Answered step by step

Verified Expert Solution

Question

1 Approved Answer

do not answer with excel expenses revenues. Another student adds that there is also no deduction of understates the tax burden. Provide your explanation. 4.

do not answer with excel

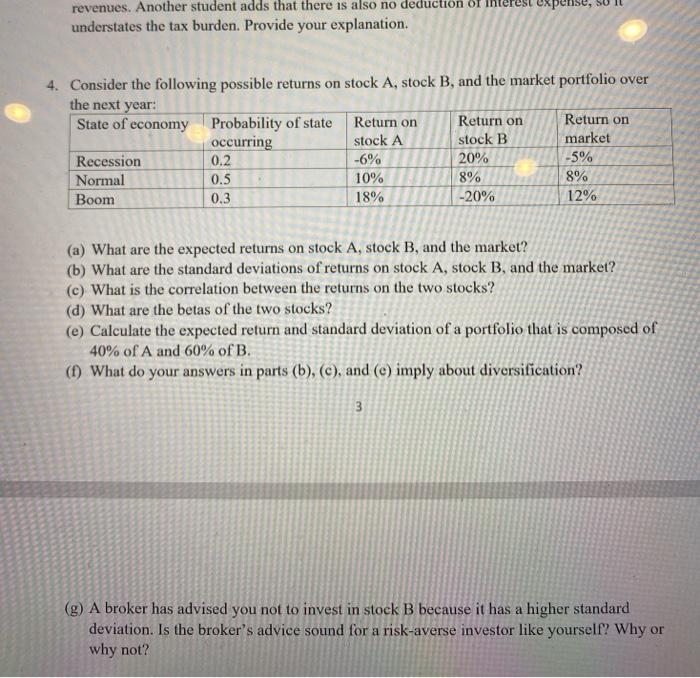

expenses revenues. Another student adds that there is also no deduction of understates the tax burden. Provide your explanation. 4. Consider the following possible returns on stock A, stock B, and the market portfolio over the next year: State of economy Probability of state Return on Return on Return on occurring stock A stock B market Recession 0.2 -6% 20% -5% Normal 0.5 10% 8% 8% Boom 0.3 18% -20% 12% (a) What are the expected returns on stock A, stock B, and the market? (b) What are the standard deviations of returns on stock A, stock B, and the market? (c) What is the correlation between the returns on the two stocks? (d) What are the betas of the two stocks? (e) Calculate the expected return and standard deviation of a portfolio that is composed of 40% of A and 60% of B. (1) What do your answers in parts (b), (c), and (e) imply about diversification? 3 (g) A broker has advised you not to invest in stock B because it has a higher standard deviation. Is the broker's advice sound for a risk-averse investor like yourself? Why or why not Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started