do correctly

if you answered wrong you will get 8 downvotes

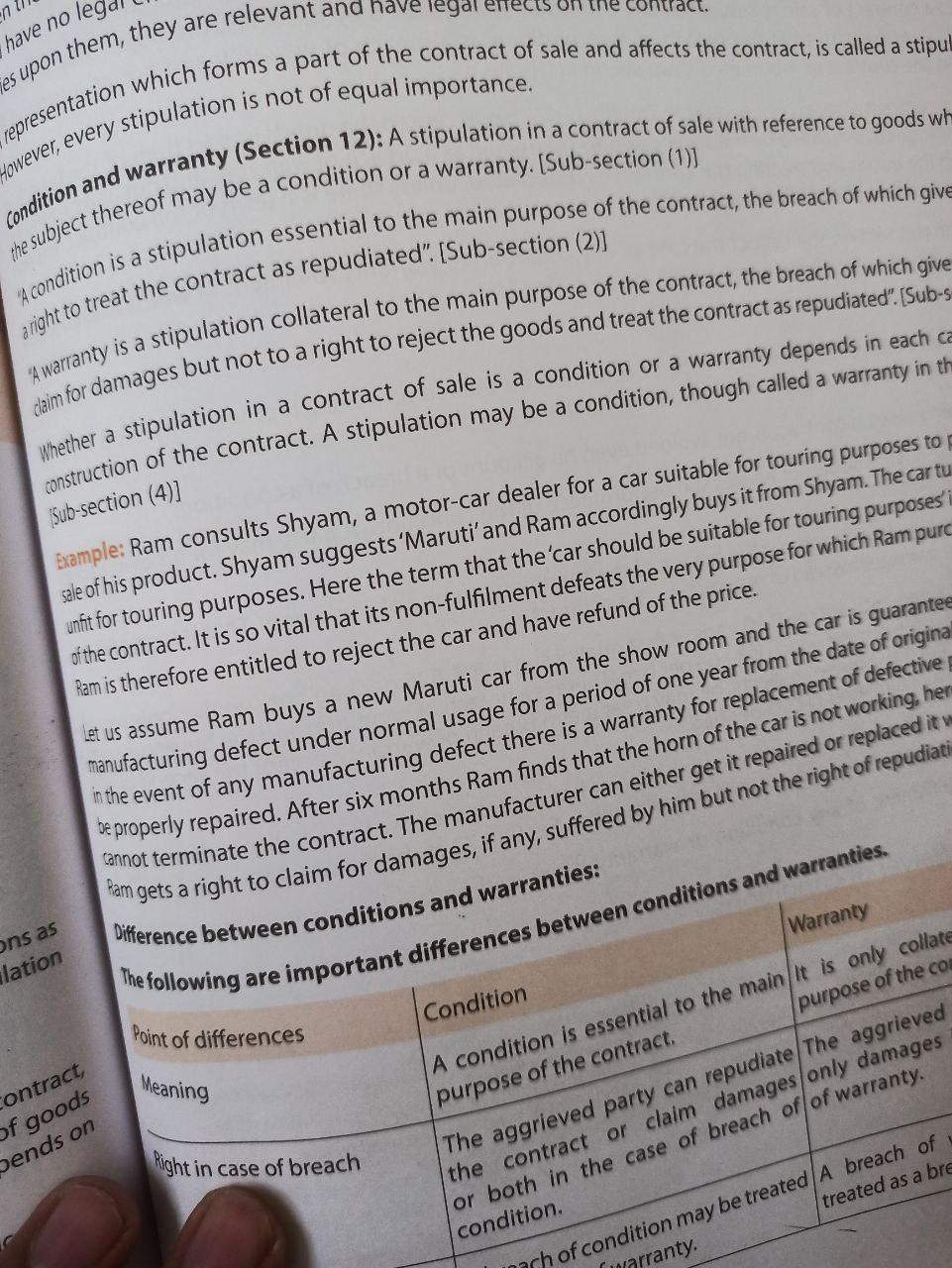

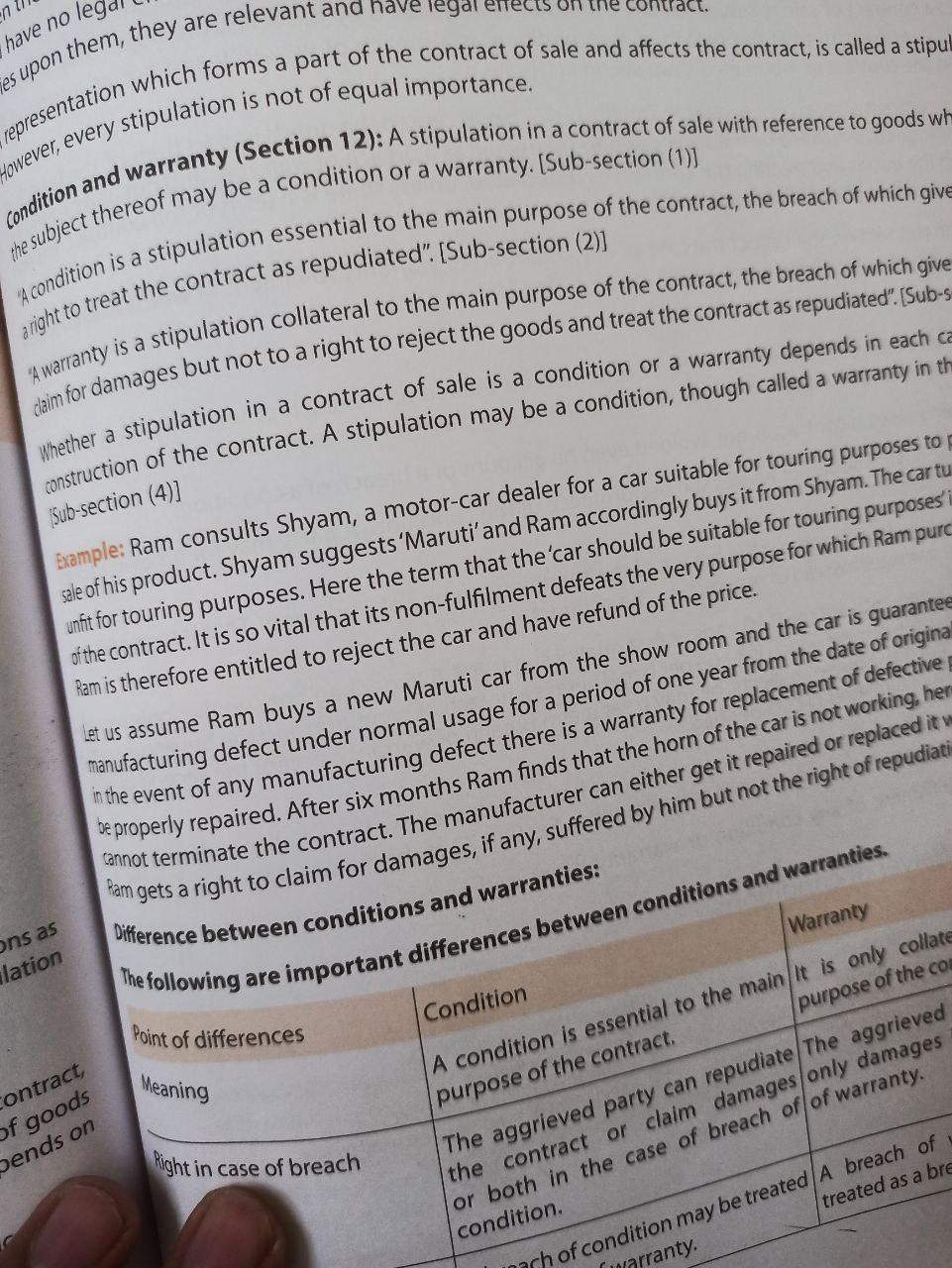

Where a contract of sale is not severable and the buyer has accepted the goods or part thereof, the breaches any condition to be fulfilled by the seller can only be treated as a breach of warranty and not as a ground rejecting the goods and treating the contract as repudiated, unless there is a term of the contract, exp or implied to that effect. [Sub-section (2)]

Nothing in this section shall affect the case of any condition or warranty fulfilment of which is excused law by reason of impossibility or otherwise. [Sub-section (3)]

Analysis:

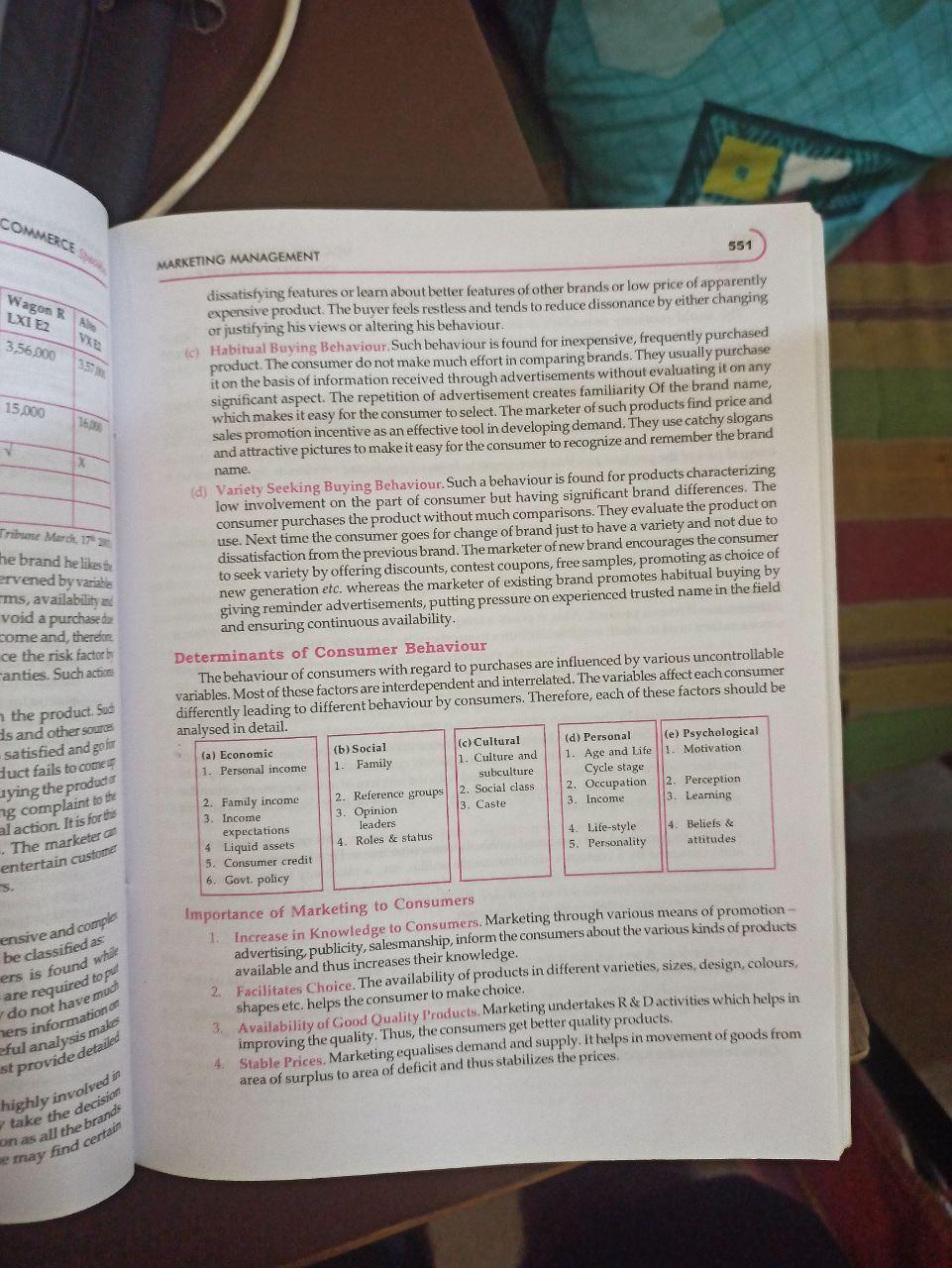

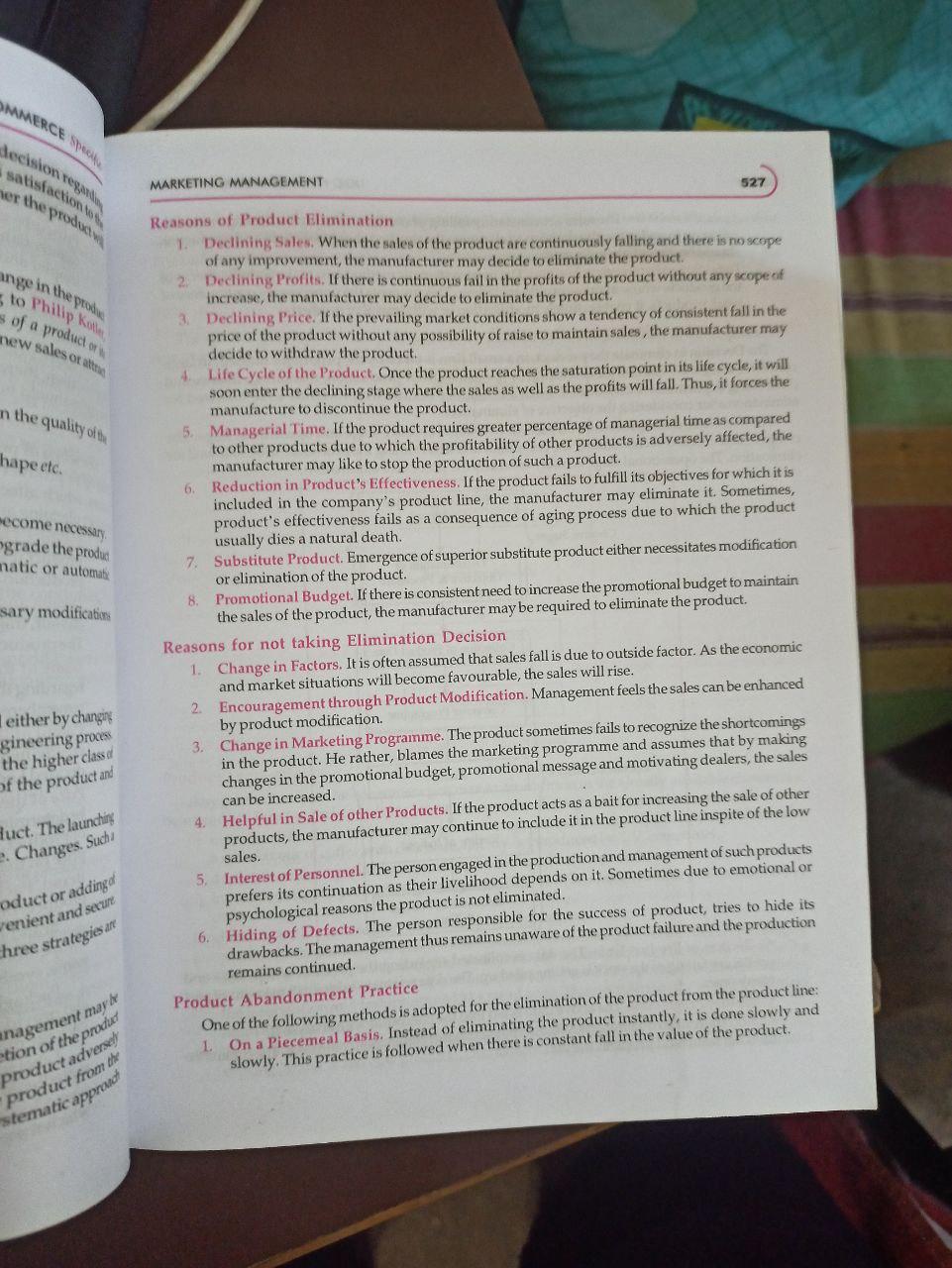

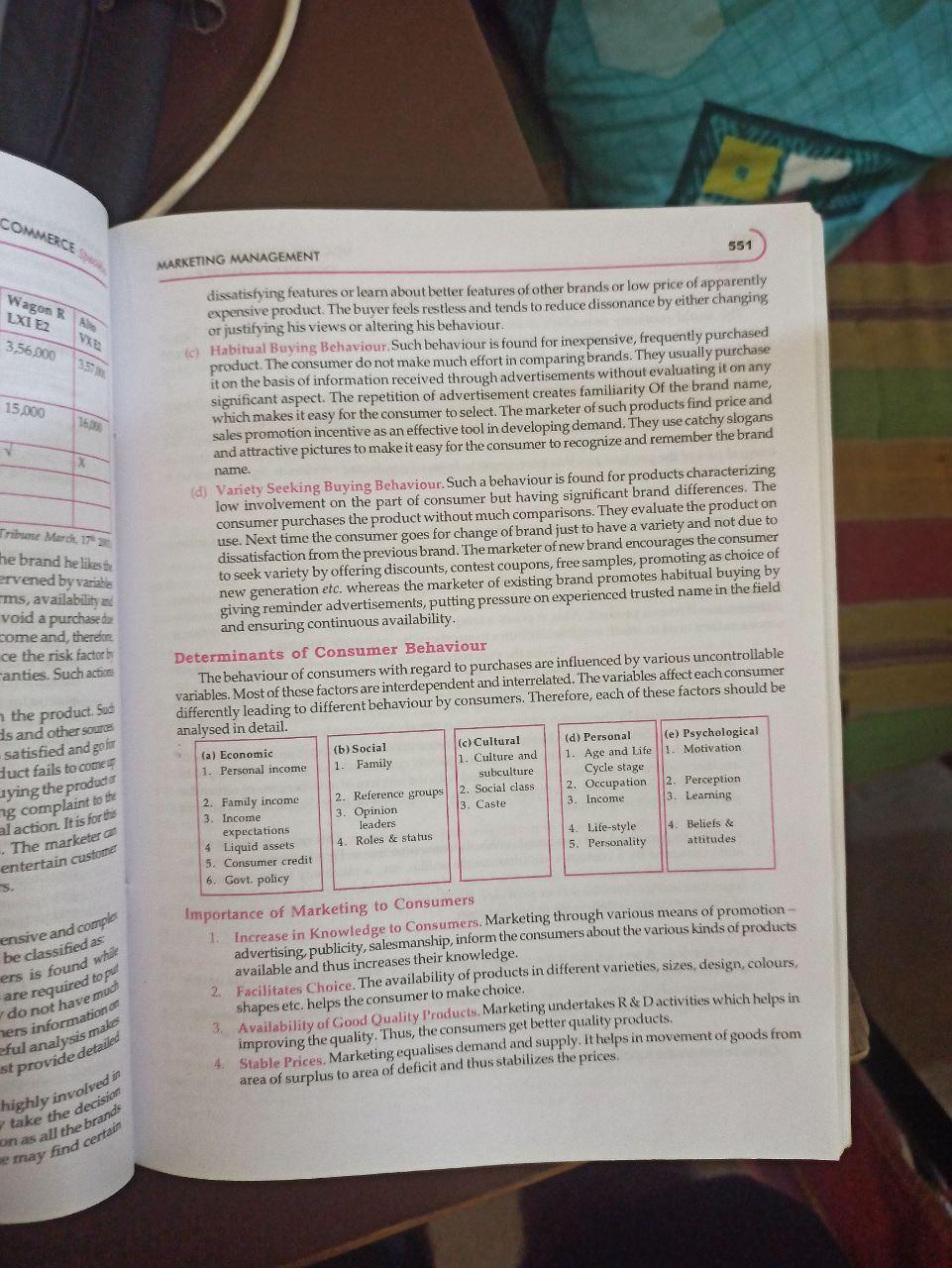

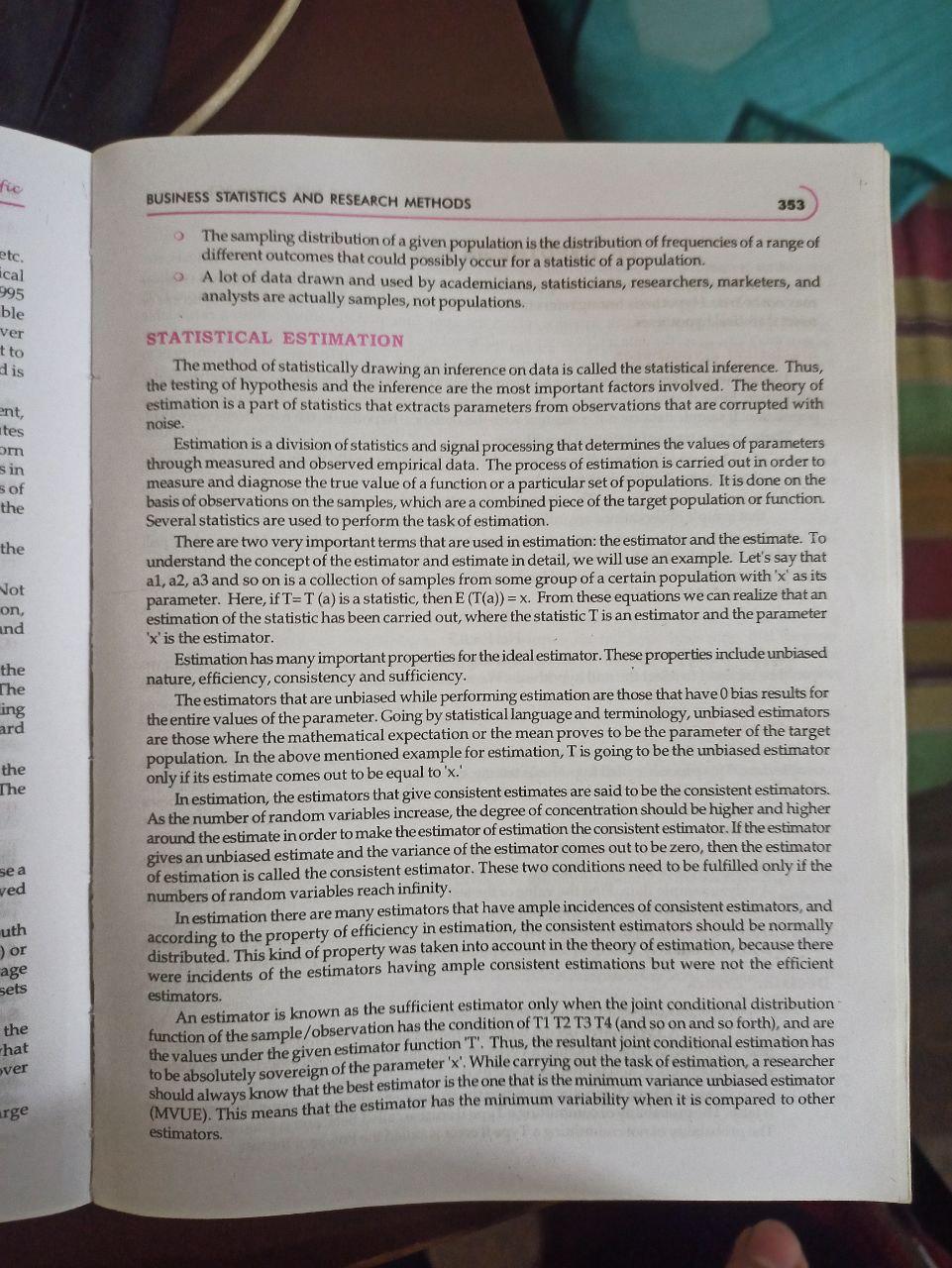

which forms a part of the contract of sale and affects the contract, is called a stipu mor damages but not to a right to Ram consults Shyam, a motor-car dealer for a car suitable for touring purposes to - Shyam suggests 'Maruti' and Ram accordingly buys it from Shyam. The car tu Ram is therefore entitled to reject the car and have refund of the price. inthe event of any manufacturing defect the date of origina se properly repaired. After six months Ram gets a right to claim for damages, if any, suffered by him but not the re ight of the repudiatine purpose of the contract. condition. \begin{tabular}{l} Warranty \\ It is only collat purpose of the co \\ The aggrieved only damages of warranty. \\ \hline \end{tabular} Bank has arranged for guaranteeing the credit raised by small scale industries. Credit Guarantee Organisation of the Reserve Bank looks after this scheme. Under this scheme 75\% of the standing loans of the small