Satellite and transmission expenses Cost of sales - equipment and other Subscriber wisition and Cost of salcs - subscriber promotion subsidice Other subscriber acquisition costs Subscriber acquisition advertising Total subscriber acquisition costs General and administrative expenses Litigation expense (Note 15) Depreciation and amortization (Note 8) Impairment of long-lived assets (Note :) Total costs and expenses 29,592 444993 519,941 994,526 793,480 50.253 292,824 426 230 769,307 725,601 74,145 579,272 $50,844 1,204,261 687.054 295,695 817,564 145,918 12,823.610 630,577 712,024 10,928,808 11,473,681 1,878,876 2.147,621 1.567 765 77,214 (23,687) 11 524 65,051 44,759 (15,006) 11,801 41,554 41,006 (63,172) 104.488 82,322 Operating income (loss) Other Income (Export): Interest income terest expense, net of amounts capitalized Other, not Total other income (expense) Income (loss) before income taxes Income tax (provision) bcncfit, net Net income (logs) Lass: Net income (loss) attributable to noncontrolling interests, net of tax Net income (logo) attributable to DISH Network Weighted average common shares outstanding - Class A and B com man stock Basic Diluted 1,943,927 (451,358) 1,492,569 93,057 1,399,512 2,189,175 (533,684) 1,655.491 80,400 1,650,087 S15,320 2,165,407 66,718 2,098,689 $ 1.575,091 479,657 537,964 467,350 525,832 466,021 522,596 Earnings per sbare - Class A and B common stock: Basic net income (loss) per share attributable to DISH Network Dilated net income (loss) per share attributable to DISH Network 2.92 $ 2.60 $ 3.37 3.00 4.50 4.07 $ $ $ 1,492,569 $ 1,655,491 2,165,407 223 1,127 (1,343) (529) 1,027 9,671 Comprehensive Income (L.): Net income (Loss) Other conuberesive income loss Forcign currency translation adjustments Unrealized holding gains (logges) on available-for-salo securities Recognition of previously unrealized (gaios) losses on available-for-sale securities included in net income (Loss) Deferred income tax (expense) benefit, net Tored other comprehensive income foss), wer of tax Comprehensive income (los) Less: Comprehensive income (loss) attributable to noncontrolling interests, net of tax Comprehensive income (los) attributable to DISH Network (299) (195) 856 1,493,425 93,057 1,400 368 (8) 124 (1,756) 1,653,735 80,400 1,573,335 (11,129) 532 101 2,165,508 66,718 2,098,790 $ $ The accompanying notes are an integral part of these consolidated financial statements. F-5 DISH NETWORK CORPORATION CONSOLIDATED BALANCE SHEETS Dollars in thousands, except share amounts) As of December 31, December 31, 2019 2018 $ $ Assets Current Assers: Cash and cash equivalents Marketable investment securities Trade accoufits receivable, net of allowance for doubulul accounts of $19,280 and $16,966, respectively Inventory Other current assets Total current gets 2,443,643 416,704 588,358 322,898 243,497 4,015,100 887,346 1,181,471 639,855 290,733 289,800 3,289.205 61,067 2,706,182 Noncurred 4. cxels: Restricted cash, cash equivalents and markctable investment securities Property and equipment, net FCC authorizations Other investment securities Operatig lease assets Other noncurrent assets, det Total concurrent assets Total assets 67,597 1,928,180 24,736,961 118,992 25,779,503 160,074 144,330 364,679 29,215,835 33,230,935 446,077 27,297,807 30,587,012 $ $ $ Liabilities and Stockholders' Equity (Deficit) Curred Liabilities: Tradc accounts payable Deferred revenue and other Accrued programming Accrued interest Other accrued expenses Current portion of long-term debt and finance leage obligations Total current liabilities 280,645 681,484 1,308,531 236,087 817,978 1,171,366 4,496,091 233,753 655,312 1,474 207 268,479 802,388 1,341.993 4,776,132 13.810,784 2,474,907 Long-Term Obligations. Ner of Currenr Portion: Long-term debt and finance lease obligations, net of current portion Deferred tax liabilities Operating lease liabilities Long-term deferred revenue and other long-term liabilities Total long-term obligations, net of current portion Total liabilities 12,968,220 2,870,655 84,795 695,018 16,618,697 21,114,788 470,932 16.756.623 21,532,755 Commitments and Contingencies (Note 15) 552,075 460,068 Redeemable noncontrolling interests (Note 2) Stockholders' Equity (Deficit): Class A commion stock, 8.01 par value, 1,600,000,000 shares authorized, 284,603,818 and 229,448,857 shares issued and outstanding, respectively Class B common stock, $.01 par valec, 800,000,000 sharcs aothorized, 238,435,208 