Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do the following exercises from the book. Show all work. Round percent answers to the nearest whole percent and money to the nearest cent where

Do the following exercises from the book.Show all work. Round percent answers to the nearest whole percent and money to the nearest cent where appropriate.

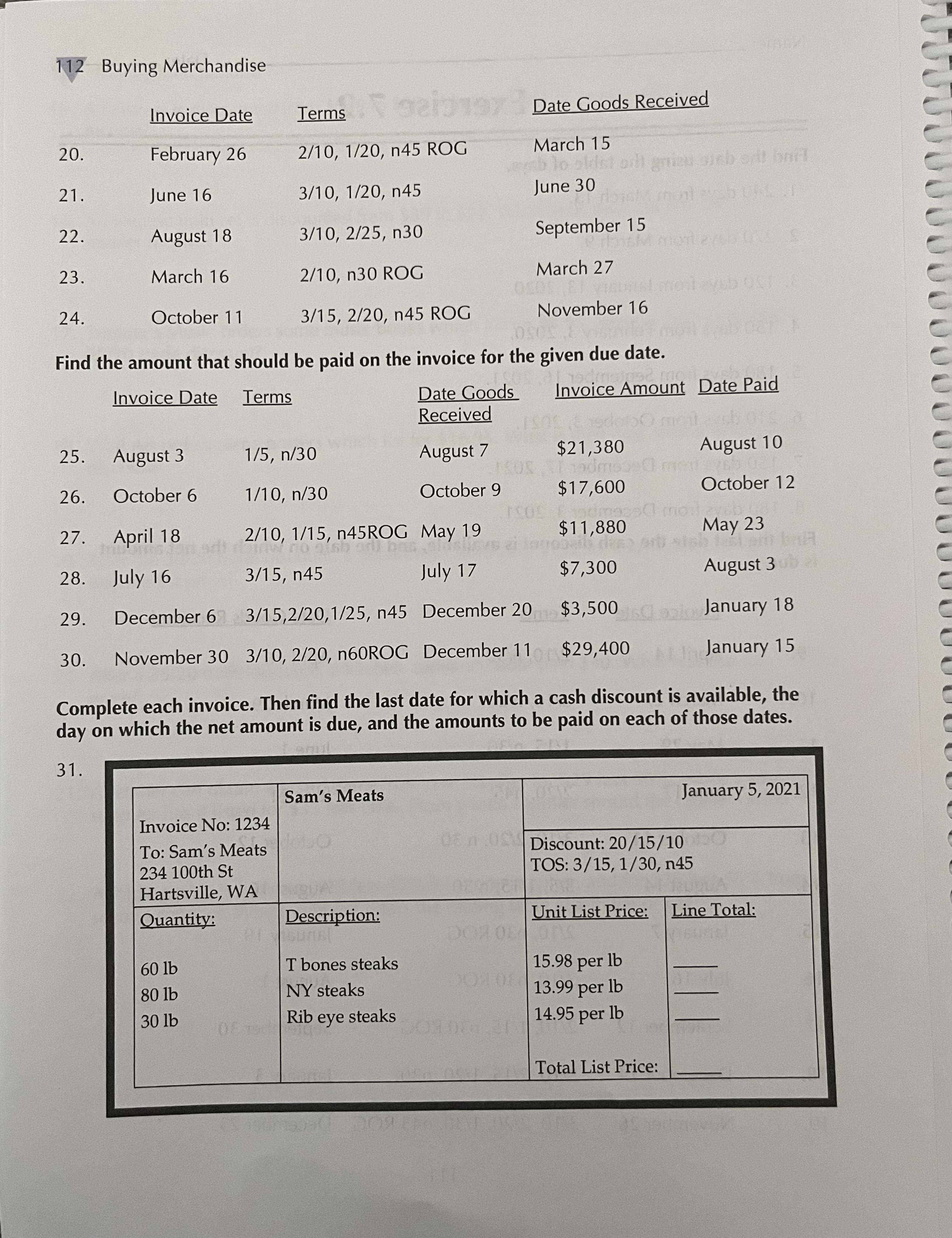

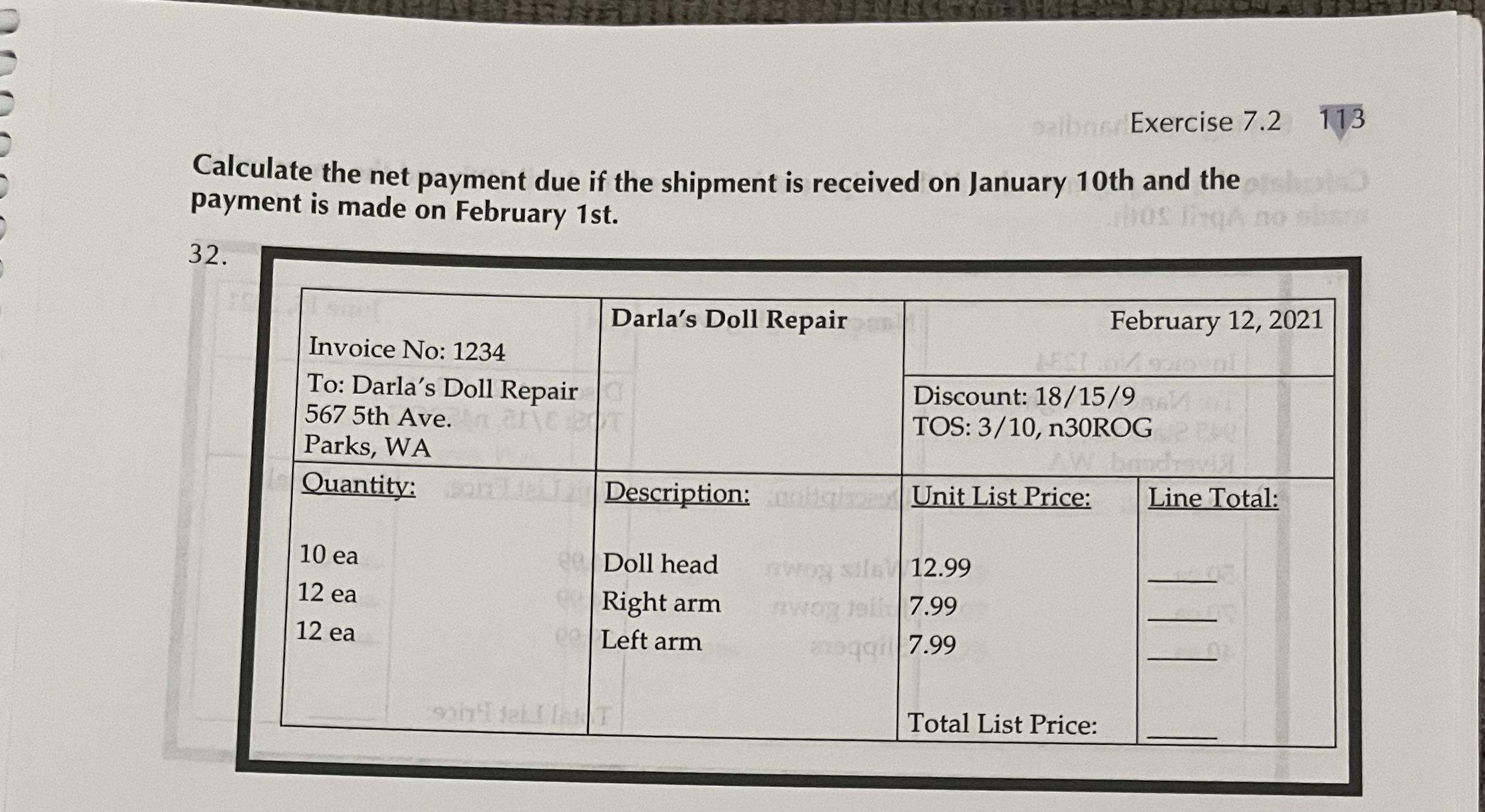

7.2 page 111 - 116 (ONLY PROBLEMS 2, 4, 6, 8, 9, 13, 23, 24, 32) (Invoice date should be January 5, 2021, not February 12, 2021.)