industries are guaranteed by Credit Guarantee Organisation. [Ni. Help to Sick I ahastrial Lomis. Reserve Bank also arranges for financial assistance to the sick industrial units. Sick Industrial Unit Division of the Reserve Bank looks after this function of the bank. This Division identifies sick units of large, medium and small industries and arranges loans for them from the Nationalized Banks. (v) Ermort tssistamce. Export Houses get financial assistance from the Reserve Bank, both directly as well as indirectly by way of 'Refinance' of the loans given by other financial institutes. In 1963 Export Credit Bill Plan was also started. And, in 1982 it was with the assistance of Reserve Bank that the Government established Export-Import Bank. This Bankavails of the credit facility from Reserve Bank. 3. Promotion of Export Finance. The Reserve Bank has adopted several measures for promotion of export finance. (ii) Special Schemes. Reserve banks has been offering special refinance facilities to banks to encourage them for providing larger credit for exports. Several schemes has been introduced from time to time to achieve this objective. Some of the notable schemes are: (a) Export Bill Credit Scheme, (b) Pre-shipmentCredit Scheme, (c) Duty Drawback Credit Scheme, (d) Concessional Rates of Interest on Bank Credit for Exports. (ii) Export-Import Bank of India. The Reserve Bank helped in setting up Export-Import Bank of India on 1st January, 1982. The main objective of this bank is to provide financial facilities to export import trade. 