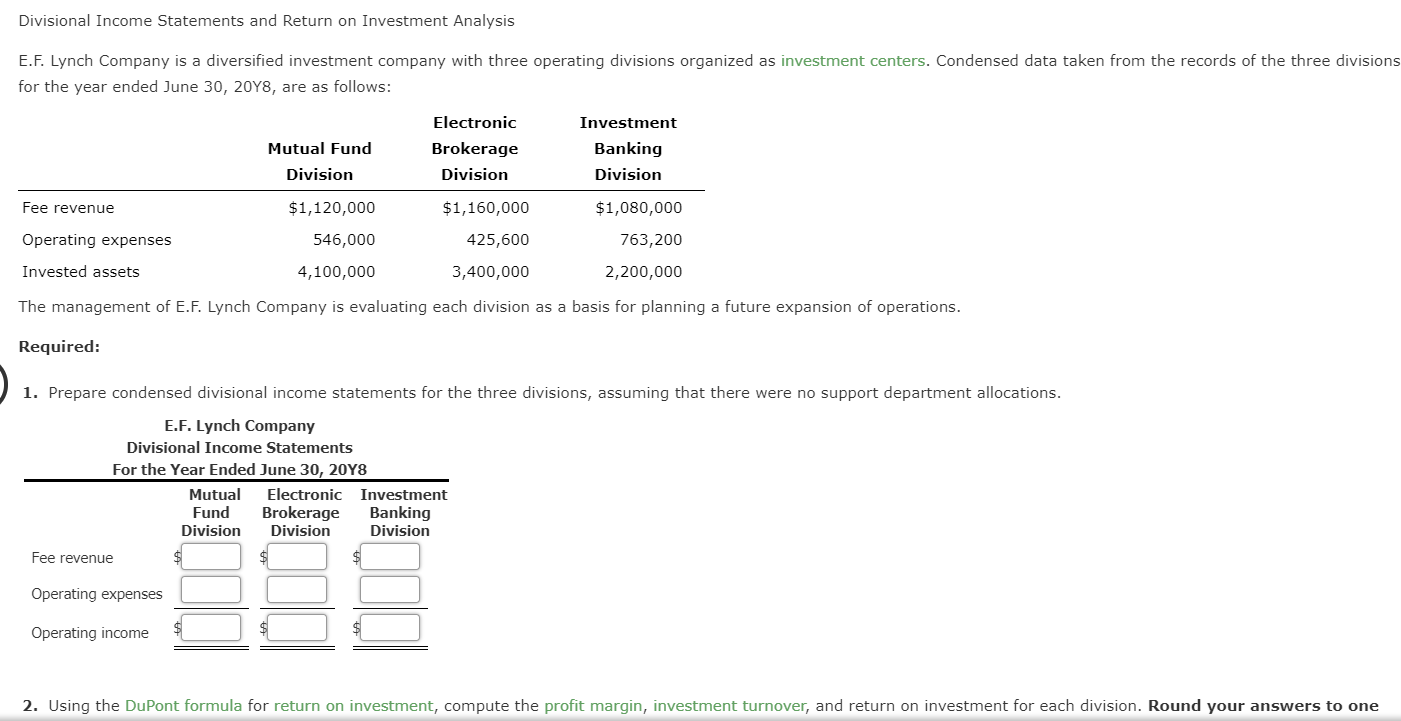

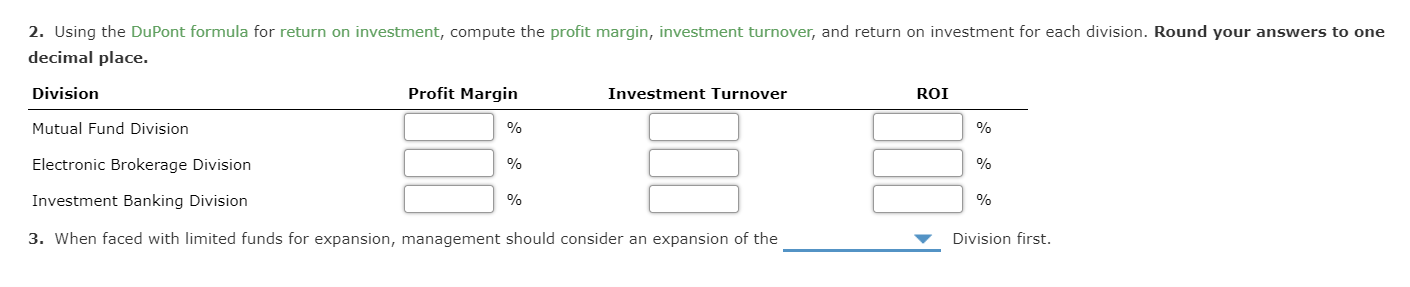

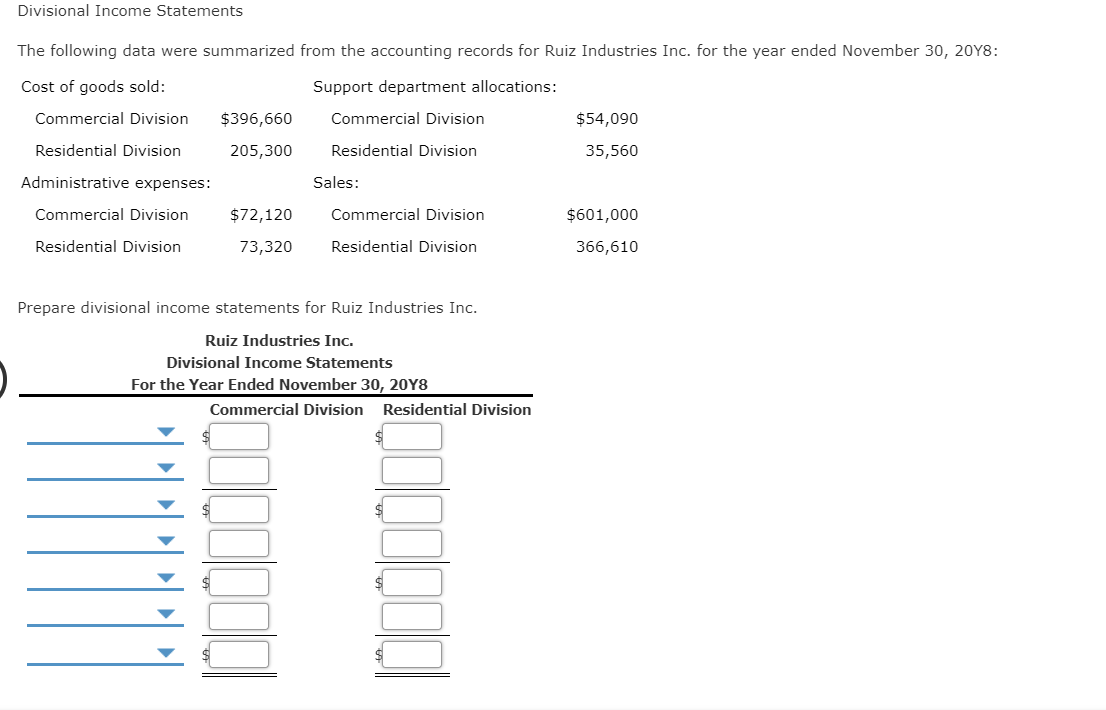

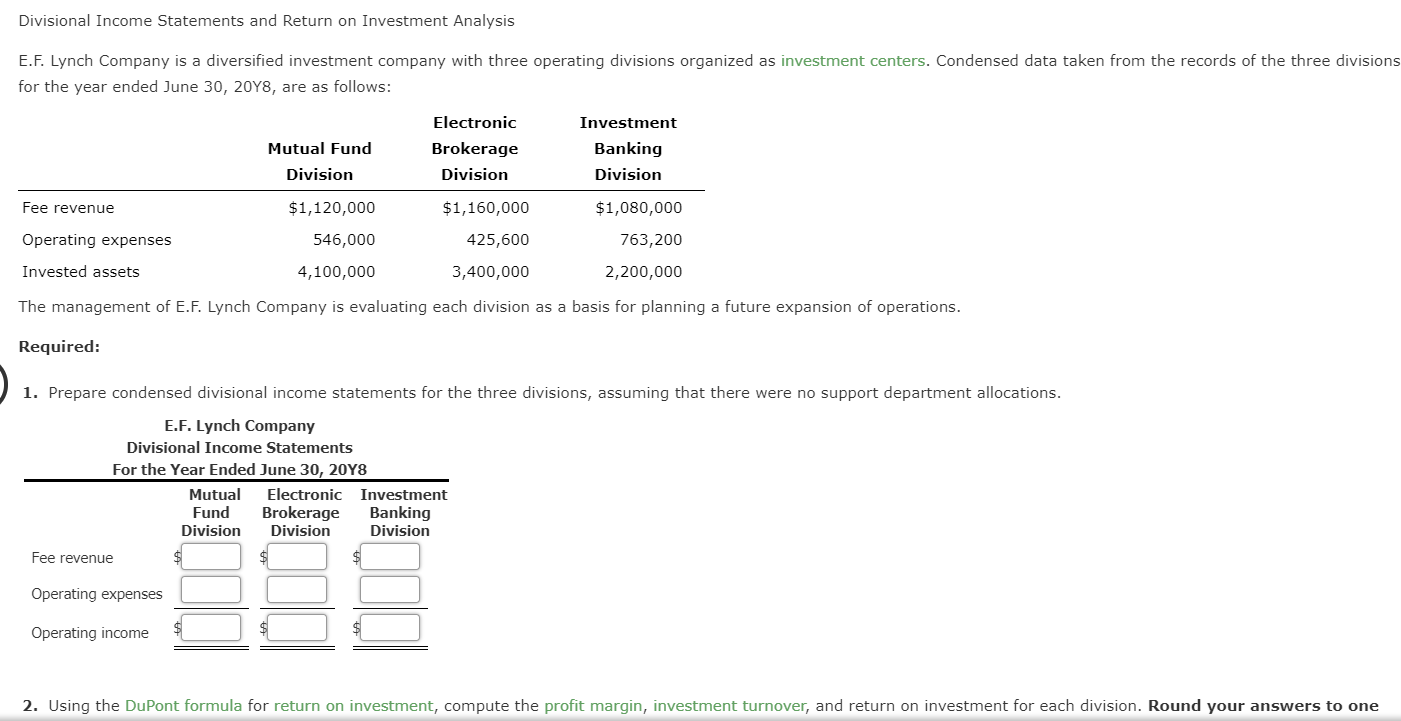

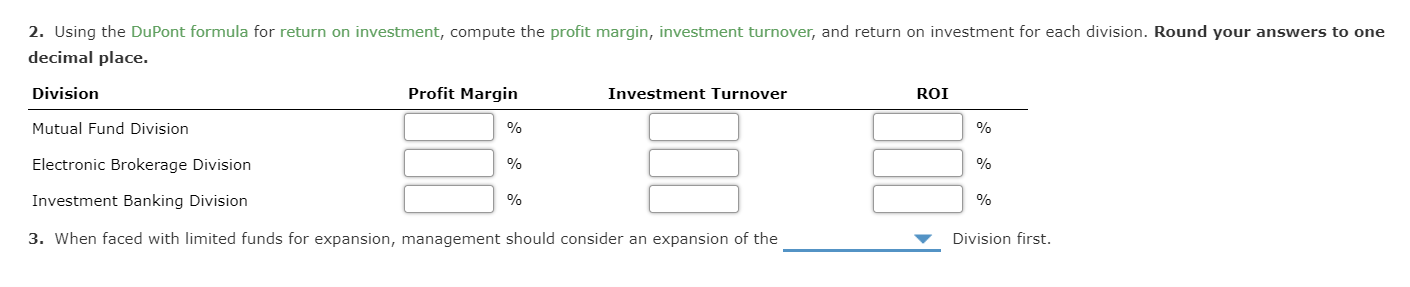

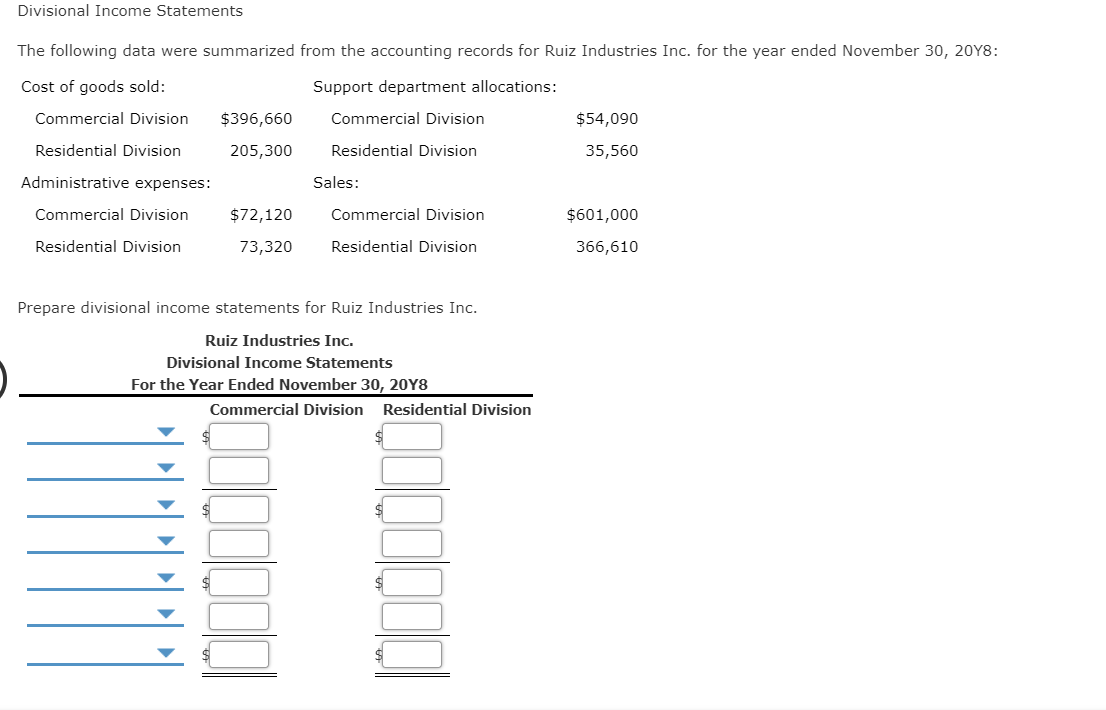

Divisional Income Statements and Return on Investment Analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 2018, are as follows: Electronic Brokerage Division Investment Banking Division Fee revenue Mutual Fund Division $1,120,000 546,000 4,100,000 Operating expenses Invested assets $1,160,000 