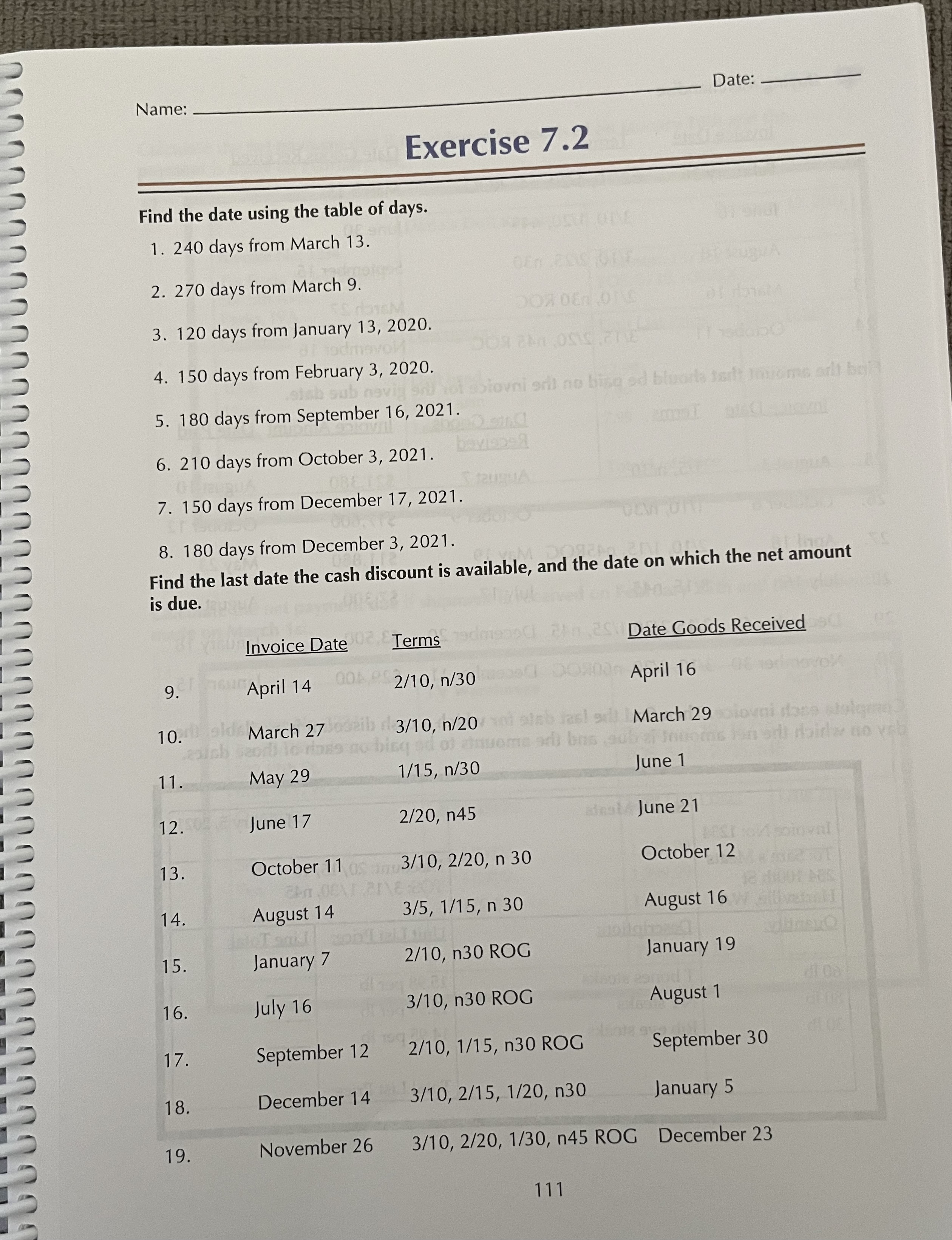

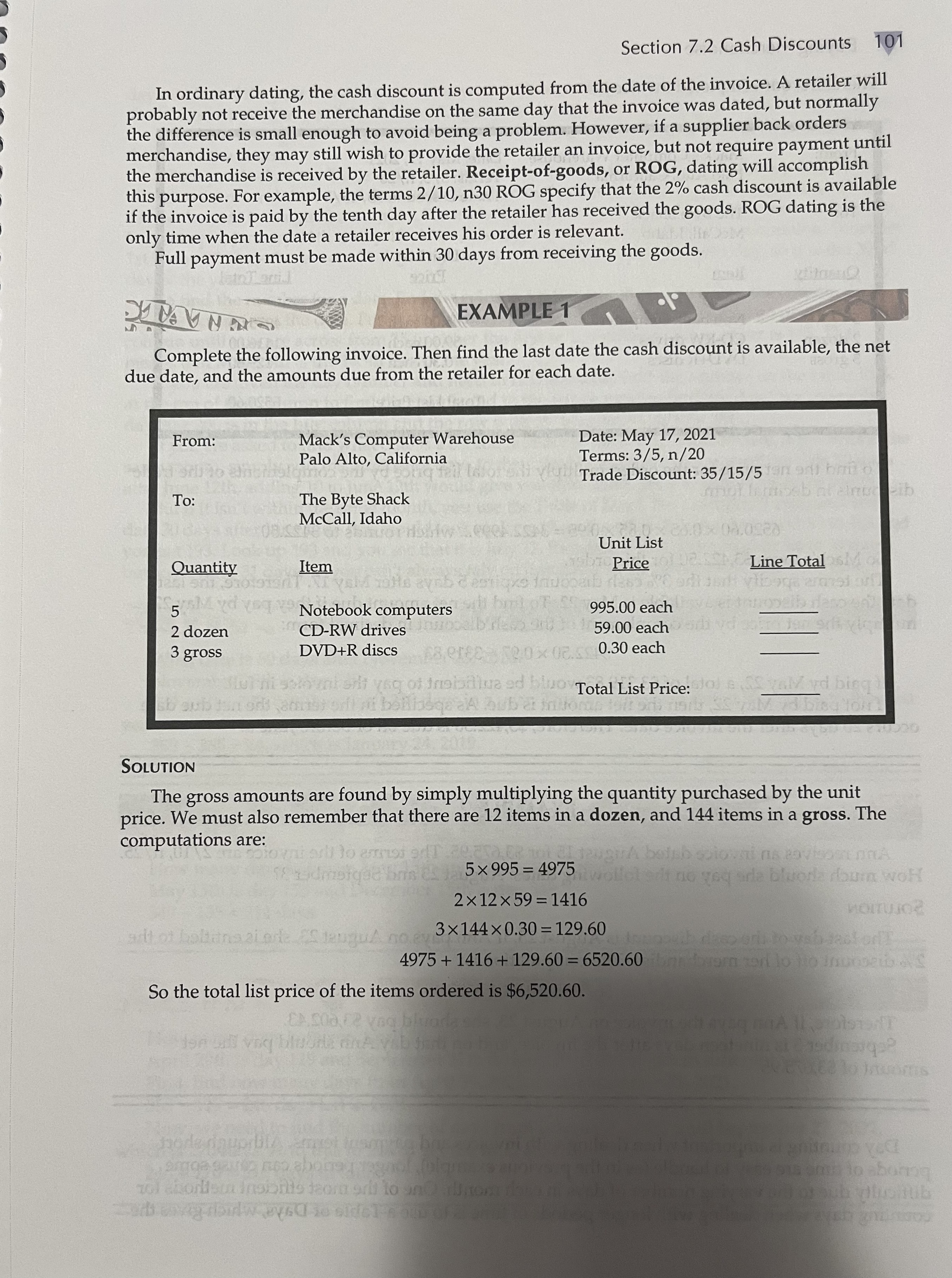

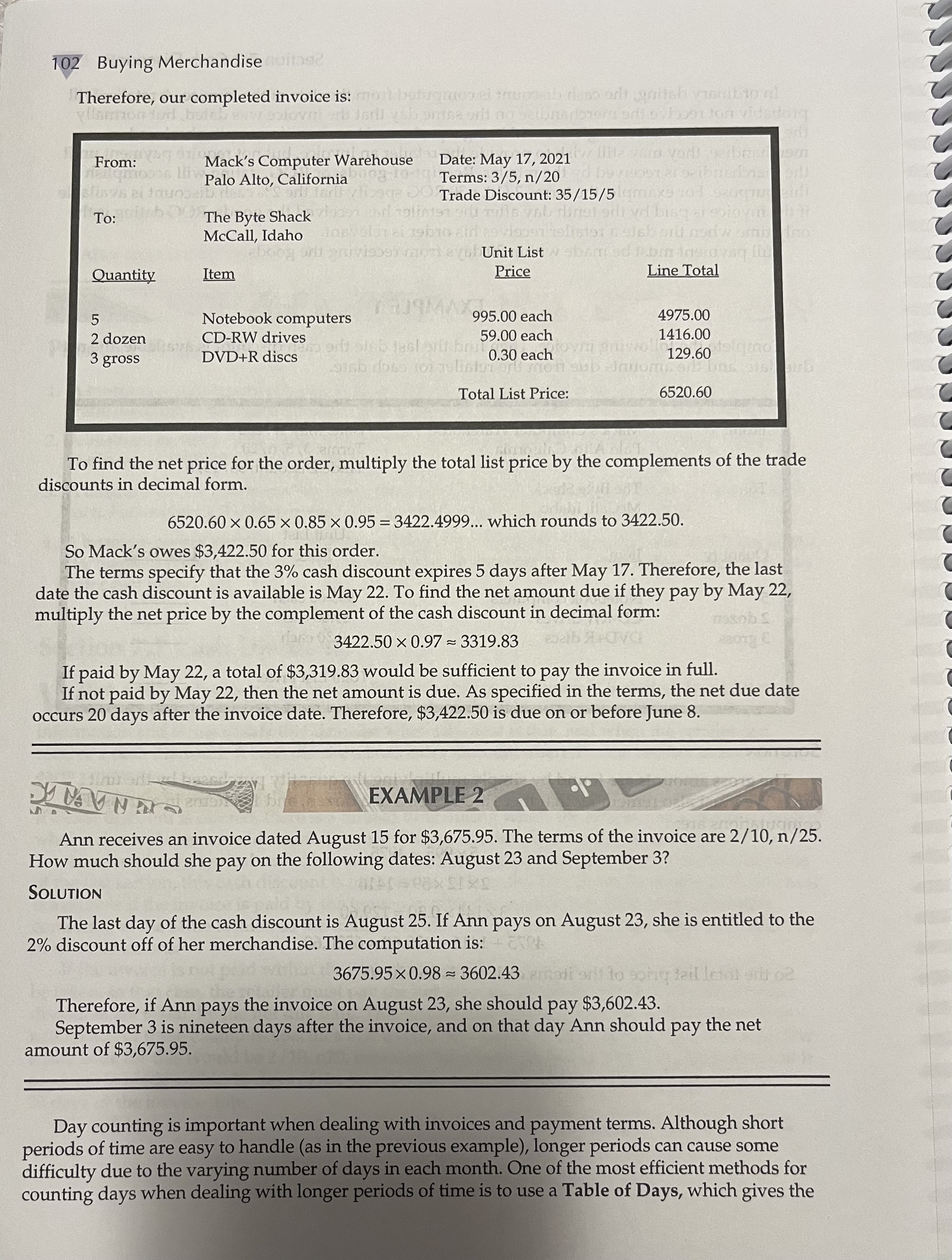

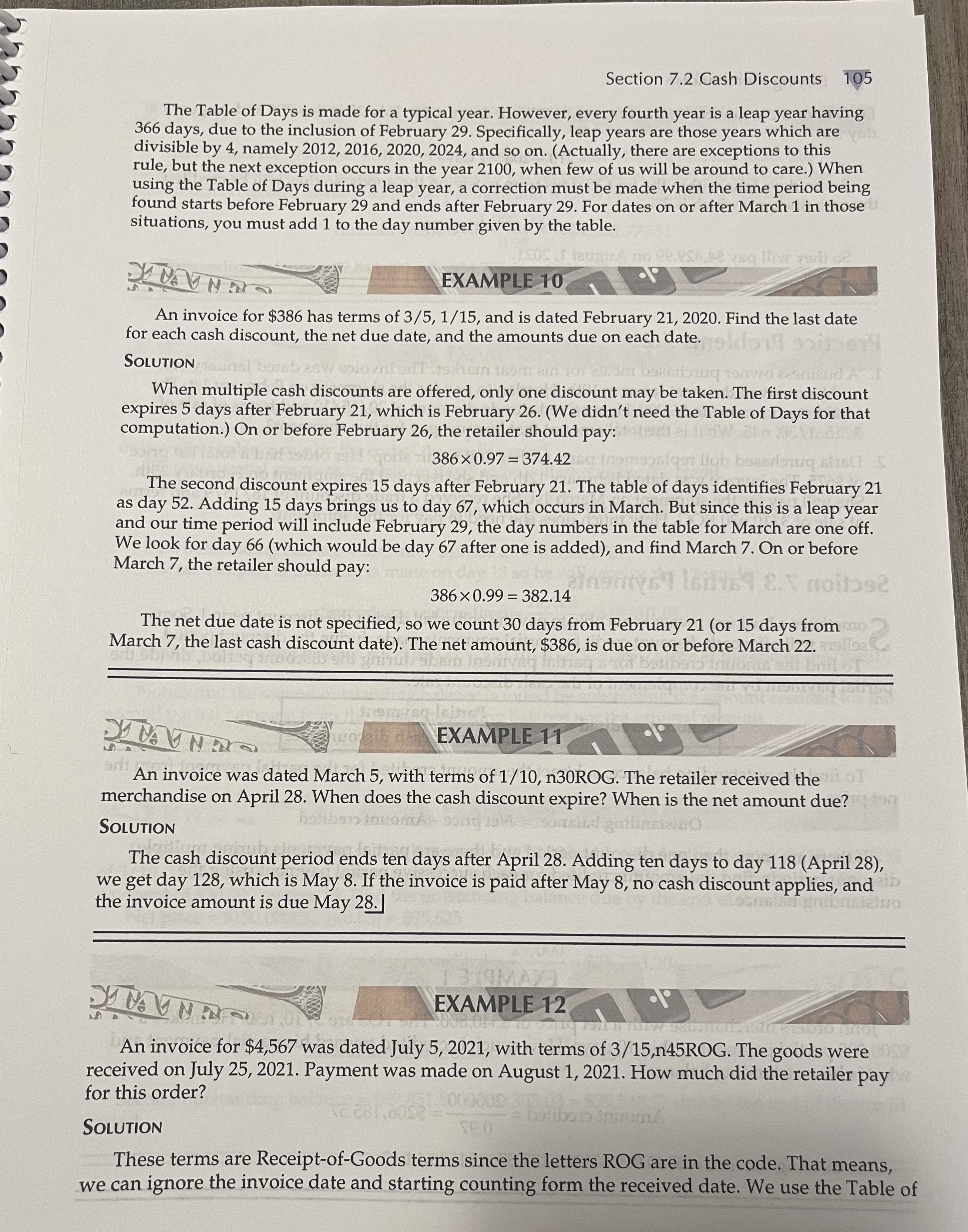

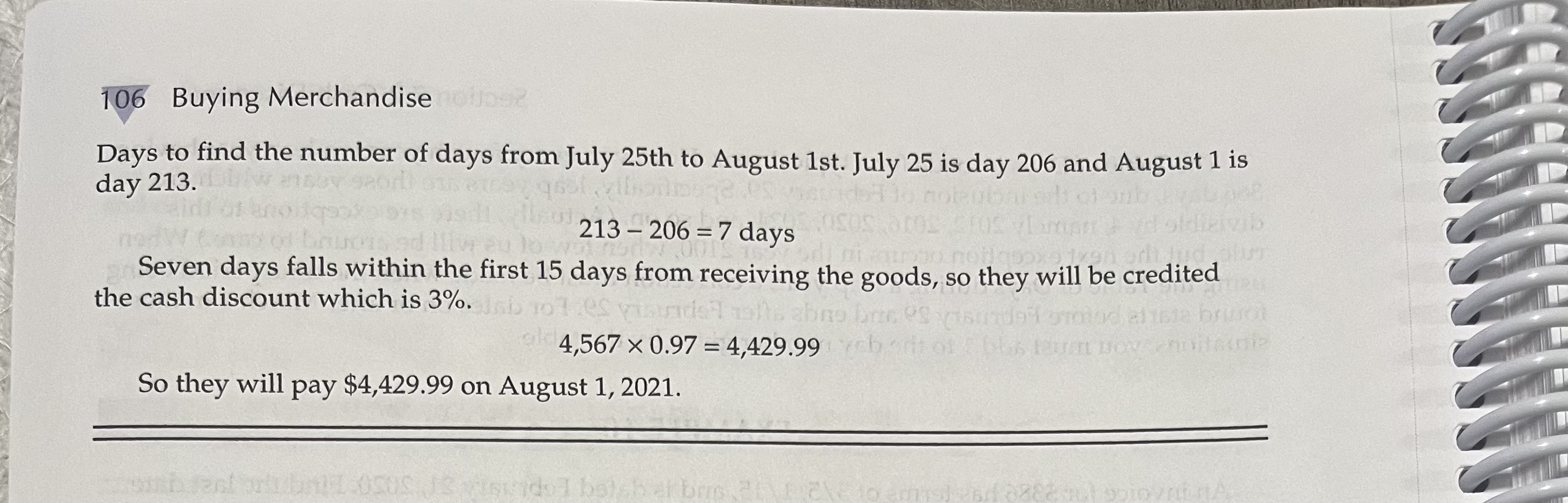

Name: Date: Exercise 7.2 Find the date using the table of days. 1. 240 days from March 13. 2. 270 days from March 9. 