4. Promotion of Banking. The Reserve Bankhas undertaken several measures to promote the banking structure of the country. The main steps undertaken in this direction are: (i) Strengthening of Banking Structure. The Reserve Bank has strengthened the banking structure of the country. A large number of weak, unsound or improperly managed banks have been eliminated or reconstructed. Amalgamation have been brought about either voluntarily or compulsorily. (ii) Extension of B anking Facilities. The banking facilities have been extended throughout the country, especially in small towns and rural areas so as to improve the geographical coverage of banks. The relatively unbanked states have been given preference in the matter of setting up new offices. (iii) Extension of Functional Coverage. The functional coverage of the banks has also been extended. The sectoral distribution of banks credit in favour of the priority sectors such as agriculture, small scale industries etc. has been improved. Now, more credit is available to small borrowers. Regional rural banks have been set up to meet the credit requirements of small farmers, artisans and other persons of small means in rural areas. Reasons of Product Elimination 1. Declining Sales. When the sales of the product are continuously falling and there is no scope of any improvement, the manufacturer may decide to eliminate the product. 2. Declining Profits. If there is continuous fail in the profits of the product without any scope of increase, the manufacturer may decide to eliminate the product. 3. Declining Price. If the prevailing market conditions show a tendency of consistent fall in the price of the product without any possibility of raise to maintain sales, the manufacturer may decide to withdraw the product. 4. Life Cycle of the Product. Once the product reaches the saturation point in its life cycle, it will soon enter the declining stage where the sales as well as the profits will fall. Thus, it forces the manufacture to discontinue the product. 