Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do a Porter 5-forces industry analysis of the soft drink industry but only focus on bargaining power of buyers (bottlers buy concentrate from Coke and

- Do a Porter 5-forces industry analysis of the soft drink industry but only focus on bargaining power of buyers (bottlers buy concentrate from Coke and Pepsi, so they are the buyers below above). Make sure you do a thorough analysis and fully explain how this one force contributes to industry profitability (of concentrate producers) by using the underlying reasoning (e.g., buyers are large and few in number relative to focal industry firms resulting in them purchasing a large portion of an industry’s output, buyers switching costs are low, buyers can pose threat to integrate backward into the sellers’ industry).

- Conclude how this force affects the industry attractiveness (or profitability) of bottlers as well as the attractiveness of concentrate producers (Coke and Pepsi) based on your analysis above.

- What could the bottlers do to increase their bargaining power?

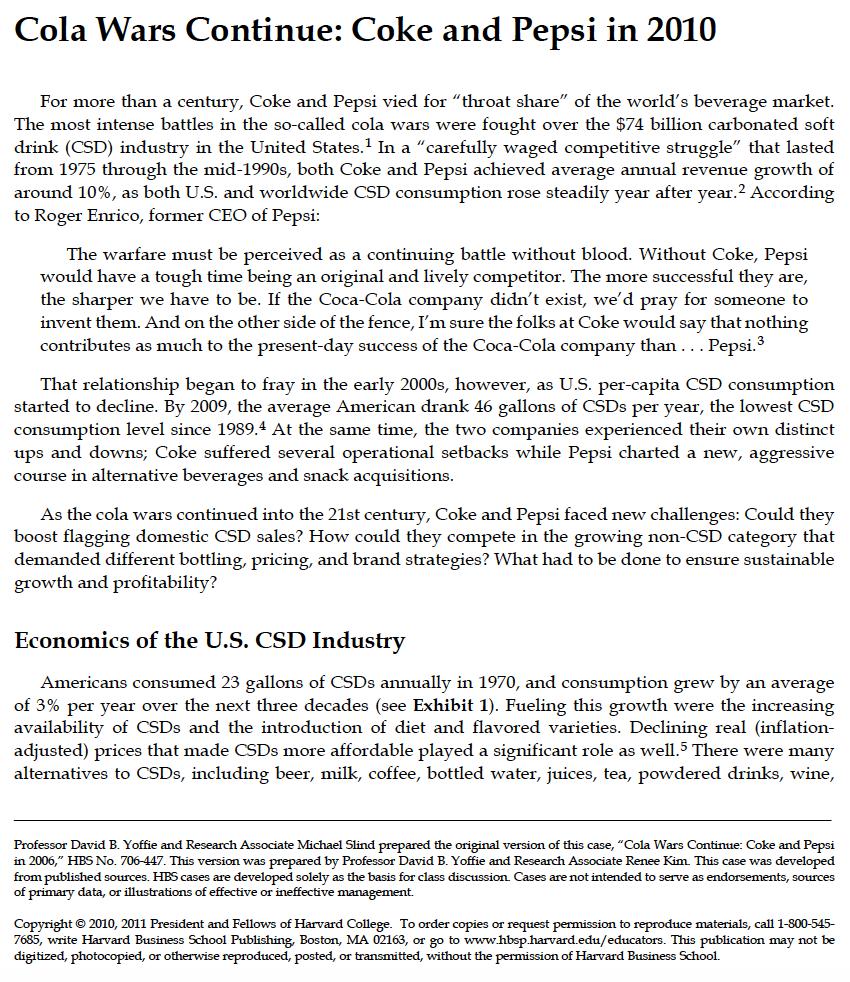

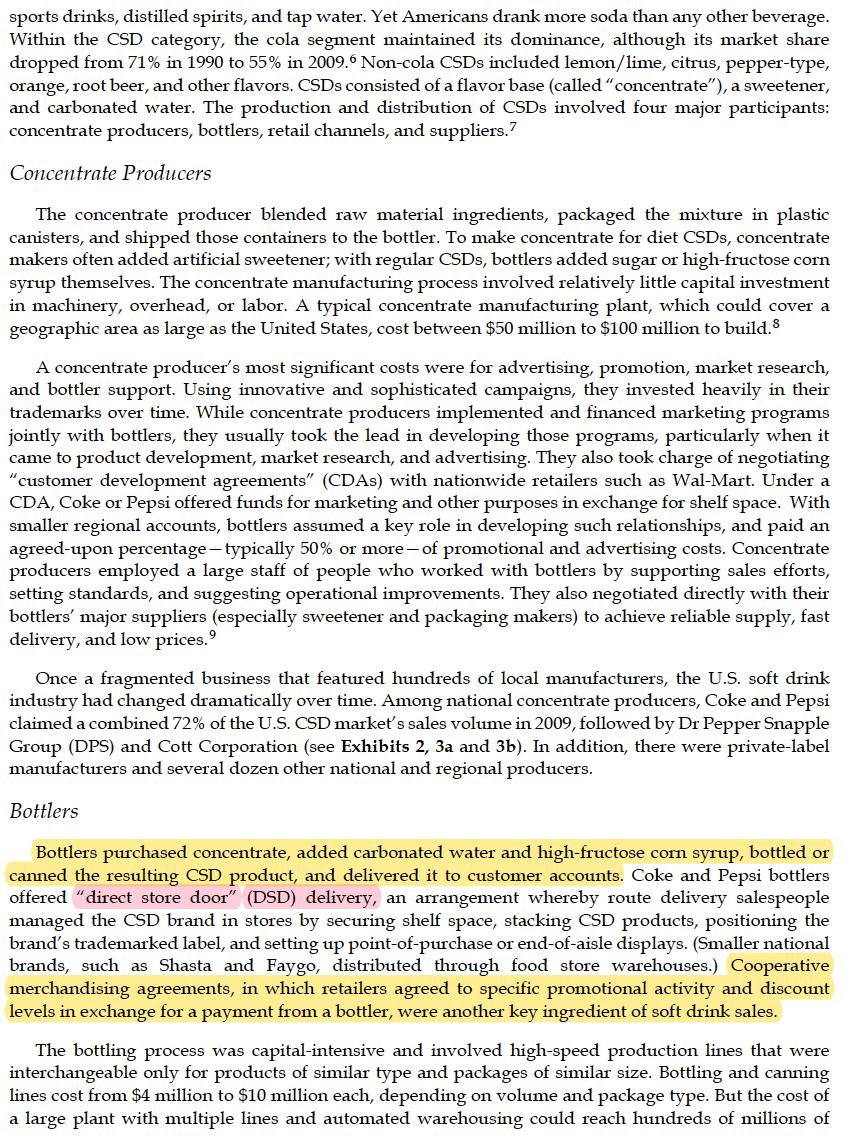

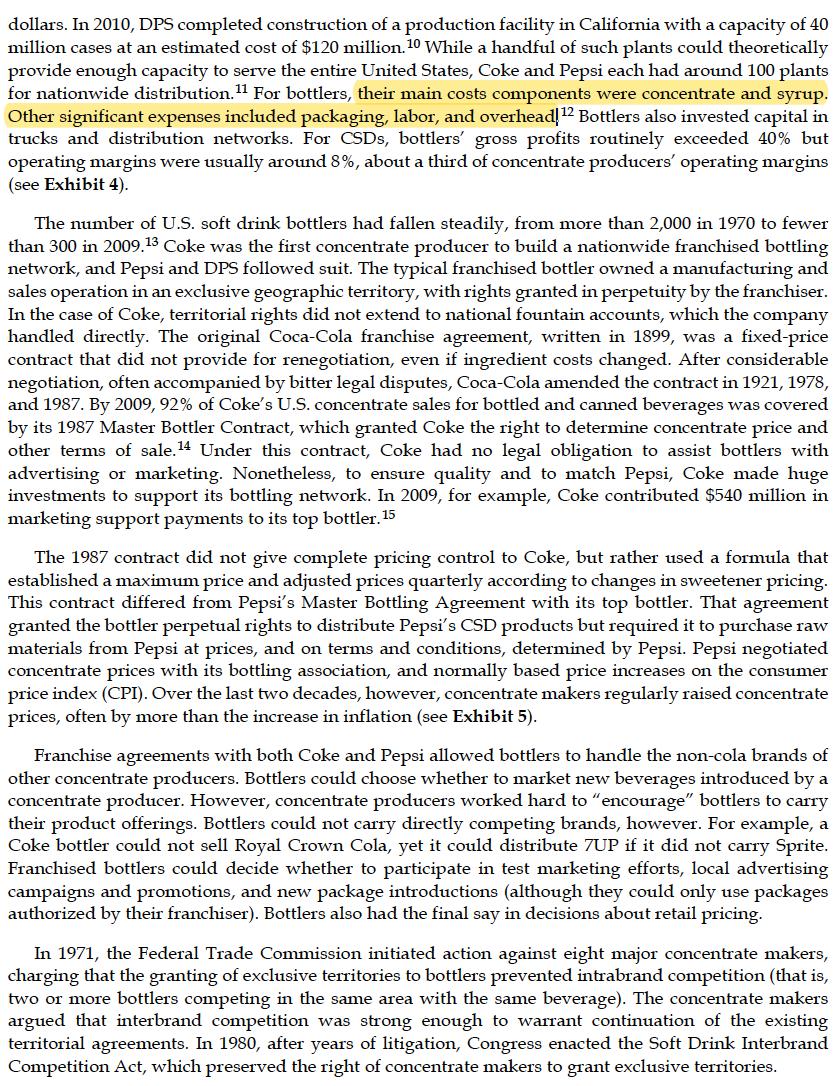

Cola Wars Continue: Coke and Pepsi in 2010 For more than a century, Coke and Pepsi vied for "throat share" of the world's beverage market. The most intense battles in the so-called cola wars were fought over the $74 billion carbonated soft drink (CSD) industry in the United States. In a "carefully waged competitive struggle" that lasted from 1975 through the mid-1990s, both