Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Distrust but Hopeful Ltd is getting ready to publish their annual financial statements. In estimating bad debt expense, Mr Scan da Lous, the newly appointed

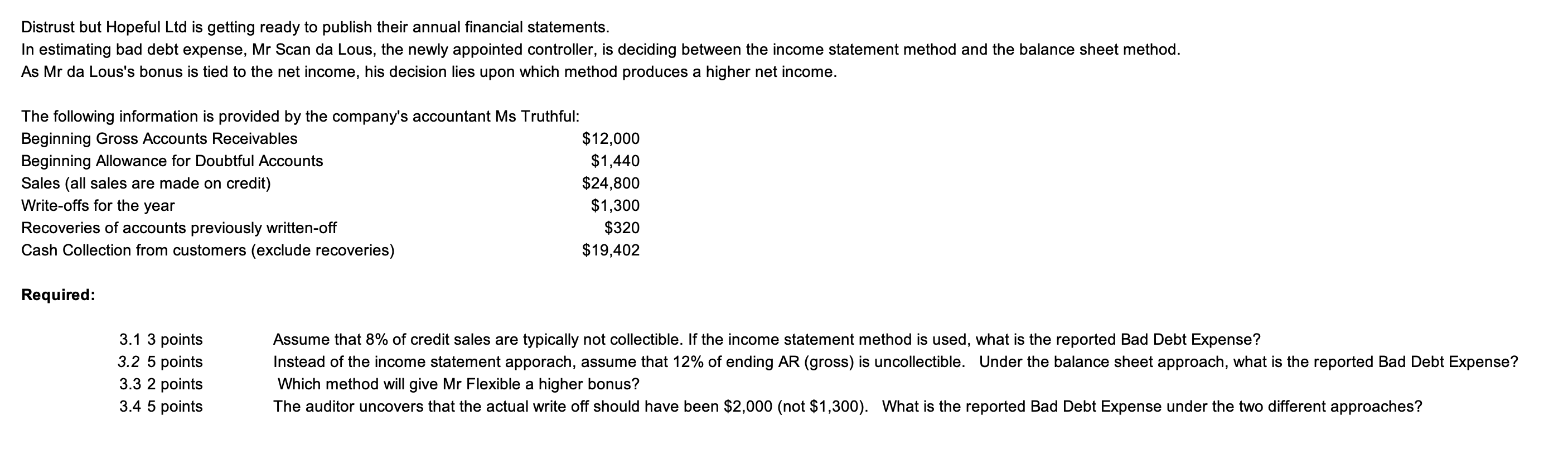

Distrust but Hopeful Ltd is getting ready to publish their annual financial statements. In estimating bad debt expense, Mr Scan da Lous, the newly appointed controller, is deciding between the income statement method and the balance sheet method. As Mr da Lous's bonus is tied to the net income, his decision lies upon which method produces a higher net income. Required: 3.13 points 3.25 points 3.32 points 3.45 points Assume that 8% of credit sales are typically not collectible. If the income statement method is used, what is the reported Bad Debt Expense? Instead of the income statement apporach, assume that 12% of ending AR (gross) is uncollectible. Under the balance sheet approach, what is the reported Bad Debt Expense? Which method will give Mr Flexible a higher bonus? The auditor uncovers that the actual write off should have been $2,000 (not $1,300 ). What is the reported Bad Debt Expense under the two different approaches

Distrust but Hopeful Ltd is getting ready to publish their annual financial statements. In estimating bad debt expense, Mr Scan da Lous, the newly appointed controller, is deciding between the income statement method and the balance sheet method. As Mr da Lous's bonus is tied to the net income, his decision lies upon which method produces a higher net income. Required: 3.13 points 3.25 points 3.32 points 3.45 points Assume that 8% of credit sales are typically not collectible. If the income statement method is used, what is the reported Bad Debt Expense? Instead of the income statement apporach, assume that 12% of ending AR (gross) is uncollectible. Under the balance sheet approach, what is the reported Bad Debt Expense? Which method will give Mr Flexible a higher bonus? The auditor uncovers that the actual write off should have been $2,000 (not $1,300 ). What is the reported Bad Debt Expense under the two different approaches Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started