5. Managerial Time. If the product requires greater percentage of managerial time as compared to other products due to which the profitability of other products is adversely affected, the manufacturer may like to stop the production of such a product. 6. Reduction in Product's Effectiveness. If the product fails to fulfill its objectives for which it is included in the company's product line, the manufacturer may eliminate it. Sometimes, product's effectiveness fails as a consequence of aging process due to which the product usually dies a natural death. 7. Substitute Product. Emergence of superior substitute product either necessitates modification or elimination of the product. 8. Promotional Budget. If there is consistentneed to increase the promotional budget to maintain the sales of the product, the manufacturer may be required to eliminate the product. Reasons for not taking Elimination Decision 1. Change in Factors. It is often assumed that sales fall is due to outside factor. As the economic and market situations will become favourable, the sales will rise. 2. Encouragement through Product Modification. Management feels the sales can be enhanced by product modification. 3. Change in Marketing Programme. The product sometimes fails to recognize the shortcomings in the product. He rather, blames the marketing programme and assumes that by making changes in the promotional budget, promotional message and motivating dealers, the sales can be increased. 4. Helpful in Sale of other Products. If the product acts as a bait for increasing the sale of other products, the manufacturer may continue to include it in the product line inspite of the low sales. 5. Interest of Personnel. The person engaged in the production and management of such products prefers its continuation as their livelihood depends on it. Sometimes due to emotional or psychological reasons the product is not eliminated. 