Coke and Pepsi achieved average annual revenue growth of around 10%, as both U.S. and worldwide CSD consumption rose steadily year after year.2 According to Roger Enrico, former CEO of Pepsi: The warfare must be perceived as a continuing battle without blood. Without Coke, Pepsi would have a tough time being an original and lively competitor. The more successful they are, the sharper we have to be. If the Coca-Cola company didn't exist, we'd pray for someone to invent them. And on the other side of the fence, I'm sure the folks at Coke would say that nothing contributes as much to the present-day success of the Coca-Cola company than... Pepsi. That relationship began to fray in the early 2000s, however, as U.S. per-capita CSD consumption started to decline. By 2009, the average American drank 46 gallons of CSDs per year, the lowest CSD consumption level since 1989.4 At the same time, the two companies experienced their own distinct ups and downs; Coke suffered several operational setbacks while Pepsi charted a new, aggressive course in alternative beverages and snack acquisitions. As the cola wars continued into the 21st century, Coke and Pepsi faced new challenges: Could they boost flagging domestic CSD sales? How could they compete in the growing non-CSD category that demanded different bottling, pricing, and brand strategies? What had to be done to ensure sustainable growth and profitability? Economics of the U.S. CSD Industry Americans consumed 23 gallons of CSDs annually in 1970, and consumption grew by an average of 3% per year over the next three decades (see Exhibit 1). Fueling this growth were the increasing availability of CSDs and the introduction of diet and flavored varieties. Declining real (inflation- adjusted) prices that made CSDs more affordable played a significant role as well.5 There were many alternatives to CSDs, including beer, milk, coffee, bottled water, juices, tea, powdered drinks, wine, Professor David B. Yoffie and Research Associate Michael Slind prepared the original version of this case, "Cola Wars Continue: Coke and Pepsi in 2006," HBS No. 706-447. This version was prepared by Professor David B. Yoffie and Research Associate Renee Kim. This case was developed from published sources. HBS cases are developed solely as the basis for class discussion. Cases are not intended to serve as endorsements, sources of primary data, or illustrations of effective or ineffective management. Copyright 2010, 2011 President and Fellows of Harvard College. To order copies or request permission to reproduce materials, call 1-800-545- 7685, write Harvard Business School Publishing, Boston, MA 02163, or go to www.hbsp.harvard.edu/educators. This publication may not be digitized, photocopied, or otherwise reproduced, posted, or transmitted, without the permission of Harvard Business School.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bargaining Power of Buyers in the Soft Drink Industry A Porter Five Forces Analysis The bargaining power of buyers in the soft drink industry is moderate to strong depending on the specific segment of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started