Do all parts

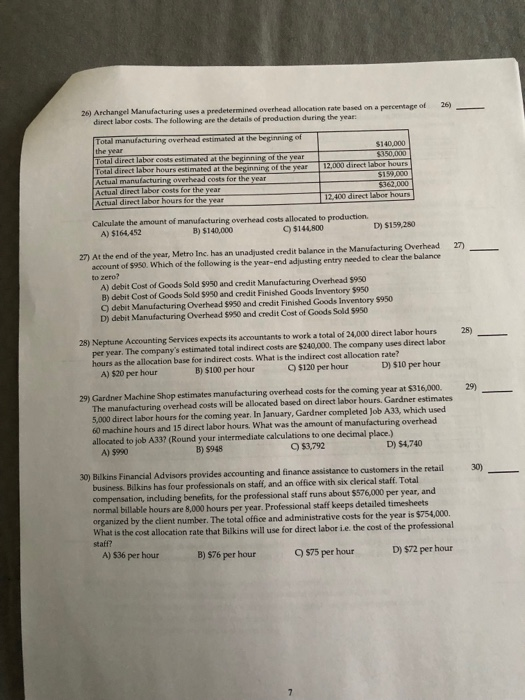

26) Archangel Manufacturing uses a predetermined overhead allocation rate based on a percentage of26) direct labor costs The following are the details of production during the year: Total manufacturing overhead estimated at the beginning of $140,000 50,000 Total direct labor hours est Actual direct labor costs for the year Calculate the amount of manufacturing overhead costs allocated to production. 159,000 5362,000 A) $164,452 B) $140,000 C) $144,800 D) $159,280 27) At the end of the year, Metro Inc. has an unadjusted credit balance in the Manufacturing Overhead 27) account of $950. Which of the following is the year-end adjusting entry needed to clear the balance to zero? A) debit Cost of Goods Sold $950 and credit Manufacturing Overhead $950 B) debit Cost of Goods Sold $950 and credit Finished Goods Inventory $950 C) debit Manufacturing Overhead $950 and credit Finished Goods Inventory $950 D) debit Manufacturing Overhead $950 and credit Cost of Goods Sold $950 28) 28) Neptune Accounting Services expects its accountants to work a total of 24,000 direct labor hours per year. The company's estimated total indirect costs are $240,000. The company uses direct labor hours as the allocation base for indirect costs. What is the indirect cost allocation rate? A) $20 per hour B) $100 per hour Q $120 per hourD)$10 per hour 29) Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $316,000. 29) The manufacturing overhead costs will be allocated based on direct labor hours. Gardner estimates 5,000 direct labor hours for the coming year, In January, Gardner completed Job A33, which used 60 machine hours and 15 direct labor hours. What was the amount of manufacturing overhead allocated to job A33? (Round your intermediate calculations to one decimal place.) A) $990 B) $948 O $3,792 D) $4,740 30) Bilkins Financial Advisors provides accounting and finance assistance to customers in the retail 30 business. Bilkins has four professionals on staff, and an office with six clerical staff. Total compensation, including benefits, for the professional staff runs about $576,000 per year, and normal billable hours are 8,000 hours per year. Professional staff keeps d organized by the dlient number. The total office and administrative costs for the year is $754,000. What is the cost allocation ra staff? te that Bilkins will use for direct labor ie. the cost of the professional A) $36 per hour B) $76 per hour 575 per hour D) $72 per hour