6. Hiding of Defects. The person responsible for the success of product, tries to hide its drawbacks. The management thus remains unaware of the product failure and the production remains continued. Product Abandonment Practice One of the following methods is adopted for the elimination of the product from the product line: 1. On a Piecemeal Basis. Instead of eliminating the product instantly, it is done slowly and slowly. This practice is followed when there is constant fall in the value of the product. dinsatisfying features or learn about better features of other brands or low price of apparently expensive product. The buyer fecls restless and tends to reduce dissonance by either changing or justifying his views or altering his behaviour. (c) Habitual Buying Behaviour. Such behaviour is found for inexpensive, frequently purchased product. The consumer do not make much effort in comparing brands. They usually purchase it on the basis of information received through advertisements without evaluating it on any significant aspect. The repetition of advertisement creates familiarity Of the brand name, which makes it easy for the consumer to select. The marketer of such products find price and sales promotion incentive as an effective tool in developing demand. They use catchy slogans and attractive pictures to make it easy for the consumer to recognize and remember the brand name. (d) Variety Seeking Buying Behaviour. Such a behaviour is found for products characterizing low involvement on the part of consumer but having significant brand differences. The consumer purchases the product without much comparisons. They evaluate the product on use. Next time the consumer goes for change of brand just to have a variety and not due to dissatisfaction from the previous brand. The marketer of new brand encourages the consumer to seek variety by offering discounts, contest coupons, free samples, promoting as choice of new generation etc. whereas the marketer of existing brand promotes habitual buying by giving reminder advertisements, putting pressure on experienced trusted name in the field and ensuring continuous availability. Determinants of Consumer Behaviour The behaviour of consumers with regard to purchases are influenced by various uncontrollable variables. Most of these factors are interdependent and interrelated. The variables affect each consumer differently leading to different behaviour by consumers. Therefore, each of these factors should be Importance of Marketing to Consumers 1. Increase in Knowledge to Consumers. Marketing through various means of promotion advertising, publicity, salesmanship, inform the consumers about the various kinds of products available and thus increases their knowledge. 2. Facilitates Choice. The availability of products in different varieties, sizes, design, colours, shapes etc. helps the consumer to make choice. 3. Availability of Good Quality Products. Marketing undertakes R \& D activities which helps in improving the quality. Thus, the consumers get better quality products. 4. Stable Prices. Marketing equalises demand and supply. It helps in movement of goods from area of surplus to area of deficit and thus stabilizes the prices. 50. S.E.Z. - (a) Small Economic Zone (b) Social Economic Zone The sampling distribution of a given population is the distribution of frequencies of a range of different outcomes that could possibly occur for a statistic of a population. A lot of data drawn and used by