Answered step by step

Verified Expert Solution

Question

1 Approved Answer

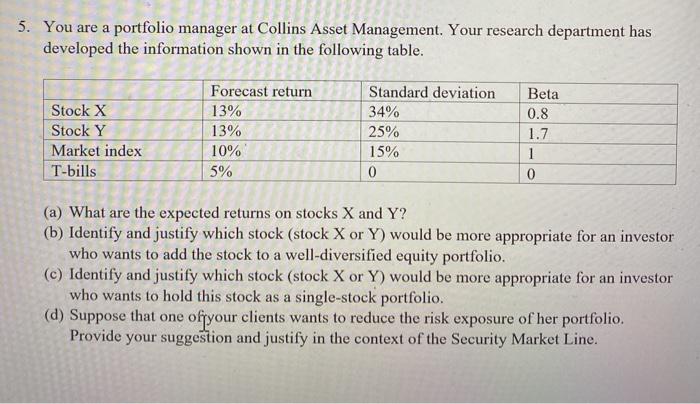

do not answer with excel 5. You are a portfolio manager at Collins Asset Management. Your research department has developed the information shown in the

do not answer with excel

5. You are a portfolio manager at Collins Asset Management. Your research department has developed the information shown in the following table. Stock X Stock Y Market index T-bills Forecast return 13% 13% 10% 5% Standard deviation 34% 25% 15% 0 Beta 0.8 1.7 1 0 (a) What are the expected returns on stocks X and Y? (b) Identify and justify which stock (stock X or Y) would be more appropriate for an investor who wants to add the stock to a well-diversified equity portfolio. (c) Identify and justify which stock (stock X or Y) would be more appropriate for an investor who wants to hold this stock as a single-stock portfolio. (d) Suppose that one of your clients wants to reduce the risk exposure of her portfolio. Provide your suggestion and justify in the context of the Security Market Line Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started