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive income (loss) Accumulated earnings (deficit) Total DISH Network stockholders' equity (deficit) Noncontrolling interest Total stockholders' equity (deficit) Total liabilities and stockholders' equity (deficit) 2,846 2,384 4,947,007 (18) 6,612,302 11,564,521 (449) 11,564,072 33,230,935 2,295 2,384 3,379,093 (874) 5,212,790 8,595,68R (1,499) 8,594,189 30,587,012 $ The accompanying notes are an integral part of these consolidated financial statements. F-4 DISH NETWORK CORPORATION CONSOLIDATED BALANCE SHEETS (Dollars in thousands, except share amounts) As of Deeember 31, 2018 December 31, 2017 $ Assets Current Arts: Cush and cash equivalents Marketable investment securities Trade accounts receivable, net of allowance for doubul accounts of $16,966 and $15,511, respectively Inventory Other current assets Total current aggets 887,346 $ 1,181,471 639,855 290,733 289,800 3,289,205 1,479,508 501,165 653,948 321,008 329,394 3,285,023 Noncurrent els Restricto cash, cash cquivalents and marketable investment sccuritics Property and equipment, net FOC authorizations Other investment securities Other noncurrent assets, niet Total concurrent assets Total aysets 67,597 1,928,180 24,736,961 118,992 446,077 27.297,807 30,587,012 72,407 2,183,661 23,725,789 113,460 393,426 26,488,743 29, 773,766 $ $ S Liabilities and Stuckholders' Equity (Deficit) Current Liabilities: Trade accounts payable Dcfcrrcd revenue and other Accrued programming Accrued interest Other accrued expenses Current portion of long-term debt and capital lease obligations Total current Liabilities 233,753 $ 655,312 1,474,207 268,479 802,388 1,341,993 4.776,132 393,305 709,074 1,571,273 282,006 803,822 1,068,524 4.828,004 Long-Term Obligations Ner of Cwrenr Porrion. Long-term debt and capital lease obligations, net of current portion Deferred tax liabilities Long-term deferred revenue and other long-term liabilities Total long-term obligations, net of current portion Total liabilities 13,810,784 2,474,907 470,932 16756, 623 21,532,753 15,134,441 2,019,538 470,487 17,624,466 22,452,470 Commitments and Contingencies (Note 14) Redeemable noncontrolling interests (Note 2) 460,068 383.390 Stockholders' Equity (Derfictt) Class A common stock, S.01 par value, 1.600,000,000 shares authorized, 229,448,857 and 228,033,671 shares issued and outstanding, respectively Class B common stock, 8.01 par value, 800,000,000 sbares authorized, 238,435,208 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive income (losa) Accumulated caming (deficit) Total DISH Network stockholders' equity (deficit) Noncontrolling interests Total stockholders' equity (deficit) Total liabilitics and stockholders' cquity (dcficit) 2.295 2,384 3,379,093 (874) 5,212,790 8,595,688 (1.499) 8,594,189 30,587,012 5 2,280 2,384 3,296,488 882 3,635,380 6,937,414 492 6,937,906 29 773 766 $ The accompanying notes are an integral part of these consolidated financial statements, F-4 DISH NETWORK CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Dollars in thousands, except per share amounts) For the Years Ended December 31, 2018 2017 2016 $ $ S Revenac; Subscriber-related revenue Equipment sales and other IGYEDUC Total revente 13,456,08% 165,214 13,621 302 14.260,412 130,963 14,391,375 15,093,939 178,363 15 212 302 8,544,577 576,568 145,604 8,919,985 658,017 95.116 8,913,624 710, 719 133,902 Costa and Expenses (exclusive of depreciation shown separately below - Note 8): Subscriber-related expenses Satellite and transmission expenses Cost of sales - equipment and other Subsember a gust once Cost of sales - subscriber promotion subsidies Other subscriber acquisition costs Subscriber acquisition advertising Total subscriber acquisition costs General and administrative expenses Litigation expense (Note 14) Depreciation and amortization (Note 8) Impairment of long-lived assets (Notc 8) Total costs and expenses 50,253 292,824 426,230 769,307 725,601 74,145 579,272 550,844 1,204,261 687.054 295,695 817,564 145,918 12,823,610 143,507 709,772 603,213 1,456,492 735,954 21,148 921,202 712,024 11,473.681 12,893,041 Operating income (lons) 2.147,621 1.567 765 2319261 Other Income (Expense): Interest income Interest expense, act of amounts capitalized Other, net Total other income (expense) 44,759 (15,006) 11,801 41,554 41,006 (63,172) 104.488 82,322 31,168 (53,141) 119315 97,342 Income (los) before income taxes Income tax (provigion) benefit, net Net income (loss) Less: Net income (logs) attributable to noncontrolling interests, niet of tex Net income (loss) attributable to DISH Network 2,189,175 (533,684) 1,655,491 80,400 1.575,091 1,650,087 $15.320 2,165,407 66,718 2,098 689 2,416,603 (865,818) 1,550,785 52,846 1.491 939 $ S Weighted average common shares outstanding - Class A and B common stock Basic Diluted 467,350 525.832 466,021 522.596 464,807 484,162 Earnlngs per share - Class A and B common stock: Basic net income (losa) per share attributable to DISH Network Diluted net incomc (loss) per share attributable to DISH Network $ $ 3.37 5 3.00 $ 4.50 4.07 S S 3.22 3.15 $ 1,655,491 S 2,165,407 $ 1,550,785 (1,343) (529) 1,027 9,671 3,050 Comprehensive Income (Las): Net income (loks) Other comparere come lacsi Foreign currency translation adjustments Unicalized holding gains (losses) on availablo-for-sale sccuritics Recognition of previously unrcalized (gains) losses on available-for-sale securities included in det income (loss) Deferred income tax (expense) benefit, met Total our coma erite income (Loss), we offrex Comprehensive income (los) Less: Comprehensive income (loss) attributable to non controlling interests, net of tax Comprchcnsive income (loss) attributable to DISH Network (8) 124 (1.756) 1,653,735 80,400 1,573,335 (11,129) 532 101 2,165,508 66, 718 2,098 790 (99,312) 35,062 (61 200) 1,489,585 52,846 1.436 739 $ S S The accompanying notes are an integral part of these consolidated financial statements. F-5 DISH NETWORK CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Dollars in thousands, except per share amounts) For the Year Ended December 31, 2019 2018 2017 $ $ Revente: Subscriber-related revenge Equipment Sales and other revenue Total revenue 12,616,442 191,242 12,807,684 13,456,088 165 214 13,621,302 14,260,412 130.963 14,391,375 7,869,593 447,811 192,821 8,544,577 576,568 145,604 8,919,985 658,017 95,116 Custa and Expenses (exclusive of depreciation shown separately below - Note 8): Subscriber-related expenses Satellite and transmission expenses Cost of sales - equipment and other Subscriber wisition and Cost of salcs - subscriber promotion subsidice Other subscriber acquisition costs Subscriber acquisition advertising Total subscriber acquisition costs General and administrative expenses Litigation expense (Note 15) Depreciation and amortization (Note 8) Impairment of long-lived assets (Note :) Total costs and expenses 29,592 444993 519,941 994,526 793,480 50.253 292,824 426 230 769,307 725,601 74,145 579,272 $50,844 1,204,261 687.054 295,695 817,564 145,918 12,823.610 630,577 712,024 10,928,808 11,473,681 1,878,876 2.147,621 1.567 765 77,214 (23,687) 11 524 65,051 44,759 (15,006) 11,801 41,554 41,006 (63,172) 104.488 82,322 Operating income (loss) Other Income (Export): Interest income terest expense, net of amounts capitalized Other, not Total other income (expense) Income (loss) before income taxes Income tax (provision) bcncfit, net Net income (logs) Lass: Net income (loss) attributable to noncontrolling interests, net of tax Net income (logo) attributable to DISH Network Weighted average common shares outstanding - Class A and B com man stock Basic Diluted 1,943,927 (451,358) 1,492,569 93,057 1,399,512 2,189,175 (533,684) 1,655.491 80,400 1,650,087 S15,320 2,165,407 66,718 2,098,689 $ 1.575,091 479,657 537,964 467,350 525,832 466,021 522,596 Earnings per sbare - Class A and B common stock: Basic net income (loss) per share attributable to DISH Network Dilated net income (loss) per share attributable to DISH Network 2.92 $ 2.60 $ 3.37 3.00 4.50 4.07 $ $ $ 1,492,569 $ 1,655,491 2,165,407 223 1,127 (1,343) (529) 1,027 9,671 Comprehensive Income (L.): Net income (Loss) Other conuberesive income loss Forcign currency translation adjustments Unrealized holding gains (logges) on available-for-salo securities Recognition of previously unrealized (gaios) losses on available-for-sale securities included in net income (Loss) Deferred income tax (expense) benefit, net Tored other comprehensive income foss), wer of tax Comprehensive income (los) Less: Comprehensive income (loss) attributable to noncontrolling interests, net of tax Comprehensive income (los) attributable to DISH Network (299) (195) 856 1,493,425 93,057 1,400 368 (8) 124 (1,756) 1,653,735 80,400 1,573,335 (11,129) 532 101 2,165,508 66,718 2,098,790 $ $ The accompanying notes are an integral part of these consolidated financial statements. F-5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started