academicians, statisticians, researchers, marketers, and analysts are actually samples, not populations. STATISTICAL ESTIMATION The method of statistically drawing an inference on data is called the statistical inference. Thus, the testing of hypothesis and the inference are the most important factors involved. The theory of estimation is a part of statistics that extracts parameters from observations that are corrupted with noise. Estimation is a division of statistics and signal processing that determines the values of parameters through measured and observed empirical data. The process of estimation is carried out in order to measure and diagnose the true value of a function or a particular set of populations. It is done on the basis of observations on the samples, which are a combined piece of the target population or function. Several statistics are used to perform the task of estimation. There are two very important terms that are used in estimation: the estimator and the estimate. To understand the concept of the estimator and estimate in detail, we will use an example. Let's say that a1,a2,a3 and so on is a collection of samples from some group of a certain population with ' x ' as its parameter. Here, if T=T (a) is a statistic, then E(T(a) ) =x. From these equations we can realize that an estimation of the statistic has been carried out, where the statistic T is an estimator and the parameter ' x ' is the estimator. Estimation has many important properties for the ideal estimator. These properties include unbiased nature, efficiency, consistency and sufficiency. The estimators that are unbiased while performing estimation are those that have 0 bias results for the entire values of the parameter. Going by statistical language and terminology, unbiased estimators are those where the