Answered step by step

Verified Expert Solution

Question

1 Approved Answer

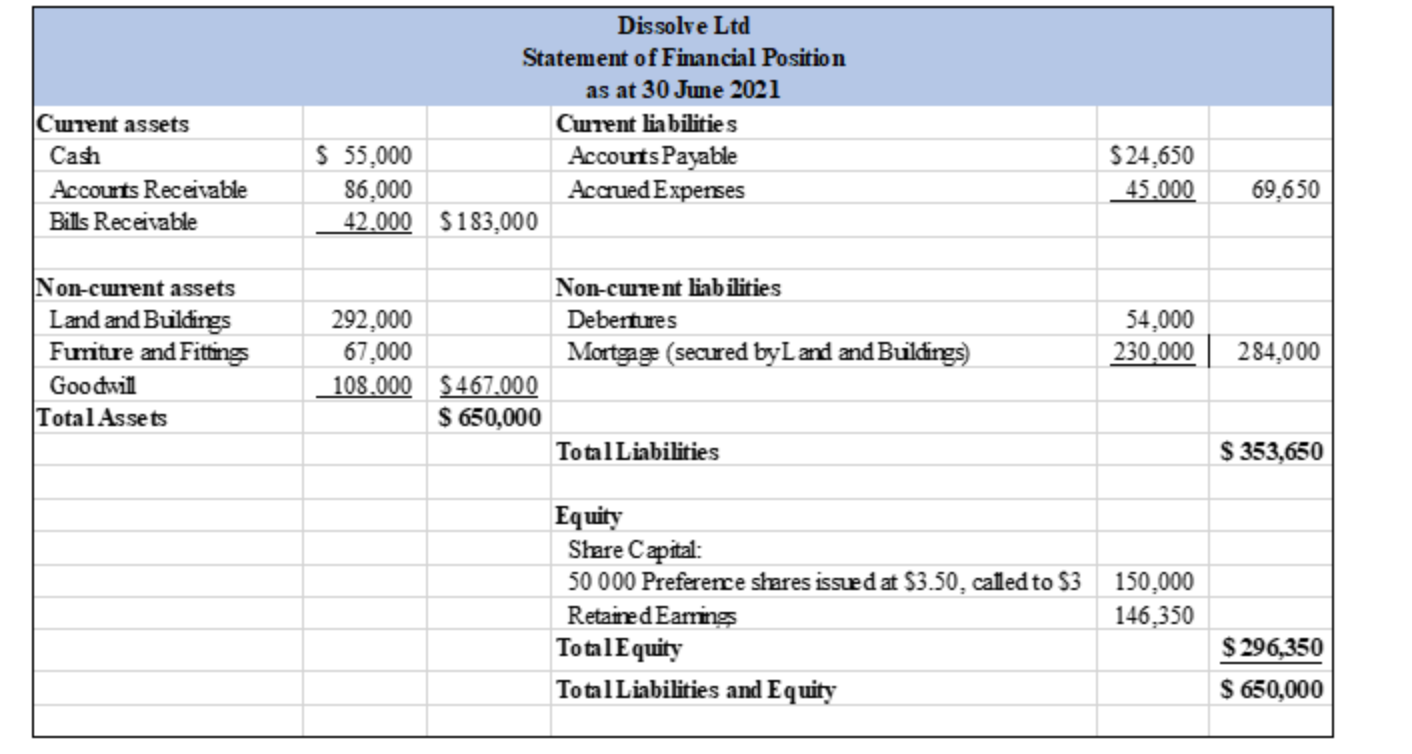

Dissolve Ltd went into voluntary liquidation on 30 June 2021. Its summarised Statement of Financial Position at that date was as follows: Additional information: The

Dissolve Ltd went into voluntary liquidation on 30 June 2021. Its summarised Statement of Financial Position at that date was as follows:

Additional information:

- The mortgage holder took possession of the land and buildings and sold them for $260,000 paying any residual to the liquidator.

- All other assets realised $168,000.

- Interest accrued on mortgage $18,500, and on debentures $3,500 not recorded.

- A further $4,500 in accounts payable has not been recognised by Dissolve Ltd.

- Liquidation costs and liquidators remuneration not recorded was $18,000.

- Arrears of cumulative preference dividend is $12,000 not recorded.

Required:

Prepare the general journal entries to record the liquidation of Dissolve Ltd.

NB. There is sufficient cash to pay all creditors in full

Current assets Cash Accounts Receivable Bills Receivable Dissolve Ltd Statement of Financial Position as at 30 June 2021 Current liabilities $ 55,000 Accounts Payable 86,000 Accrued Expenses 42.000 $183,000 $24,650 45.000 69,650 Non-current assets Land and Buildings Furniture and Fittings Goodwill Total Assets Non-cutent liabilities Debertures Mortage (secured byLand and Buildings) 54,000 230,000 292,000 67,000 108.000 $467.000 $ 650,000 284,000 Total Liabilities $ 353,650 Equity Share Capital: 50 000 Preference shares issued at $3.50, called to $3 150,000 Retaired Earrings 146,350 Total Equity Total Liabilities and Equity $ 296,350 $ 650,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started