3. 120 days from January 13, 2020. admavol 4. 150 days from February 3, 2020. stab sub nevi sa 5. 180 days from September 16, 2021. 6. 210 days from October 3, 2021. OBES 7. 150 days from December 17, 2021. 8. 180 days from December 3, 2021. Em DOR DE 0 ovni gril no bisq od bluoch tort moms art bel Find the last date the cash discount is available, and the date on which the net amount is due. Invoice Date 02. Terms 2 29 Date Goods Received 9. April 14 0000 2/10, n/30 0020 April 16 10. March 27 ib 3/10, n/20 slab jasl sdl March 29 ad) bos doce stulgran sdi doira no vab 11. May 29 1/15, n/30 June 1 12. June 17 2/20, n45 dest June 21 13. October 11 03/10, 2/20, n 30 October 12 14. August 14 3/5, 1/15, n 30 August 16 O 15. January 7 2/10, n30 ROG January 19 16. July 16 3/10, n30 ROG 29nod T August 1 17. September 12 2/10, 1/15, n30 ROG September 30 18. December 14 3/10, 2/15, 1/20, n30 January 5 19. November 26 3/10, 2/20, 1/30, n45 ROG December 23 111

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets go through each exercise step by step Exercise 72 Finding the Date Using the Table of Days 2 240 days from March 13 4 150 days from February 3 2020 6 210 days from October 3 2021 8 180 day...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started