mathematical expectation or the mean proves to be the parameter of the target population. In the above mentioned example for estimation, T is going to be the unbiased estimator only if its estimate comes out to be equal to ' x. ' In estimation, the estimators that give consistent estimates are said to be the consistent estimators. As the number of random variables increase, the degree of concentration should be higher and higher around the estimate in order to make the estimator of estimation the consistent estimator. If the estimator gives an unbiased estimate and the variance of the estimator comes out to be zero, then the estimator of estimation is called the consistent estimator. These two conditions need to be fulfilled only if the numbers of random variables reach infinity. In estimation there are many estimators that have ample incidences of consistent estimators, and according to the property of efficiency in estimation, the consistent estimators should be normally distributed. This kind of property was taken into account in the theory of estimation, because there were incidents of the estimators having ample consistent estimations but were not the efficient estimators. An estimator is known as the sufficient estimator only when the joint conditional distribution function of the sample/observation has the condition of T1 T2 T3 T4 (and so on and so forth), and are the values under the given estimator function ' T '. Thus, the resultant joint conditional estimation has to be absolutely sovereign of the parameter ' x '. While carrying out the task of estimation, a researcher should always know that the best estimator is the one that is the minimum variance unbiased estimator (MVUE). This means that the estimator has the minimum variability when it is compared to other