Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do all of them, otherwise leave it for other tutoor, no need for explanation just give the correct answer 9 - 1 point A company

Do all of them, otherwise leave it for other tutoor, no need for explanation just give the correct answer

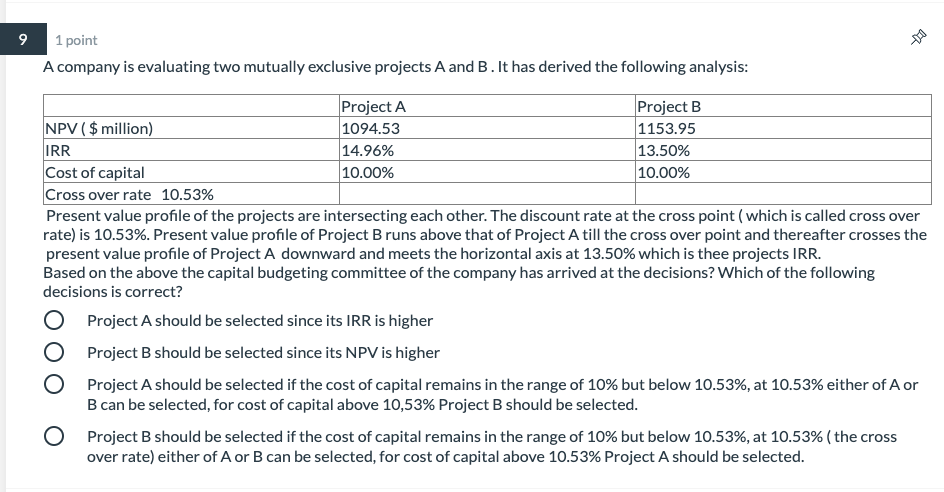

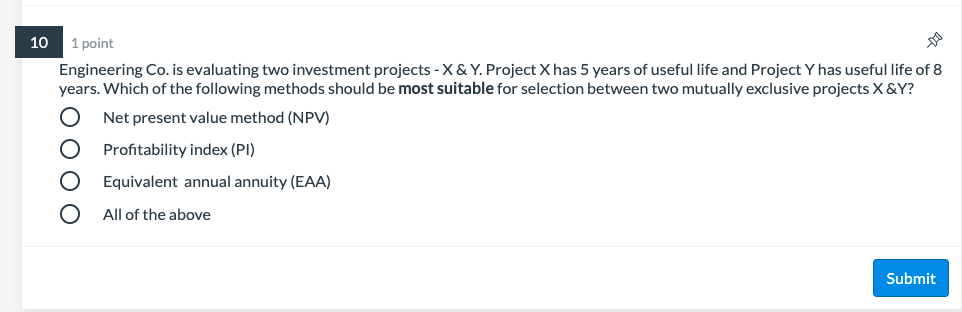

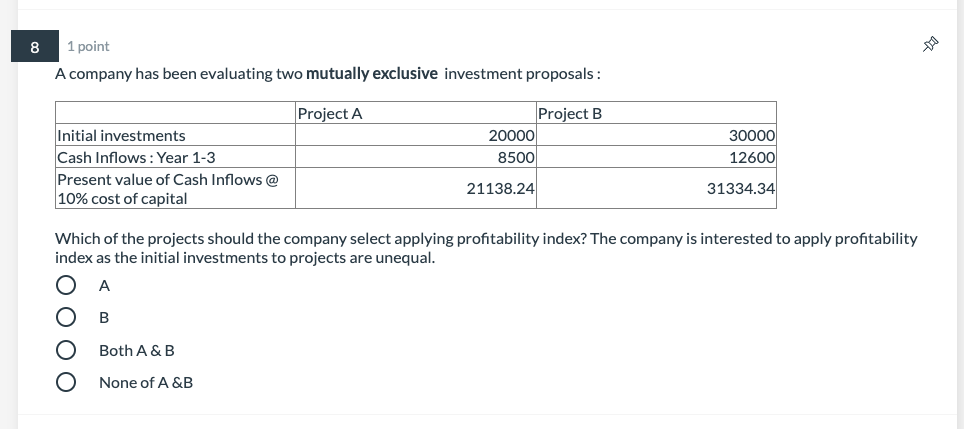

9 - 1 point A company is evaluating two mutually exclusive projects A and B. It has derived the following analysis: Project A Project B NPV ($ million) 1094.53 1153.95 IRR 14.96% 13.50% Cost of capital 10.00% 10.00% Cross over rate 10.53% Present value profile of the projects are intersecting each other. The discount rate at the cross point (which is called cross over rate) is 10.53%. Present value profile of Project Bruns above that of Project A till the cross over point and thereafter crosses the present value profile of Project A downward and meets the horizontal axis at 13.50% which is thee projects IRR. Based on the above the capital budgeting committee of the company has arrived at the decisions? Which of the following decisions is correct? O Project A should be selected since its IRR is higher O Project B should be selected since its NPV is higher O Project A should be selected if the cost of capital remains in the range of 10% but below 10.53%, at 10.53% either of A or B can be selected, for cost of capital above 10,53% Project B should be selected. O Project B should be selected if the cost of capital remains in the range of 10% but below 10.53%, at 10.53% (the cross over rate) either of A or B can be selected, for cost of capital above 10.53% Project A should be selected. 10 1 point Engineering Co. is evaluating two investment projects - X & Y. Project X has 5 years of useful life and Project Y has useful life of 8 years. Which of the following methods should be most suitable for selection between two mutually exclusive projects X&Y? Net present value method (NPV) Profitability index (PI) OOOO Equivalent annual annuity (EAA) All of the above Submit Submit 8 1 point A company has been evaluating two mutually exclusive investment proposals : Project A Project B 20000 8500 30000 12600 Initial investments Cash Inflows: Year 1-3 Present value of Cash Inflows @ 10% cost of capital 21138.24 31334.34 Which of the projects should the company select applying profitability index? The company is interested to apply profitability index as the initial investments to projects are unequal. B Both A&B None of A&BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started