425,600 3,400,000 $1,080,000 763,200 2,200,000 The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Required: 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no support department allocations. E.F. Lynch Company Divisional Income Statements For the Year Ended June 30, 2048 Mutual Electronic Investment Fund Brokerage Banking Division Division Division Fee revenue Operating expenses Operating income 2. Using the DuPont formula for return on investment, compute the profit margin, investment turnover, and return on investment for each division. Round your answers to one 2. Using the DuPont formula for return on investment, compute the profit margin, investment turnover, and return on investment for each division. Round your answers to one decimal place. Division Profit Margin Investment Turnover ROI Mutual Fund Division % Electronic Brokerage Division Investment Banking Division 3. When faced with limited funds for expansion, management should consider an expansion of the Division first. Divisional Income Statements The following data were summarized from the accounting records for Ruiz Industries Inc. for the year ended November 30, 2048: Support department allocations: Commercial Division Residential Division $54,090 35,560 Cost of goods sold: Commercial Division $396,660 Residential Division 205,300 Administrative expenses: Commercial Division $72,120 Residential Division 73,320 Sales: Commercial Division Residential Division $601,000 366,610 Prepare divisional income statements for Ruiz Industries Inc. Ruiz Industries Inc. Divisional Income Statements For the Year Ended November 30, 2048 Commercial Division Residential Division